Hong Kong, a bustling metropolis known for its skyscrapers, international business prowess, and vibrant culture, is a beacon of economic opportunity. In this dynamic city, managing payroll is more than just a routine task—it’s a delicate process that requires precision, compliance, and adaptability.

Understanding the intricacies of the payroll system Hong Kong runs on is paramount for HR professionals navigating the inner workings of this financial hub.

Here, we’ll look at how to decode the payroll system Hong Kong operates. From the unique aspects of commission payments, allowances, bonuses, and overtime to diving deep into the legal requirements that shape payroll practices, you’ll gain the insights you need to demystify this complex landscape.

Payroll Process and Key Steps

The payroll system Hong Kong operates on is known for its efficiency and compliance with rigorous employment regulations. To effectively administer payroll, HR professionals must navigate multiple payment styles, each with its own nuances.

With its simple, low-tax environment and competitive business ecosystem, Hong Kong is a global financial hub. Its payroll processes are characterized by their precision and adherence to legal requirements.

Commission Payments

Handling commission payments within the payroll system Hong Kong requires meticulous attention to detail. Here’s a step-by-step guide to the process:

1. Sales Agreement:

- Agreement Terms: Ensure that each employee involved in commission-based roles has a clear sales agreement outlining the terms and conditions of commission.

- Calculation Method: Define a transparent method for calculating commissions, typically as a percentage of sales revenue or profits.

- Performance Metrics: Establish the performance metrics on which commission payouts are based.

2. Tracking and Reporting:

- Sales Records: Maintain accurate records of individual sales, as these records will be crucial in calculating commissions.

- Regular Reporting: Implement a system for regular reporting and review of sales performance.

3. Commission Calculation:

- Calculate Earned Commissions: Using the predefined method, calculate the commissions earned by each employee.

- Deductions and Taxes: Consider any deductions or taxes applicable to commission payments and ensure compliance with relevant tax regulations.

- Processing: Process commission payments alongside regular payroll according to your company’s payment schedule.

Allowance Payments

Allowance payments play a vital role in compensating employees for various expenses. In Hong Kong, they are subject to specific rules:

1. Identify Eligibility:

- Allowance Types: Identify the types of allowances offered, such as housing, transportation, or meal allowances.

- Eligibility Criteria: Determine which employees are eligible for specific allowances based on their job roles and company policies.

2. Documentation:

- Receipts and Records: Establish a system for employees to submit receipts or records for expenses related to their allowances.

- Approval Process: Implement an approval process to verify the accuracy and legitimacy of expense claims.

3. Calculate Allowances:

- Amount Calculation: Calculate allowances based on the eligible expenses and company policies.

- Tax Considerations: Ensure compliance with tax regulations when providing allowances.

Bonus Payments

Bonus payments are a common practice in Hong Kong to increase engagement and incentivize and reward employee performance:

1. Bonus Policies:

- Policy Formation: Establish bonus policies outlining the criteria, timing, and calculation methods for bonuses.

- Performance Metrics: Define the performance metrics upon which bonus calculations will be based.

2. Performance Assessment:

- Evaluate Performance: Conduct performance evaluations to determine bonus eligibility.

- Fairness: Ensure that bonus allocation is based on objective performance assessments.

3. Calculation and Payment:

- Calculate Bonuses: Calculate bonuses based on the predefined criteria and performance metrics.

- Processing: Process bonus payments in accordance with the company’s payment schedule.

Overtime Payment

Overtime payment is essential in the payroll system Hong Kong operates to compensate employees for extended work hours:

1. Overtime Policy:

- Establish a Policy: Create a clear overtime policy that outlines when overtime is applicable, such as extended work hours or weekend shifts.

- Rate Determination: Define the rate at which overtime is compensated, typically as a multiple of the regular hourly wage.

2. Time Tracking:

- Accurate Records: Ensure accurate tracking of employee work hours, including regular hours and overtime hours worked.

- Employee Records: Maintain detailed records of employee overtime hours for reference and verification.

3. Overtime Authorization:

- Approval Process: Implement an approval process for overtime hours, requiring employees to seek prior authorization for overtime work.

- Supervision: Supervisors or managers should oversee and authorize overtime hours in line with the company’s policy.

4. Calculate Overtime:

- Hourly Calculation: Calculate overtime pay based on the predefined rate and the number of overtime hours worked.

- Double-Check: Double-check calculations to ensure accuracy.

5. Deductions and Compliance:

- Deductions: Consider any statutory deductions or taxes applicable to overtime payments.

