Hong Kong’s cityscape is undoubtedly a desirable place to work and reside, but living in this cosmopolitan hub is not without its challenges—particularly when it comes to housing costs. Recognizing the significance of affordable housing, Hong Kong’s government has implemented various schemes to provide financial relief to its residents. One such initiative, the Hong Kong Rental Reimbursement Scheme, stands as a crucial pillar in the city’s housing support system.

While the Rental Reimbursement Scheme acts as an important step towards housing affordability in Hong Kong, navigating its intricacies might prove tricky to someone approaching it for the first time.

We’ll take a thorough look at the scheme, exploring its purpose, determining eligibility criteria, walking you through the application process, and shedding light on details that every current (or aspiring) resident should know.

Hong Kong Rental Reimbursement Scheme Explained

In a city as densely populated and expensive as Hong Kong, navigating the challenging housing market can be a daunting task. To address the housing affordability issue, the Hong Kong government has implemented the Rental Reimbursement Scheme. Here, we’ll take a comprehensive look at the scheme, outlining its core components and implications on housing in Hong Kong.

What is the Rental Reimbursement Scheme?

The Rental Reimbursement Scheme is a government initiative designed to alleviate the financial burden of high rent for Hong Kong residents. It offers monetary assistance to eligible individuals or households to help them cope with the skyrocketing rental costs in the region. This is a stated part of the Hong Kong government’s broader commitment to enhancing the living standards and overall well-being of its citizens.

Who is Eligible to Benefit?

Eligibility for the Rental Reimbursement Scheme is determined through specific criteria, including income levels and family composition. Generally, low-income individuals, the elderly, and those with disabilities are more likely to qualify for assistance. The scheme aims to target those who need it the most, ensuring that they can access affordable housing options without compromising their financial stability.

Overview of Rental Assistance

Under this scheme, qualified individuals receive financial aid to offset a portion of their rental expenses. This assistance is especially valuable in Hong Kong—a city where rental costs often consume a substantial part of residents’ income. By providing financial support, the government aims to make housing more affordable, reduce the risk of homelessness, and enhance the overall quality of life for those who benefit.

Relationship with Hong Kong’s Housing Policies

The Rental Reimbursement Scheme is an integral part of Hong Kong’s broader housing policies, which aim to strike a balance between providing affordable housing options and maintaining a competitive property market. By offering this form of financial aid, the government can address immediate housing needs while also working towards sustainable long-term solutions to the city’s housing challenges.

Application Process

Applying for the Rental Reimbursement Scheme is a structured process that involves several key steps. Prospective beneficiaries should initiate the process by submitting an application to the relevant government department. The application procedure often requires individuals to provide comprehensive information regarding their financial situation, housing arrangements, and other pertinent details. This process is typically facilitated through government-run offices, both on and offline.

Required Documentation and Qualifications

To ensure the transparency and effectiveness of the scheme, applicants must meet specific qualifications and provide essential documentation. Generally, eligibility is determined by criteria such as income levels, family composition, and whether there are any elderly or disabled individuals in the household. Applicants may also need to demonstrate financial need by submitting income statements, employment records, and other relevant documents.

Calculation of Reimbursement Amounts

The amount of rental reimbursement an individual or household is eligible to receive under this scheme is calculated based on several factors. These include the applicant’s financial status, the size and composition of the household, and the rental expenses incurred. The government utilizes a structured formula to ensure that eligible applicants receive assistance that matches with their financial need and living arrangements.

Frequency of Reimbursement Payouts

The frequency at which beneficiaries receive rental reimbursements is a crucial aspect of the scheme. Payouts are typically dispersed on a regular basis, ensuring that beneficiaries can count on consistent financial assistance to offset their rental expenses. The specific schedule for payouts is outlined by the government and may be monthly, quarterly, or otherwise structured to meet the scheme’s objectives.

In the next section, we’ll dive into each of these aspects, allowing potential beneficiaries to navigate the Rental Reimbursement Scheme with confidence and clarity.

Eligibility Criteria

The Rental Reimbursement Scheme operates under a set of specific eligibility criteria designed to ensure that assistance reaches those who need it most, soonest. To understand who can benefit from the scheme, we’ll explore the income thresholds, considerations related to family composition, and the limits on rental expenses.

Income Thresholds

Income is a fundamental determinant of eligibility for the Rental Reimbursement Scheme. The government sets specific income thresholds to establish who qualifies for assistance. Generally, individuals or households with lower incomes are more likely to meet these criteria. As a rule of thumb, those with earnings below the specified threshold are eligible to apply for the scheme.

Family Composition Considerations

The composition of the applicant’s family plays a crucial role in determining eligibility. The scheme recognizes that the financial needs and living arrangements of families may differ significantly. Because of this, it takes into account factors such as the number of family members and whether there are elderly or disabled individuals within the household. These considerations ensure that families with particular needs receive appropriate assistance.

Rental Expense Limits

Rental expenses are subject to specific limits under the Rental Reimbursement Scheme. To be eligible for assistance, the rental costs incurred by applicants must fall within the established limits.

Under this framework, the rental expense limits depend on the type of accommodation provided. Here’s a breakdown:

- Residential Unit / Serviced Apartment: The rental value (RV) is calculated at 10% of the net income after deducting outgoings and expenses (excluding self-education expenses).

- 2 Rooms in a Hotel, Hostel, or Boarding House: RV is 8%.

- 1 Room in a Hotel, Hostel, or Boarding House: RV is 4%

Employees may also choose to substitute the “Rateable Value” (RV based on government assessment) for the calculated RV if it reduces their tax liability.

“Rent suffered” (rent paid by employees to the employer) can also be deducted from RV.

