The Malaysia Employment Act 1955 is a cornerstone of Malaysian employment law, which means employers hiring in Malaysia need to know it inside and out—especially if there are updates.

At the beginning of 2023, an amendment went into effect in response to changes in the cost of living, currency values, and other developments, to enhance employee protection in Malaysia. This amendment also included key changes to the First Schedule, which defines the categories of employees covered by the Malaysia Employment Act 1955.

With the implementation of the bill which came into effect in January 2023, there’s been wide-spread confusion on exactly what and how the changes should be implemented. These include expanded coverage of the act, reduced working hours, protection for gig workers and more. Here, we’ll break down the important changes that HR managers in Malaysia should be aware of to remain compliant with the Malaysia Employment Act.

Core Components of Employment Act 1955

The Malaysia Employment Act 1955 is the cornerstone of Malaysia’s labor laws, governing the relationship between employers and employees. It covers a wide range of issues that affect both parties, ensuring fair treatment and protection for everyone in the workforce.

You can check out the details in this Malaysia Employment Act 2023 pdf, or keep reading for a rundown of the core components of the Act:

Employee coverage

The Act now covers all employees regardless of their wage, removing the previous RM2,000 monthly wage limit. This ensures equal protection and rights for all workers.

Key employment terms

The Act sets standards for things like:

- Minimum wage: The lowest amount an employer can legally pay.

- Working hours and overtime pay: How many hours your employees can work in a day or week, and what you should be paid for extra hours.

- Rest days and public holidays: When employees are entitled to take a break, and whether they get paid for it.

- Annual and sick leave: How much time off employees can take for vacation or when they’re not feeling well.

- Termination and layoff procedures: The proper way to terminate a position, and the roadmap after for laid off employees.

Employee rights and benefits

The Act is about more than just basic employment protections. It also covers wellbeing within the workplace. These include:

- Maternity protection and benefits: For employees who are expecting mothers, the Act has rules about time off, pay, and how your job is protected. The amended Act prohibits expecting mothers from being terminated except under very specific circumstances (which we touch on below).

- Protection against discrimination and unfair dismissal: It’s illegal for employers to discriminate against employees, and the act defines the detailed circumstances under which an employee can be dismissed while remaining compliant.

- Safety and health regulations: Your workplace should be a safe environment, and the Act outlines what your organization needs to do to keep your employees healthy and safe on the job.

Employer obligations

It’s important to know what is expected of employers so that your organization can remain compliant and build a safe and effective workplace. Obligations include:

- Safe and healthy workplace: Employers have to make sure the work environment they create doesn’t put employees at risk.

- Paying wages correctly and on time: Timely payments are extremely important, not just to maintain employee morale and provide meaningful compensation, but because it’s the law—your organization could face penalties for withholding or delaying wage payment.

- Proper termination procedure: There’s a process defined by the Act for letting employees go, and your organization needs to follow it.

- Keeping good records: Employers need to keep track of employee details, hours worked, and pay.

Learn more: Your Guide to Malaysia Payroll

Dispute resolution

Sometimes things don’t go smoothly at work. The Malaysia Employment Act provides ways to resolve disagreements between employers and employees:

- Mediation and conciliation: The Labour Department can help provide mediation for disputes between your organization and an employee. This third party approach can help de-escalate and minimize bias.

- Industrial Court: If an agreement can’t be reached even with mediation, the Industrial Court can make a decision and enforce the law.

2024 Updates to Labour Law Malaysia 2023

While the Act has been protecting Malaysian workers since 1955, major updates to the Labour Law Malaysia took place last year. Here’s what you need to know about the updates for 2024 and beyond:

1. Overtime pay threshold

The salary threshold for overtime eligibility has increased. Previous to the update, only employees earning below a certain amount (RM2,000) were entitled to overtime pay. Now, that threshold has been raised to RM4,000.

2. Coverage based on wages

The Malaysia Employment Act 1955 now covers all employees, regardless of their wages. Previously, the Act only applied to employees earning monthly salaries of RM2,000 or less, along with specific worker categories.

Amendments to the Act’s First Schedule mean that all employees, regardless of their salary, are now covered. However, those earning above RM4,000 per month are exempted from certain provisions, including:

- Overtime rates for rest days

- Overtime rates outside working hours

- Allowances for shift-based work

- Overtime on public holidays

- Overtime for half working days on holidays.

This change provides legal protection to employees who were previously not covered by the Malaysia Employment Act.

3. Flexible working arrangements

The amended Malaysia Employment Act now includes provisions for flexible working arrangements, which are important in the post-pandemic business landscape. Under Section 60P and 60Q, employees can request flexible work arrangements in writing, and employers must respond within 60 days, providing reasons in case of rejection.

4. Maximum working hours

The maximum working hours for workers have been reduced from 48 hours per week to 45 hours per week, effective 1 January 2023, excluding meal breaks. This change aims to protect workers’ welfare, reduce employee burnout, and aligns with the International Labour Organization (ILO) Convention.