- Compliance: Ensure compliance with labor laws regarding overtime pay rates and rest periods.

Legal Requirements

In Hong Kong, the administration of payroll is not just about ensuring employees are accurately compensated—it also involves strict adherence to a range of legal requirements. To successfully navigate the payroll system Hong Kong compliance landscape, you need to understand and meet the obligations under various ordinances and schemes.

Mandatory Provident Fund (MPF) Scheme

The Mandatory Provident Fund (MPF) Scheme is a cornerstone of Hong Kong’s retirement protection system. Employers and employees alike contribute to this fund, which serves as a safeguard for employees’ financial well-being during retirement. The contributions are calculated based on a percentage of an employee’s relevant income, and there are specific rules about contribution limits, contributions holidays, and investment options.

Inland Revenue Ordinance (IRO)

The Inland Revenue Ordinance (IRO) lays out Hong Kong’s taxation framework. Understanding the IRO is crucial, as it governs the calculation and reporting of salaries, wages, and other forms of remuneration. Employers are responsible for calculating and withholding income tax from employees’ salaries and remitting it to the Inland Revenue Department (IRD) on their behalf. The IRO outlines tax rates, deductions, allowances, and filing requirements.

Employment Compensation Ordinance (ECO)

The Employment Compensation Ordinance (ECO) is another critical piece of legislation that deals with issues related to employment contracts and employee compensation. It’s designed to provide a safety net for employees in the unfortunate event of workplace injuries or occupational diseases. It establishes the framework for compensating employees and their dependents for work-related injuries, disabilities, or even death.

Personal Data (Privacy) Ordinance (PDPO)

In an era of heightened data privacy concerns, the Personal Data (Privacy) Ordinance (PDPO) plays a pivotal role. Hong Kong employers are entrusted with sensitive employee data, and the PDPO mandates strict guidelines on its collection, use, and protection. Safeguarding employee privacy is not just a legal obligation but also a matter of trust and integrity.

Payroll System Hong Kong Logistics

Behind every smoothly running payroll system Hong Kong offers, there’s a tapestry of logistics that ensures employees are paid accurately and on time while complying with legal requirements. Understanding these logistical aspects is crucial for businesses operating a payroll system Hong Kong.

Payroll Schedule

The payroll schedule is the heartbeat of payroll logistics. It outlines when and how often employees are paid, the cut-off dates for salary calculations, and the disbursement process. Hong Kong follows diverse payroll schedules, including monthly, bi-monthly, and semi-monthly.

MPF Contributions

Mandatory Provident Fund (MPF) contributions are a vital part of an employee’s financial security. Both employers and employees contribute to MPF accounts, and adhering to the precise schedule for these contributions is essential to meet compliance requirements and support employee retirement planning.

Taxation

Hong Kong operates on a territorial tax system, which means that only income earned within its borders is subject to taxation. However, even within this scope, various tax codes and categories exist, each with its own set of rules. Employees may fall under different tax categories based on their residency status, income sources, and other factors. It’s essential for payroll administrators to accurately classify employees according to these codes to ensure the correct withholding tax.

Employment Contracts

Clear and comprehensive employment contracts lay the foundation for the employer-employee relationship. They specify terms of employment, salary structures, benefits, and obligations. Ensuring that employment contracts are meticulously drafted and align with local labor laws is key to preventing disputes.

Employee Records

Accurate record-keeping is the backbone of payroll system Hong Kong logistics. Maintaining detailed employee records helps in managing payroll calculations, compliance reporting, and resolving employee disputes. It’s essential to keep these records secure and accessible.

Payroll Outsourcing

For many businesses, managing the intricate logistics of the payroll system Hong Kong runs on can be daunting. As a result, payroll outsourcing is a common practice. By outsourcing payroll, organizations can offload the administrative burden of payroll processing, which involves a multitude of tasks, from calculating salaries and allowances to handling deductions and compliance matters. This shift in responsibilities frees up valuable time and resources, allowing businesses to focus on their core operations.

Automation for Accurate and Compliant Payroll

In a world where time is of the essence, and accuracy and compliance are non-negotiable, the role of automation in payroll management shines brighter than ever. The intricate payroll system Hong Kong runs on, with its unique features and logistical complexities, requires a well organized and secure system.

