Thailand offers a stable and attractive business environment suitable for global expansion. As evidenced by Statista, 99% of the Thai population was employed in 2023. Buttressing the country’s economic strength, McKinsey highlights a 2.3% GDP growth rate in the second quarter of 2024, up from 1.6% in the first quarter.

However, while Thailand’s labor market is rich with opportunities, hiring and managing local talents poses challenges. Strict compliance requirements, cultural nuances, and administrative burdens can complicate the entire process.

That’s where a Thailand Employer of Record (EOR) steps in. As a third-party organization, a Thailand employer of record legally hires workers, manages payroll, and ensures compliance with local employment regulations on behalf of your company.

If you’re looking to explore Thailand’s skilled workforce while minimizing risk and administrative challenges, this article will guide you on how an EOR Thailand can expand your business seamlessly. Whether you aim to hire Thai employees, stay compliant, or streamline your operations, this guide will give you the tools for a successful workforce expansion in Thailand.

Benefits of Using Employer of Record Thailand

30% of APAC countries use EOR services to solve hiring problems, retain talent, and tackle other international expansion challenges. Beyond that, an EOR in Thailand benefits companies in these ways:

Hire local talent

Expanding your workforce in Thailand poses several challenges. Traditionally, it involves establishing a legal entity, registering the company, opening local bank accounts, creating a legal team, organizing compensation and benefits, and adhering to local laws. All these take several months and are usually expensive.

But with an employer of record Thailand, you can hire employees that align with your business needs and company culture without setting up a local entity. An EOR Thailand sources, hires, and supports foreign workers throughout the employee lifecycle. They also draft employment contracts and manage your overseas payroll while you retain total autonomy over your workforce in your base country.

Compliance

An EOR Thailand has in-depth knowledge of local laws regarding taxation, employee rights, severance, global payroll, benefits, and intellectual property. For instance, the Labour Protection Act B.E. 2541 mandates all employers to provide annual holidays of no fewer than six working days to Thai employees who have worked consistently for one year. Similarly, employers must give workers at least one hour of rest after every five working hours.

Navigating these complex legislations can be a hassle if you’re new to the Thailand employment landscape. It becomes worse if you have other global teams you’re trying to build compliantly, as you may encounter mix-ups and oversights.

Hence, a Thailand PEO relieves HR teams of the burden of getting familiar with these Thai labor laws, ensuring your company legally and efficiently manages its workers for global compliance. Ultimately, an employer of record Thailand saves organizations from financial losses, fines, and other legal penalties accompanying non-compliance.

Risk Mitigation

Building a global team is fraught with legal and compliance risk factors. But you don’t have to worry about breaching any employment regulation when you hire an employer of record Thailand. With their knowledge of Thai law, they easily evade penalties, fines, and disputes among employees.

For example, they understand complex areas like termination procedures, working hours, rest periods, and severance pay. This adherence reduces the legal and financial risks associated with breaking laws, ensuring your company gets a compliant workforce.

Cost effective

Creating a local subsidiary or branch is costly, especially regarding office space, local staffing, business registration, and recurring administrative expenses. However, hiring employees through an EOR Thailand is cost-effective as it eliminates these time-consuming, expensive processes.

Focus on core business

Hiring a Thailand employer of record empowers HR leaders to focus on core business needs while outsourcing time-consuming administrative tasks, such as onboarding new hires, paying salaries, or offboarding existing staff.

This strategy frees up workloads and allows HR teams to manage their time efficiently while concentrating on strategic business activities that advance organizational growth.

How does an EOR Thailand work?

Here’s how a Thailand employer of record acts as the legal employer for your Thai workforce:

1. Hiring process

An Employer of Record Thailand helps your business find and hire the right talent during recruitment. They know the demands of the Thai local job market and the job portals, like JobsDB, to find the right talent. All you need to do is specify your preferred candidate requirements. Your EOR Thailand will scout candidates, schedule screening interviews, and eventually recruit the best Thai talents while ensuring the entire process complies with labor regulations.

2 Employment contract

After recruiting a new hire, a Thai employer of record drafts an employment contract that complies with Thai labor laws, protecting both the employee and the client company. The employment agreement includes crucial terms such as job scope, start date, salary, benefits, working hours, rest days, probation periods, and termination policies like notice periods and severance pay.

3. Payroll and benefits

Once the Thailand EOR legally employs a candidate, they set up payroll for the new employee and prepare payslips every month. First, they choose a payroll system compliant with government regulations and your company policy, then assign workers Tax Identification Numbers (TIN). They also calculate and process pay in Thai Baht and withhold tax, insurance contributions, and other mandatory deductions for compliance.

Read next: How to Run Payroll in Thailand

4. Compliance

A PEO Thailand stays informed of any regulatory updates, such as minimum wage adjustments, tax rates, or new labor protections. They ensure these changes are reflected in employment activities such as proper documentation and statutory filings.

This streamlined compliance helps you avoid administrative burdens and legal consequences, allowing you to focus on other crucial business operations and employee relationships.

