There’s a lot that goes into payroll processes, and they’re all highly scrutinized. From leadership looking for accuracy, to employees wanting to understand deductions and regulatory bodies examining your compliance, there is a lot of pressure to ensure your payroll processing runs smoothly.

This is especially the case during tax season, where accurate reports need to be submitted on time, and all deductions calculated precisely. Read on to know what you need in order to streamline your payroll processes and ease your stress this tax season.

Payroll Processes Explained

When it comes to payroll management, multiple processes play essential roles for making sure employees are paid appropriately and tax obligations are met. From calculating wages and deductions to managing benefits and taxes, these processes are the backbone of payroll administration.

During tax season, the complexity intensifies as accurate reporting and compliance become necessary, and it’s all-hands-on-deck to ensure timeliness and accuracy. Here’s what the most common payroll processes look like:

Wage calculation: The fundamental process involves determining employees’ wages based on factors like hourly rates, salaries, or commission structures. This calculation needs to be accurate to reflect the actual work hours, rates, and any extra pay earned by employees.

Deductions management: Payroll administrators must sift through a large number of deductions, including taxes, insurance premiums, retirement contributions, and other considerations. Accuracy is also incredibly important here so as to comply with regulations and meet employee expectations.

Benefits administration: Managing employee benefits like health insurance, retirement plans, and other perks are some of the highest profile aspects of managing payroll. During tax season, making sure these benefits are accurately reported is essential for compliance.

Time and attendance tracking: Accurate recording of employees’ work hours and attendance is another important part of payroll management. During tax season, precise timekeeping ensures that wages and taxes are calculated correctly.

Tax withholding: This process involves deducting the specific amount of income tax from employees’ paychecks. Keeping compliant with tax laws and reflecting any changes in tax regulations during the latest tax season is important, so staying up to date on regulatory shifts is a must.

Record keeping: Maintaining detailed records of all payroll transactions is absolutely necessary in the event of audits and to remain compliant. At tax time, having well-organized records makes the process more efficient and less error-prone.

Understanding and optimizing these processes are necessary for all HR professionals managing payroll (especially during tax season) when precision and efficiency become extra important.

Internal Manual Payroll Processing vs Payroll Service Provider

When it comes to managing payroll, your organization will need to make an important decision—whether to handle it internally through manual processes or enlist the services of a payroll service provider? Let’s take a look at the characteristics of each so you can make an informed decision.

Pros of internal manual payroll processing

Control and customization: Handling payroll internally provides a high level of control over processes. You can customize calculations, deductions, and processes according to your specific needs, and tailor them quickly when things change.

Cost control: In some cases, especially for small businesses, internal payroll processing might be more cost-effective, avoiding the fees associated with outsourcing.

Direct oversight: Internal processing allows for direct oversight of your payroll activities, reducing the risk of miscommunication.

Cons of internal manual payroll processing

Time-Consuming: Manual processing is inherently time-consuming. From calculating wages to managing deductions, the workload can become overwhelming, especially as your workforce grows.

Error-Prone: The manual nature of the process increases the likelihood of errors, whether in data entry, tax calculations, or compliance issues. This is especially true for smaller organizations who may not have invested in automated HR software and processes.

Resource Intensive: It demands a dedicated team or individual to manage payroll tasks, diverting resources from your other core business activities.

Pros of a payroll service provider

Efficiency: Payroll service providers can harness automation for quick and efficient processing. This can be especially beneficial during tax season when time is of the essence.

Expertise: Providers often have a team of experts well-versed in tax regulations and payroll compliance, reducing the risk of errors. If your team doesn’t employ a dedicated expert, outsourcing to specialists might be the right way to go.

Time-saving: Outsourcing payroll frees up valuable time for your organization to focus on core operations rather than getting bogged down by administrative tasks.

Cons of a payroll service provider

Cost: While outsourcing can save time, it comes at a cost. You will need to weigh the expense against the benefits.

Less control: Businesses that outsource payroll processes relinquish some control over them, which might be a concern for those who prefer hands-on management.

Dependence: Relying on an external provider introduces a level of dependence, and any issues on their end could potentially affect your business.

Ultimately, the choice between internal manual payroll processing and a payroll service provider depends on factors such as the size of your business, budget considerations, and the need for control and customization. Each approach has its merits, and you should align your choice with your specific requirements and priorities.

