China, with its massive economy and vast talent pool, is understandably an appealing opportunity for businesses seeking global expansion. In fact, China has the world’s largest labor force, with approximately 791 million people employed as of 2021. But navigating the complexities of recruiting in China requires careful planning and a thorough understanding of local regulations.

In this guide, we’ll walk you through everything about the Chinese labor market, from hiring foreign workers in China to the China payroll process and everything in between.

1. Understanding the Chinese Labor Market

If you’re committed to recruiting in China, there’s a lot you need to first understand about the labor market in China. These include:

Labor laws

Labor contract law: This law governs the formation, content, performance, modification, and termination of employment contracts in China. It sets out the rights and obligations of both employers and employees, covering aspects like wages, working hours, rest and holidays, social insurance, and labor disputes.

Social insurance law: This law mandates social insurance contributions for employees, covering areas like pension, medical insurance, unemployment insurance, work-related injury insurance, and maternity insurance. Both employers and employees are required to make contributions.

Individual income tax law: This law governs the taxation of individual income in China, including salaries, wages, bonuses, and other forms of compensation. Employers recruiting in China are responsible for withholding income tax from their employees’ salaries and remitting it to the tax authorities.

Minimum wage

China has a tiered minimum wage system, with different minimum wage levels set by each province, municipality, and autonomous region. For example, in Shanghai, the monthly minimum wage as of October 2024 is CNY 2,690. In Beijing, it’s CNY 2,320. Minimum wage levels are subject to periodic adjustments, so it’s important to stay updated on the latest regulations in your specific location.

Working hours

Standard workweek: The standard workweek in China is 40 hours, with a maximum of 8 hours per day.

Overtime: Overtime work is permitted, but it’s subject to strict regulations and requires additional compensation. Generally, overtime is limited to 36 hours per month.

Rest and holidays: Employees are entitled to rest days, public holidays, and paid annual leave, which vary based on their length of service.

Social security

Mandatory contributions: Both employers and employees are required to contribute to China’s social security system, which covers five main areas:

- Pension insurance

- Medical insurance

- Unemployment insurance

- Work-related injury insurance

- Maternity insurance

Contribution rates: The contribution rates vary based on the location and the employee’s salary. Employers typically contribute a higher percentage than employees.

Benefits: Social security contributions provide employees with a safety net, offering benefits like retirement pensions, medical coverage, unemployment benefits, and maternity leave pay.

2. Process for recruiting in China

Hiring the right people is crucial for any business, but recruiting in China requires careful planning and an understanding of local practices. Here’s a step-by-step guide to help you navigate the process:

Job description

Clarity and specificity: A well-crafted job description is essential to attract qualified candidates when you’re recruiting in China. It should clearly outline the job title, responsibilities, required skills, qualifications, and compensation package.

Chinese language: While English proficiency is increasing in China, it’s crucial to have a Chinese version of the job description to reach a wider audience.

Highlight company culture: Consider including information about your company culture and company values to attract candidates who align with your organization.

Read next: How to Define Your Employee’s Job Scope (With a Template!)

Recruitment channels

Online job boards: When recruiting in China, online recruitment is the most popular method for finding jobs in China, with over 90% of job seekers using online platforms. Popular Chinese job boards like 51job and Liepin are widely used by people on the job hunt.

Social media: Platforms like WeChat and Weibo are essential for reaching a wider audience and promoting your employer brand.

Recruitment agencies: Partnering with reputable recruitment agencies when you’re recruiting in China can help you source and screen candidates with specific skills or experience.

Campus recruitment: If you’re looking for young talent, consider participating in campus recruitment events at universities and colleges.

Professional networking: Attend industry events and conferences to network with potential candidates.

Screening and selection

Resume screening: Review resumes and cover letters, paying attention to relevant skills, experience, and educational background.

Interviews: Conduct interviews to assess candidates’ qualifications, communication skills, and cultural fit. Be prepared for a more formal interview process in China, with a focus on technical skills and experience.

Assessments: Consider using assessments to evaluate candidates’ skills, personality traits, and cultural intelligence when recruiting in China.

Background checks: Conduct background checks to verify information provided by candidates and ensure their suitability for the role.

Additional reading: What Is a Screening Interview? 5 Important Questions for HR to Ask

Job offers

Competitive compensation: Offer competitive salaries and benefits packages to attract top talent when recruiting in China’s competitive job market.

Clear contract: Provide a clear and comprehensive employment contract that outlines the terms and conditions of employment, including salary, benefits, working hours, and termination procedures.

Negotiation: Be prepared for some negotiation on salary and benefits, especially for senior or highly skilled positions.