5. HR administration

An employer of record Thailand provides continuous support for employees and manages routine HR tasks, such as onboarding, payroll, taxation, benefits, employee relations, performance reviews, and disciplinary actions. They become the main point of contact between your Thai hires and your company for HR-related matters.

Things to Consider When Choosing Employer of Record Thailand

Consider the following features before choosing an EOR Thailand:

Local expertise

Before investing in a Thailand employer of record, evaluate their knowledge and experience with the Thai hiring environment. Ensure the Thailand EOR thoroughly understands the local employment regulations and compliance requirements, including the Labor Protection Act (LPA), tax implications, Social Security Fund contributions, work permits, and other crucial Thai-specific labor laws.

This expertise is necessary to navigate the Thai employment landscape and avoid legal penalties. Furthermore, the PEO Thailand must be familiar with local customs, culture, and business practices and have established networks that ease their operations.

Compliance track record

Non-compliance can cost your company financial losses and reputational damage. So, when choosing an EOR Thailand, review their track record for achieving compliance, especially regarding payroll processing, taxation, and benefits administration.

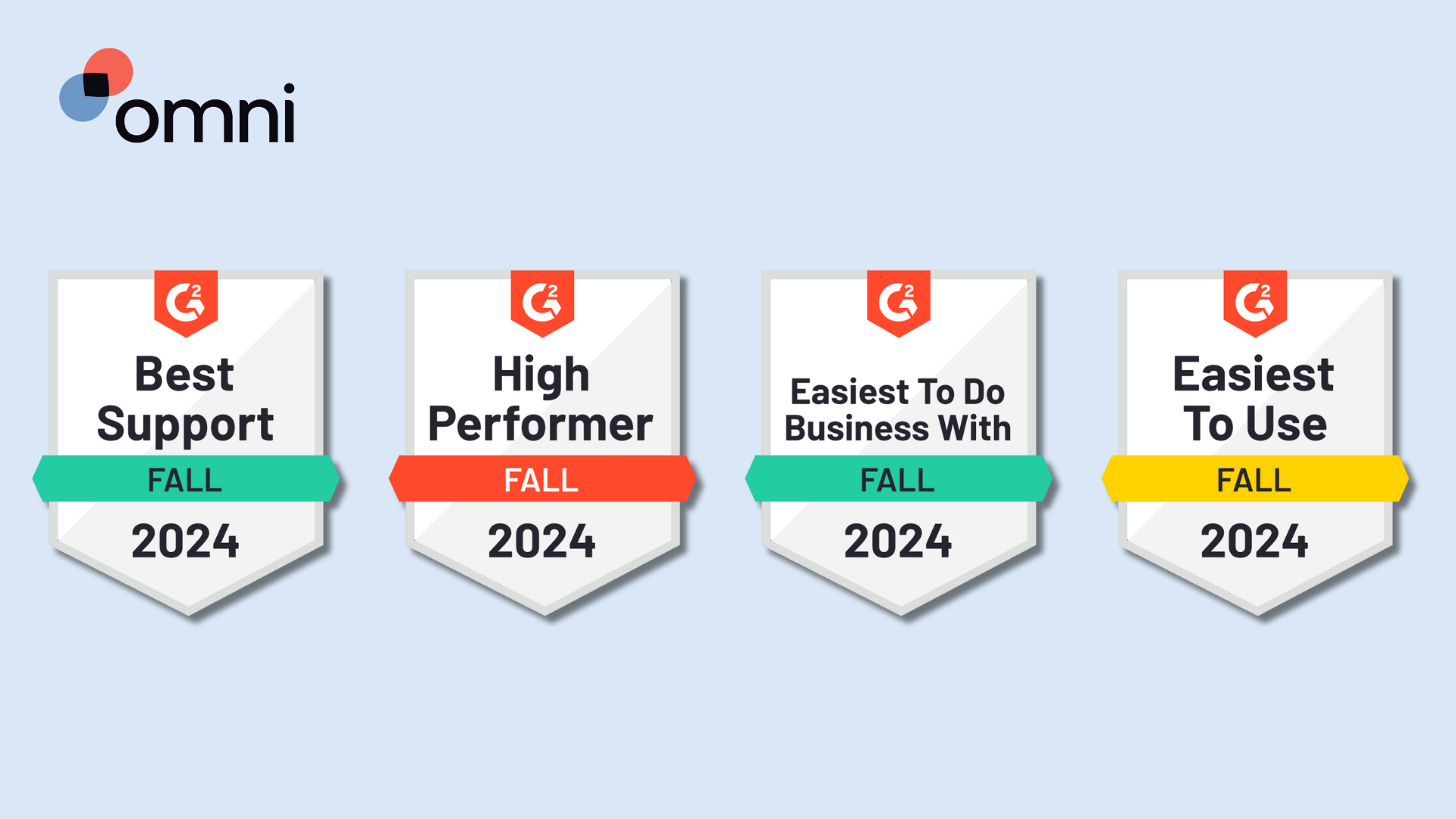

Check for reviews on third-party sites to ensure that your chosen Thailand employer of record is well-experienced and competent in handling delicate business matters for clients.