Choosing the Best Service Provider for Your Payroll Processes

Selecting the right payroll service provider is a major decision for businesses seeking efficiency, accuracy, and compliance in their payroll processes. Here are key considerations to consider when choosing the best service provider for your payroll needs:

1.Reputation and Experience

- Research: Explore reviews, testimonials, and case studies to gauge the provider’s reputation. Make sure to check with a variety of sources, and consider both positive and negative reviews (if there are any) to paint an accurate picture

- Experience: Consider providers with a proven track record and experience in handling payroll for businesses similar in size and industry. If a company similar to yours has me with success, it’s a good indicator your organization will too.

2. Compliance Expertise

- Regulatory knowledge: Ensure the provider you’re looking at has a deep understanding of local and federal tax regulations and stays updated on changes. It’s a good idea to consider outsourcing to a locally based payroll management service.

- Compliance track record: Check their compliance track record to mitigate risks associated with regulatory penalties. If they have a clean track record that’s a good sign they’re accurate with their record keeping.

3. Technology and Integration

- User-friendly platforms: Assess the user-friendliness of their platforms, ensuring that your team can easily navigate and manage payroll-related tasks. Consider the time and cost of having to train your team just to use the platforms provided by the outsourced payroll manager.

- Integration capabilities: Confirm that the provider’s systems can seamlessly integrate with your existing HRIS or accounting software.

4. Scalability

- Growth support: Choose a provider capable of accommodating your business’s growth trajectory. Make sure that they can scale their services to keep up with the evolving needs of your workforce.

5. Data Security

- Security protocols: Prioritize providers with robust security measures to safeguard sensitive payroll information. Check with them about their experience dealing with security threats and what their plan of action was.

- Compliance with standards: Check to ensure their compliance with industry standards and regulations related to data protection. Any issues staying compliant is a big red flag.

6. Service Customization

- Tailored Solutions: Look for providers offering customizable solutions to meet your unique payroll requirements. A one-size-fits-all solution won’t work for most organizations.

- Flexibility: Ensure the provider you’re considering can adapt to changes in your payroll structure and policies.

7. Cost Structure

- Transparent pricing: Seek providers with transparent and straightforward pricing structures. Be wary of hidden fees that can impact the overall cost and reduce any cost-savings you might be counting on by outsourcing your payroll processes.

- Value for money: Balance cost considerations with the value and features offered by the provider.

8. Trial Periods and Demos

- Trial options: If available, take advantage of trial periods to assess the functionality and compatibility of the provider’s systems. This try-before-you-buy approach can be done across a few service providers, and lets you get a feel for the options that work for you and your team.

- Live demos: Request live demonstrations to get a firsthand look at the features and usability of their platforms.

By carefully evaluating these factors, your organization can make an informed decision when choosing a payroll service provider, so that they align with your specific needs and help lead to a stress-free tax season.

Read next: Your Guide to Successfully Pitching HR Software to Leadership

Steps of Payroll Processing

Collect employee tax information

Gather relevant tax forms to ensure accurate withholding of all relevant taxes. Regularly collect and update employee information, including changes in dependents, marital status, or other tax-related details.

Create a record management process

Establish a secure system for storing sensitive payroll information, ensuring compliance with data protection regulations. You’ll also need to implement policies for keeping and accessing payroll records to meet legal requirements and facilitate any audit that might happen.

Determine pay schedule

Define a clear pay schedule, whether it’s weekly, bi-weekly, or monthly, and communicate it to your employees. You should maintain consistency in the pay schedule to provide predictability for your employees and streamline the payroll processing workflow.

Track time and attendance

Use time-tracking systems to accurately record hours worked by your employees. This should be accompanied by clear attendance policies to manage employee attendance effectively, and minimize confusion.

Calculate deductions

Deduct employee contributions for health insurance, if applicable. Then, calculate and deduct contributions for retirement plans or other contributions (like to a housing subsidy).

Pay employees

You’ll need to choose a secure and convenient payment method, including direct deposit or printed checks. No matter what you choose, make sure it’s compliant with wage and hour laws, including minimum wage requirements.

Submit payroll tax payments and filings

Remit payroll taxes to the relevant tax authorities accurately and on time. Submit required payroll tax filings, and make sure you meet the deadlines to do so.

Streamlining Payroll Processes with HRIS

If payroll processing seems daunting don’t worry—HRIS software has made record keeping and administration hassle-free and accurate. Here are some of the benefits you can expect:

Automated calculations

- Accuracy: HRIS automates complex payroll calculations, reducing the risk of errors associated with manual calculations.