5. Increased paid parental leave

Maternity leave entitlement for working mothers has increased from 60 days to 98 days post-delivery. For the first time, the Act includes paid paternity leave of 7 consecutive days, subject to the following conditions:

- The male employee must be married to the mother in question

- He must have been employed by the same employer for at least 12 months

- He must notify the employer at least 30 days from expected confinement (or as early as possible)

Read next: Malaysia Parental Leave Guide

6. Protection for expectant mothers

Pregnant mothers and those suffering from pregnancy-related illnesses are now protected against termination under the updated Malaysia Employment Act, with exceptions for:

- Breach of contract

- Misconduct

- Business closure

7. Protection for gig workers

A new section in the Malaysia Employment Act covers gig workers, providing them with protection even in the absence of a written contract, under the following conditions:

- Their manner of work is subject to the control or direction of another person

- Their hours of work are subject to the control or direction of another person

- They are provided with tools, materials or equipments by another person to execute work

- Their work constitutes an integral part of another person’s business

- Their work is performed solely for the benefit of another person, or where payment is made to them in return for work done by them at regular intervals

8. Sexual harassment awareness

Section 81H of the Malaysia Employment Act requires employers to display notices raising awareness about sexual harassment in the workplace.

9. Employment of foreign workers

Changes to Section 60K now require employers to obtain prior approval from the Director-General to hire foreign employees and notify the Director-General within 30 days if foreign employees are terminated. Previously, employers who hire foreign employees were required to inform the Director-General of new foreign employees along with details within 14 days of employment.

Frequently Asked Questions About the Malaysia Employment Act 1955

What is considered “wages”?

To determine which employees qualify for wages up to RM4,000 per month, it’s important to understand the specific definition of “wages” under the Malaysia Employment Act. According to the Act, “wages” include basic wages and all cash payments to an employee for their work under the contract of service. However, it does not include the following:

- The value of housing, food, fuel, light, water, medical care, approved amenities, or services provided by the employer.

- Contributions made by the employer to pension funds, provident funds, superannuation schemes, and other similar funds for the employee’s benefit.

- Traveling allowances or concessions.

- Payments to cover special expenses related to the employee’s job.

- Gratuity paid upon discharge or retirement.

- Annual bonuses or any portion thereof.

How does the EA define “overtime”?

The Malaysia Employment Act defines “overtime” in two key sections:

- Section 60A(3)(b) of the EA defines overtime as the hours worked beyond the normal daily working hours. If work extends beyond ten hours after the initial spread over period, the entire duration from the end of the spread over period to the end of the workday is considered overtime.

- Section 60A(3)(c) of the EA specifies that “normal hours of work” are the hours mutually agreed upon by the employer and employee in their contract of service, which cannot exceed the limits set in Section 60A(1).

Based on these sections, overtime is any work done outside the hours stated in the employment contract. However, the hours in the contract are subject to the restrictions outlined in Section 60A(1), which now includes limits such as not working more than 5 consecutive hours without a 30-minute leisure break and not exceeding 45 hours in a week.

How to determine when employees are entitled to overtime payments?

Employees on a monthly wage are entitled to overtime payments in the following situations, along with the respective formulas/rates:

- Working more than the normal working hours on a regular workday: 1.5x the hourly rate of pay [Section 60A(3)(a)].

- Working on a rest day, with the work period not exceeding half the normal working hours: 0.5 times the ordinary rate of pay [Section 60(3)(b)(i)].

- Working on a rest day, with the work period exceeding half but not exceeding the normal working hours: One day’s wages at the ordinary rate of pay [Section 60(3)(b)(ii)].

- Working on a rest day beyond the normal hours of work: 2x the hourly rate of pay [Section 60(3)(c)].

- Working on a public holiday, with the work period not exceeding normal working hours: Two days’ wages at the ordinary rate of pay [Section 60D(3)(a)(i)].

- Working on a public holiday beyond the normal hours of work: 3x the hourly rate of pay [Section 60D(3)(aa)].

How to Calculate an employee’s “ordinary rate of pay” and “hourly rate of pay”

Overtime rates depend on the “ordinary rate of pay” and “hourly rate of pay,” which the Malaysia Employment Act defines. For employees paid on a monthly rate of pay:

- The “ordinary rate of pay” is their monthly wages divided by 26.

- The “hourly rate of pay” is the ordinary rate of pay divided by their normal daily working hours.

For example, if an employee’s monthly salary is RM3,900 and their employment contract requires them to work 8 hours a day, they would have:

- An ordinary rate of pay of RM150 (3900/26).

- An hourly rate of pay of RM18.75 (150/8).