3. Onboarding and Compliance for Hiring Foreign Workers in China

As of 2023, there were an estimated 900,000 foreign nationals working in China. Even so, successfully onboarding foreign workers in China requires careful attention to legal requirements and cultural considerations. Here’s a breakdown of the key steps to ensure a smooth transition for your new hires when recruiting in China:

Employment contracts

Written contracts are mandatory: Chinese labor law mandates written employment contracts for all employees, including foreign nationals. The contract should be in Chinese and clearly outline the terms of employment, including:

- Job title and responsibilities

- Compensation and benefits

- Working hours and leave entitlements

- Probationary period (if applicable)

- Termination procedures

- Confidentiality and non-compete clauses (if applicable)

Take great care that the contract complies with all relevant Chinese labor laws and regulations.

Work permits

Necessary for foreign workers: Individuals looking for work in China for foreigners must obtain a valid work permit and residence permit. The process can be complex and time-consuming, involving various government agencies and documentation requirements.

EOR assistance: An EOR can streamline recruiting in China by guiding you through the necessary steps, preparing the required documents, and liaising with the relevant authorities on your behalf.

Read next: Global Employer of Record Guide: China

Social security registration

Mandatory for all employees: All employees in China, including foreign nationals, must be enrolled in the social security system. This includes five main insurance programs: pension, medical, unemployment, work-related injury, and maternity insurance.

Employer and employee contributions: Both employers and employees contribute to the social security system based on the employee’s salary and local regulations. An EOR can handle the registration process, calculate and deduct contributions, and ensure compliance with all social security regulations.

Induction training

Cultural integration: Induction training is crucial for helping foreign workers adapt to the Chinese workplace culture and understand their roles and responsibilities.

Company policies and procedures: Familiarize new hires with your company’s policies, code of conduct, and any specific procedures relevant to their roles.

Practical support: Provide practical support to help foreign workers settle into their new environment, such as assistance with housing, transportation, and opening bank accounts.

4. Managing Your Workforce

China payroll process and benefits

Chinese payroll processing involves various factors, including individual income tax deductions, social insurance contributions (pension, medical, unemployment, work-related injury, and maternity), housing fund contributions, and other statutory deductions. Ensuring accurate and timely payroll processing is crucial for employee satisfaction and compliance with Chinese labor law.

Also, it’s often worth it to offer competitive benefits packages that can help attract and retain top talent in China’s competitive job market. This could include supplemental health insurance, housing allowances, meal subsidies, transportation allowances, and other perks.

Leave management

When recruiting in China, it’s important to note that Chinese labor law mandates various types of leave, including:

- Annual leave: The amount of annual leave varies based on the employee’s length of service.

- Public holidays: China has 11 official public holidays, and employees are generally entitled to paid time off during these holidays.

- Maternity leave: Female employees are entitled to 98 days of maternity leave, with possible extensions for certain circumstances.

- Paternity leave: The duration of paternity leave varies by region, but it’s generally between 10 and 30 days.

- Sick leave: Employees are entitled to sick leave with pay based on their length of service and medical certificates.

- Other leave: Other types of leave may include marriage leave, bereavement leave, and personal leave.

Read next: What is a Leave Management System? Why Every Business Needs One

Performance management

Set clear performance goals and expectations for your employees, providing regular feedback and performance reviews. Be mindful of cultural differences in communication and feedback styles. Direct criticism may be perceived negatively, so focus on constructive feedback and suggestions for improvement.

Make sure to provide opportunities for employee development and training to enhance their skills and contribute to their career growth.

Employee relations

Commit to open and transparent communication with your employees, encouraging them to share their ideas and concerns. This will help create a respectful and inclusive workplace that values diversity and promotes a positive work environment.

Address any workplace conflicts or grievances promptly and fairly, considering cultural nuances and legal requirements.

Compliance

When recruiting in China, ensure your HR policies and practices comply with all relevant Chinese labor laws and regulations. You should protect employee data in accordance with Chinese data privacy laws, including the Personal Information Protection Law (PIPL). Also, ensure accurate and timely payment of taxes and social insurance contributions to avoid any legal consequences.

5. Taxes and Contributions

Understanding and managing taxes and contributions is an important aspect of employing workers in China. Both your organization and its employees have specific obligations to ensure compliance and contribute to the social security and well-being of the workforce. Here’s what you need to know:

Employer obligations

Social insurance contributions

Employers are required to contribute to China’s social insurance system on behalf of their employees. This system covers five main areas:

- Pension insurance

- Medical insurance

- Unemployment insurance

- Work-related injury insurance

- Maternity insurance

Housing provident fund (HPF) contributions

The HPF is a government-mandated program designed to help employees save for housing purchases, renovations, or rent. Both employers and employees contribute to the fund, which acts as a long-term savings plan with some unique features.

Employers typically contribute the same percentage as their employees, although the specific rates can vary by location. The total contribution rate (employer + employee) usually ranges from 10% to 25% of the employee’s salary, with each party contributing an equal share.

Unemployment insurance contributions

Employers in China are obligated to contribute to unemployment insurance. Both employee and employer contribute, but it’s up to the employer to deduct the appropriate amounts from employee pay. In Beijing, employees contribute 0.2% of their gross income and employers contribute 0.8%.