- Efficiency: Accelerate the payroll process by automating routine calculations, including wages, deductions, and bonuses.

Tax deduction management

- Accurate withholding: HRIS ensures precise tax withholding based on the latest tax regulations, minimizing compliance risks and human errors.

Real-time tax update

- Dynamic Compliance: Stay compliant with changing tax laws through real-time updates integrated into the HRIS.

- Adaptability: Swiftly adjust tax calculations to align with updates to tax codes or regulations.

Electronic submissions and reporting

- Effortless reporting: Generate and submit electronic payroll reports seamlessly, reducing paperwork and manual effort.

- Regulatory compliance: Stay compliant with tax authorities by using HRIS for accurate and timely submissions.

Integration with accounting software

- Financial precision: Integrate HRIS with accounting software to synchronize payroll data, keeping your financial records up-to-date.

- Simplified bookkeeping: Enhance overall financial management by eliminating manual data entry between HR and accounting systems.

Employee self-service for tax information

- Access and transparency: Empower your employees to access their tax information, including pay stubs and tax forms, through employee self-service portals.

- Reduced employee questions: Minimize HR queries by providing your employees with direct access to their tax-related documents.

Centralized data management

- Unified platform: Centralize all payroll-related data in one platform, promoting consistency and reducing data discrepancies.

- Efficient retrieval: Simplify data retrieval in case of audits or inquiries by having a centralized repository.

Compliance tracking

- Audit trail: Maintain a comprehensive audit trail within the HRIS, making compliance tracking easy and ensuring accountability.

- Documentation: Automatically document compliance-related activities to meet regulatory requirements.

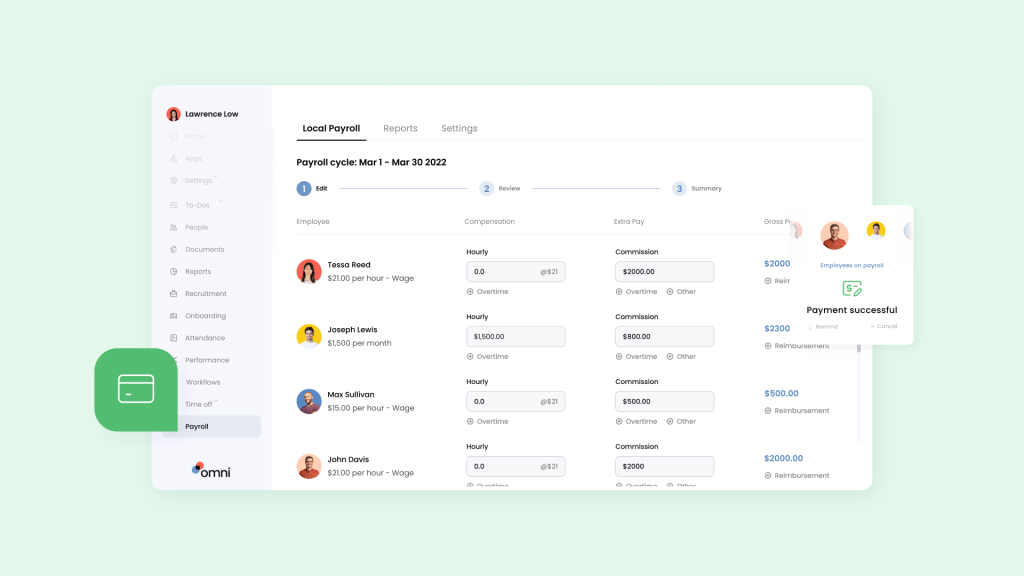

Optimize Tax-Ready Payroll Operations with Omni

Leveraging HRIS for payroll processes not only enhances efficiency but also mitigates compliance risks, ultimately fostering a streamlined and error-free payroll experience.

Omni’s all-in-one HR solution helps streamline payroll processes and free of manual error to reduce the administrative burden on HR. With secure and centralized employee records, HR teams can easily store, update, and communicate employee information across departments and with employees.

Omni makes it easier than ever to calculate accurate employee payments and tax calculations through automation that saves time and reduces errors. And with automated payroll information synchronization, end of month processing becomes a streamlined and seamless effort.

Book a demo with our team, or try out Omni for a free 14-day trial to learn how our HR solution can help you remain compliant and reduce your administrative workload for all of your payroll processes.