Application Process

Luckily for those seeking financial assistance, the process of applying for rental reimbursement under the Hong Kong Rental Reimbursement Scheme is a systematic one. It’s designed to ensure that individuals or households in need can access the assistance they require. Here, we’ll take a look at the application process, offer practical tips for preparing a successful application, and highlight common pitfalls to avoid along the way.

Step-by-Step Guide to Applying for Rental Reimbursement

Applying for rental reimbursement follows a structured set of steps, which applicants should carefully follow to complete the process successfully. Applicants for the Rental Reimbursement Scheme in Hong Kong need to submit their documentation to the Inland Revenue Department (IRD). The IRD handles the calculation of taxable benefits related to housing, including rental value assessments.

Determine Eligibility: Before beginning your application, it’s essential to ensure you meet the eligibility criteria, including income thresholds and family composition considerations.

Gather Required Documentation: Collect all the necessary documentation, including proof of income, rental expenses, and other relevant paperwork.

Complete the Application Form: Fill out the application form provided by the Inland Revenue Department, ensuring that all required details are accurate and complete.

Submit Your Application: Once your application is ready, submit it to the IRD for processing your rental reimbursement claims.

Verification and Review: The IRD will review your application and may request additional information or documentation for verification.

Notification of Approval: If your application is approved, you’ll receive a notification detailing the approved reimbursement amount and the frequency of payouts.

Receiving Reimbursement: Rental reimbursement will be disbursed according to the specified schedule, helping to ease the financial burden of rental expenses.

Tips for Preparing a Successful Application

To increase the chances of a successful application, consider the following tips:

- Ensure all documentation is complete, accurate, and up-to-date. Double-check that your application form is correctly filled out, and all required information is provided.

- Keep copies of all submitted documents for your records. Make a copy of your completed application for your records. This ensures you have a reference if there are any discrepancies or inquiries about your submission.

- Provide accurate financial information. Accurately disclose your financial situation, including income, expenses, and assets. Being transparent will help determine the level of assistance you qualify for, and avoids any questions about discrepancies down the road.

Common Pitfalls to Avoid During the Application Process

When applying for rental reimbursement, you certainly want the process to go smoothly—and quickly. That’s why it’s crucial to be aware of common pitfalls that can lead to application delays or rejections. These include:

- Providing inconsistent information. Ensure that all the information you provide is consistent throughout your application. Discrepancies in details can raise red flags.

- Missing application deadlines. Missing the application deadline can result in losing out on the assistance. Stay updated with the submission schedule.

- Inadequately preparing. Rushing through your application without proper preparation can lead to errors and omissions. Take your time and ensure all details are accurate and complete.

By following the step-by-step guide, adhering to the tips for a successful application, and avoiding common pitfalls, you can navigate the application process with confidence and improve your chances of securing rental reimbursement through the Hong Kong Rental Reimbursement Scheme.

How Can Omni Help Hong Kong Employees?

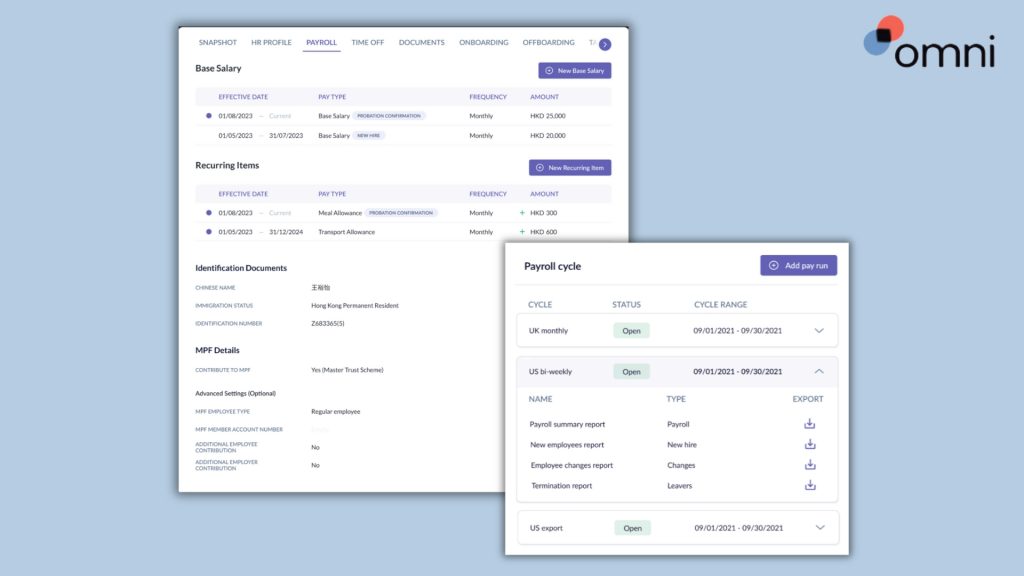

Whether you’re an employee or business owner in Hong Kong, Omni makes it easier than ever to support Hong Kong employees seeking rental assistance or simply working in the vertical city.

Our centralized document management solution makes gathering the necessary data required to apply for Hong Kong’s rental scheme seamless and timely. With customized workflows and automated reminders, HR can help empower employees to manage the deadlines and documentation requirements for rental scheme applications. And centralized documents and real-time data makes it easy for employees to access salary information and produce reports and documents necessary for verification.

Offering a comprehensive payroll solution tailored to Hong Kong’s specific requirements with features like support for HKD, automated tax calculations, and managed MPF contributions, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Learn more: Your Guide to Managing Payroll Hong Kong

Book a demo with our team to learn more about how Omni can support your Hong Kong workforce.