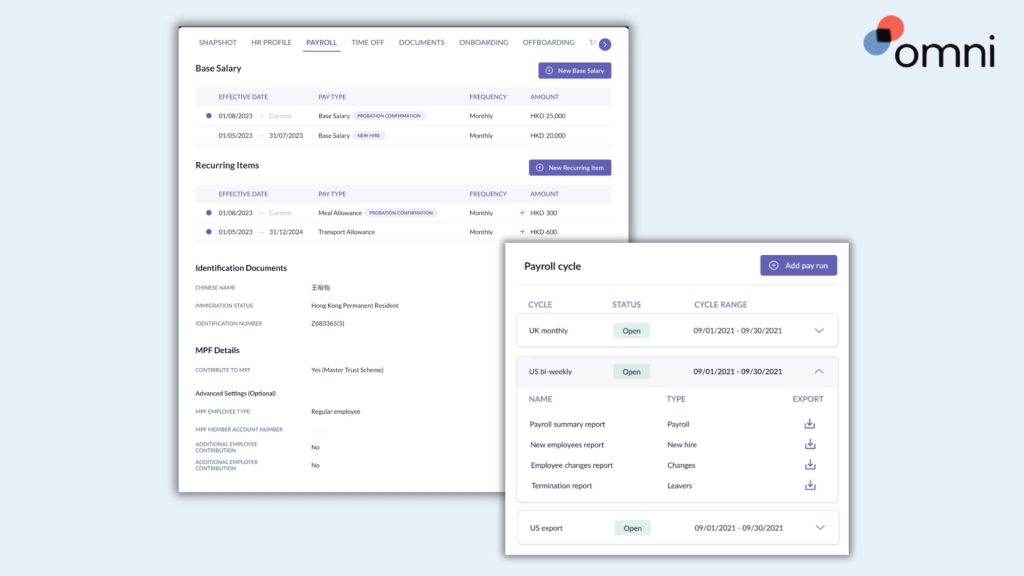

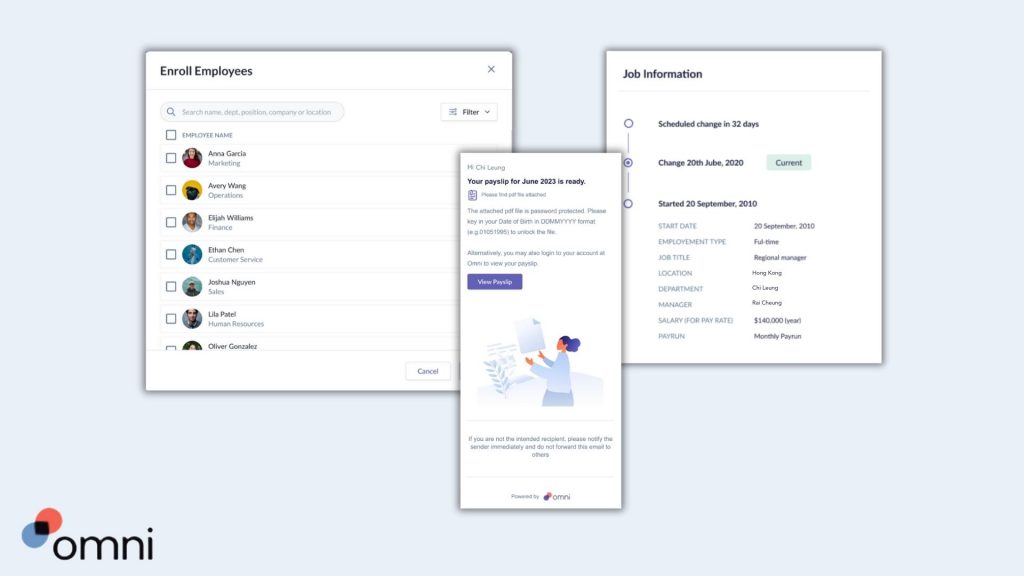

Omni’s suite of features makes the requirements for running a compliant and efficient payroll system in Hong Kong easy. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support payroll practices. Our time and attendance features empower teams to automate data and produce accurate reports in minutes. And with payroll solutions that support Hong Kong currency and pay schedules, Omni offers an entire suite of solutions to make your payroll system Hong Kong seamless.

Manage more than one company? Omni helps you establish a dedicated payroll admin for each company, who have the power to enroll employees, manage company settings and easily process your payroll.

With Omni, you not only get the convenience of automation but also the peace of mind that comes with a solution designed to meet the specific needs of your business in Hong Kong. Ready to take advantage of the convenience, efficiency and reliability of automated payroll? Book time to chat with us today!