Service offerings

Confirm if the EOR Thailand services meet your company’s needs and growth trajectory. This is important as your business may need to scale up or down, depending on its needs.

Regardless, an ideal employer of record Thailand offers a comprehensive HR package that includes advisory services, hiring, work permit applications, payroll management, employee contracts, and termination.

Technology platform

Weigh the HR tools and global payroll solutions the PEO Thailand uses for onboarding, employee relations, payroll processing, and communication to ensure compliance with local regulations. A centralized, secure, and user-friendly technology platform is necessary for achieving compliance, efficiency, data accuracy, and clear communication between your company, the EOR, and your employees.

References and testimonials

Check for industry reviews, client testimonials, and case studies on third-party sites like G2 or Trustpilot that prove the PEO Thailand has a great work ethic and a track record of success. Also, request references from past and present clients who have used their services in Thailand. If the feedback is positive, the Thailand employer of record will likely deliver excellent services.

Challenges and Risks for Thailand Employer of Record

Managing global teams for businesses presents several challenges for employers of record Thailand. Here’s an overview:

Complex Thailand employment law

Thai labor legislation is subject to frequent changes, including laws regarding taxation, employee protection, employment contracts, benefits, and termination. So, if your PEO Thailand doesn’t adapt to evolving regulations, it can cause increased costs, fines, operational delays, labor disputes, or other legal penalties. The solution is to hire a PEO Thailand with a strong legal team that keeps up with regulatory changes.

Employer of record Thailand selection

Since Thailand has many employers of record, choosing the right provider can be challenging, especially when all of them claim to be the best. A helpful tip is to thoroughly research and assess the reputation of different EOR Thailand companies before partnering with any. Some EORs may claim to have local expertise but have limited knowledge of specific industry practices or niche legal requirements in Thailand.

Also, check for transparent, responsive, and flexible services that match your organizational objectives, budget, and business needs.

Protecting employee data

Hiring an employer of record Thailand means handing over your employment affairs to a third-party provider. As such, you may encounter risks regarding employee data protection and breaches. Hence, an employer of record Thailand must have robust data protection standards to protect your corporate information and intellectual property.

Thailand’s Personal Data Protection Act (PDPA), which took effect on 1 June 2022, regulates and protects how businesses handle personal data. It applies to all businesses operating in Thailand and foreign businesses offering services or products to Thai residents.

Frequently Asked Questions for Employer of Record Thailand

1. What is an EOR?

An Employer of Record is an independent organization that manages all employment-related tasks for companies without establishing a local legal entity.

2. How long does it take to hire an employee through an employer of record Thailand?

Hiring a Thai employee through an EOR Thailand typically takes one to three weeks, depending on the role’s complexity, the candidate’s availability, and the required documentation processes.

3. What are the costs associated with using an employer of record Thailand?

The costs of using an EOR in Thailand typically include monthly service fees based on the number of employees managed, payroll expenses, setup costs, and bank charges. Although the EOR administers them, you’ll need to cover the cost of hiring Thai workers, including salaries, contributions, employee benefits, and termination fees.

4. Can I terminate an employee through EOR Thailand?

Yes, you can terminate an employee through a PEO in Thailand. However, the offboarding process must comply with Thai labor laws to meet all legal requirements regarding notice periods and severance payments.

5. Does an employer of record Thailand provide benefits to employees?

Yes, a Thailand employer of record administers employee benefits as part of their service. This includes health insurance, retirement contributions, paid leave, and other statutory benefits the local law requires. However, not all EORs do this; some may focus solely on legal compliance and payroll. So, identify your company’s needs and ensure the EOR services align with them.

6. Can an employer of record Thailand help with visa and work permit applications?

Yes, a Thailand Employer of Record can help with visa and work permit applications for Thai employees. They’re well-versed in local regulations and are the legal employers responsible for handling all employment-related tasks, including obtaining work permits and visas.

Maximize Your Business Potential with Employer of Record Thailand

An employer of record Thailand can be a valuable asset for businesses looking to expand into the Thai market. By partnering with a reliable and reputable EOR, you can streamline your HR processes, mitigate risks, access global top talents, reduce costs, and enhance your company’s reputation in Thailand.

Omni makes it easy to support employees across multiple countries, time zones, and currencies.

Our centralized document management solution makes gathering the necessary data required to apply for employment visas and other country-specific initiatives seamlessly and timely. With customized workflows and automated reminders, HR can help empower employees to manage the deadlines and documentation requirements for applications. And centralized documents and real-time data makes it easy for employees to access salary information and produce reports and documents necessary for verification.

Omni offers a comprehensive payroll solution tailored to Thailand’s specific requirements. With features like support for Thai baht and automated tax calculations, Omni can help HR teams simplify their payroll processing and ensure compliance with ease. Not only that, with secure document storage and straightforward data input, you can quickly access and submit essential information required for working in Thailand.

Our dedicated local team of experts provides personalized support and ensures your business remains compliant with Thailand’s labor laws. Book a demo with our team to learn more about how Omni can help maximize your business potential.