To-Do List for HR Teams

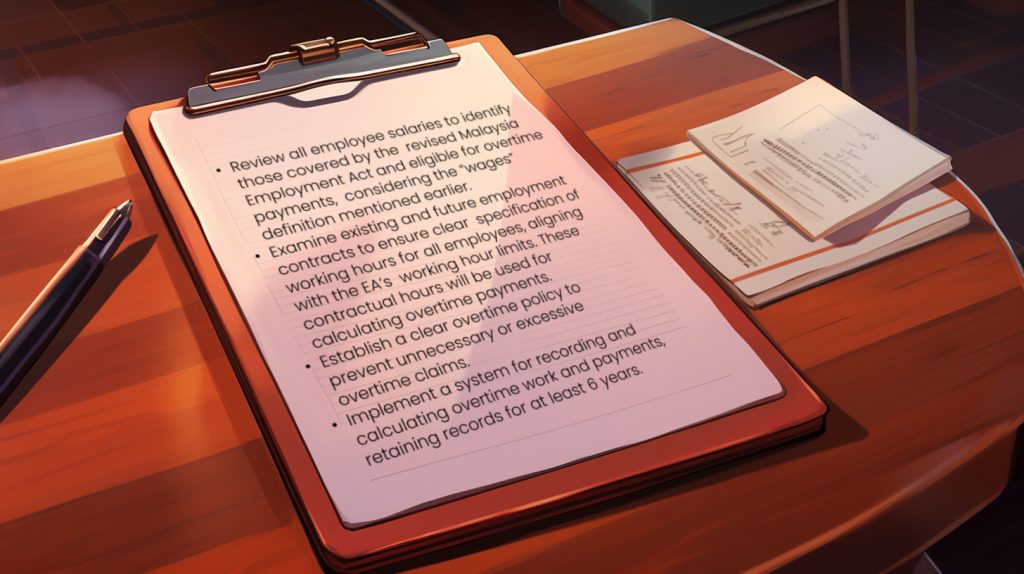

Due to the recent amendments to the Malaysia Employment Act, employers who were not previously concerned with overtime payment regulations now need to take action. Here are the steps you need to take::

- Review all employee salaries. This will help you identify those covered by the revised Malaysia Employment Act and eligible for overtime payments, considering the “wages” definition mentioned above.

- Examine existing and future employment contracts. This will help clear specification of working hours for all employees, aligning with the EA’s working hour limits. These contractual hours will be used for calculating overtime payments.

- Establish a clear overtime policy. A clear overtime policy will prevent unnecessary or excessive overtime claims.

- Systematize overtime calculations. Implement a system for recording and calculating overtime work and payments, retaining records for at least 6 years.

Seamlessly Manage Employee Records and Payroll

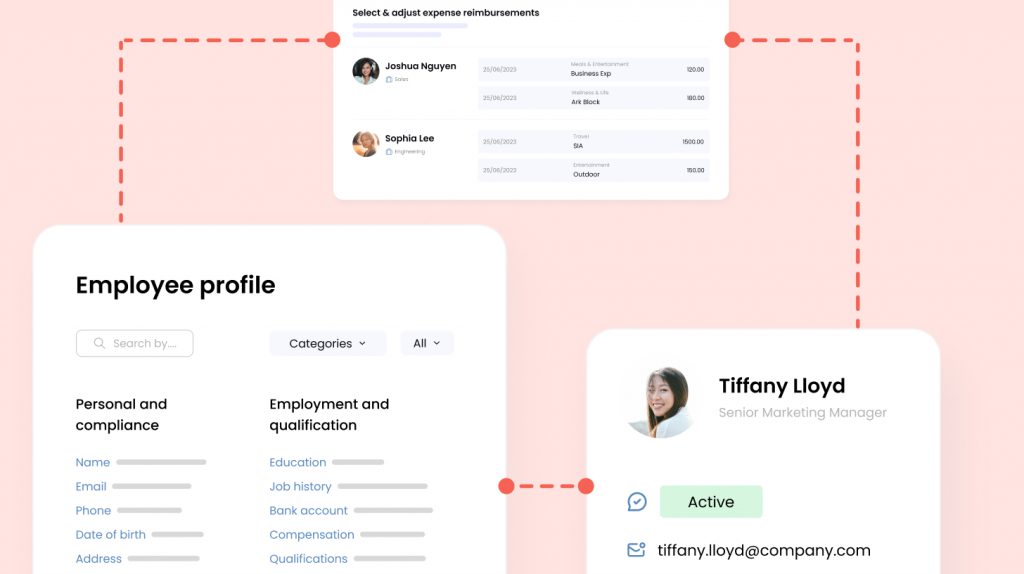

HR managers have their hands full, and the recent amendments to the Malaysia Employment Act 1955 add yet another layer of responsibility to their already existing workload. Tracking and calculating hours, managing employee records, and administering payroll requires a clear, secure, and accurate system to ensure compliant and timely payouts for your employees.

Omni’s all-in-one HR solution helps make these tasks streamlined and free of manual error to reduce the administrative burden on HR. With secure and centralized employee records, HR teams can easily store, update, and communicate employee information across departments and with employees. Our payroll solutions make it easier than ever to calculate accurate employee payments and tax calculations through automation that saves time and reduces errors. And with automated payroll information synchronization, end of month processing becomes a streamlined and seamless effort.

Book a demo with our team, or try out Omni for free to learn how our automation can help you remain compliant and reduce your administrative workload for all of your People management needs.