Occupational injury insurance contributions

All employers in China are required to participate in the occupational injury insurance scheme and make contributions on behalf of their employees. Unlike other types of social insurance, employees do not contribute to occupational injury insurance. The employer bears the full cost.

The contribution rates for occupational injury insurance vary based on the industry’s risk level. Higher-risk industries, such as construction and manufacturing, have higher contribution rates. The rates generally range from 0.5% to 2% of the employee’s salary.

Tax compliance

- Payroll processing: Accurate payroll processing is crucial for ensuring correct tax deductions and contributions to social security and housing fund programs. Consider using payroll software or outsourcing to a local provider to streamline this process.

- Record keeping: Maintain detailed records of all payroll transactions, including payslips, tax deductions, and contributions to social security and housing fund programs. These records should be kept for a specified period for compliance and audit purposes.

- Tax filing: Employers are responsible for filing various tax returns, including annual income tax returns for their employees and corporate income tax returns. Ensure you meet all filing deadlines to avoid penalties.

Employee obligations

Income tax

Employees are responsible for filing their annual individual income tax returns with the tax authorities. The Chinese individual income tax system is progressive, with tax rates increasing as income rises.

Here’s a table showing the tax rates for 2024:

| Monthly Taxable Income (CNY) | Tax Rate (%) |

| 0 – 36,000 | 3 |

| 36,000 – 144,000 | 10 |

| 144,000 – 300,000 | 20 |

| 300,000 – 420,000 | 25 |

| 420,000 – 660,000 | 30 |

| 660,000 – 960,000 | 35 |

| 960,001 and above | 45 |

Social insurance contributions

Employers bear the brunt of social insurance contributions, but employees also contribute a portion of their salary (handled by the employer, and automatically deducted) to the five main areas listed above.

Housing provident fund contributions

As noted above, the employer contributes a larger portion to the housing provident fund, but all Chinese employers are nonetheless automatically enrolled and contribute a small portion of their salary to the HPF.

Unemployment insurance contributions

Similar to the HPF, employees automatically contribute a portion of their income to unemployment insurance, with percentages ranging depending on the region.

Occupational injury insurance contributions

Employers contribute exclusively to this category.

Optimize Your China Hiring Strategy Today

When it comes to recruiting in China, it requires meticulous attention to legal regulations and thorough documentation. You should strive to minimize human error by leveraging automation to ensure accuracy and compliance.

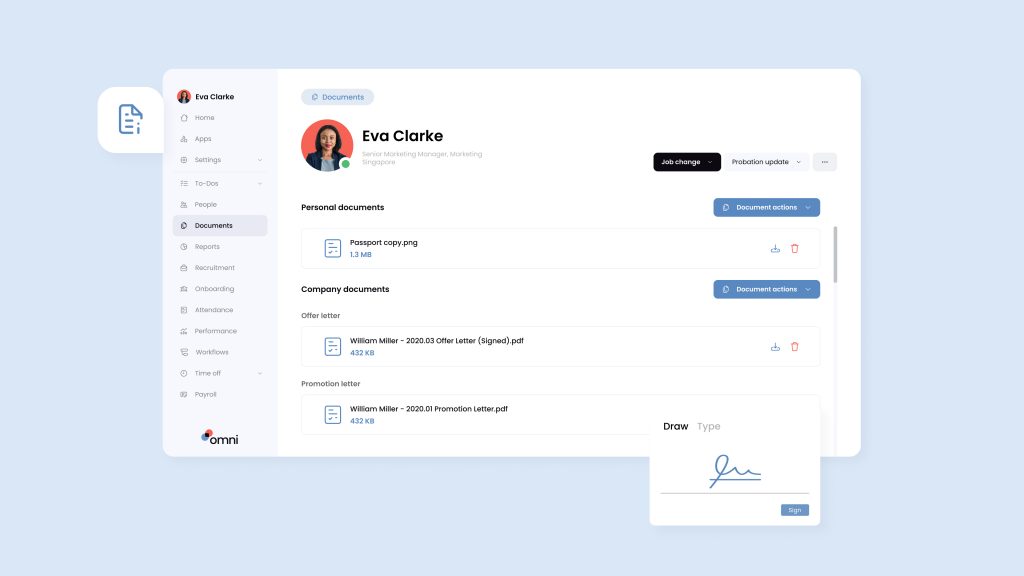

Omni’s suite of features makes recruiting in China efficient and compliant. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support the requirements for hiring foreign workers in China.

For leave management, our time off management capabilities allows managers to approve leave applications on the go, and keep track of who’s in and out of the office with at-a-glance scheduling. Our employee self-service portal allows employees to submit their employee time off request, which automatically routes to the appropriate manager thanks to customizable approval workflows. With automated calculations, employees and managers can easily view leave balances in real-time, and track how many vacation days they have left without having to go through HR.

When it comes time for payroll and tax processing, Omni offers a comprehensive payroll solution tailored to China’s specific requirements. With features like support for Chinese yuan and automated tax calculations, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Book your product tour with our team today to learn more about how Omni can simplify your process for recruiting in China.