Filing your Income Tax Return (ITR) Philippines is crucial for responsible financial management, but it can also seem daunting. This guide simplifies the process and equips individuals and businesses with the knowledge and tools to navigate how to compute ITR Philippines effectively.

Who is Required to File for ITR?

Individuals and entities engaged in income-generating activities are required to compute ITR Philippines. This includes employees, self-employed individuals, corporations, partnerships, and other entities earning income within the country.

According to the Bureau of Internal Revenue (BIR), you are mandated to file income tax return, if it meets the following criteria:

- Resident citizens engaged in trade, business, or practice of profession within and without the Philippines.

- Non-resident citizens who have income from sources within the Philippines.

- Resident aliens who have income from sources within the Philippines.

- Non-resident aliens engaged in trade or business in the Philippines.

- Estates and trusts engaged in trade or business in the Philippines.

- Corporations, partnerships, and other juridical entities registered with the Securities and Exchange Commission (SEC) and doing business in the Philippines.

- Cooperatives registered with the Cooperative Development Authority (CDA) and doing business in the Philippines.

Common Jobs in the Philippines

The Philippines boasts a diverse workforce, with individuals employed in various sectors contributing to the nation’s economy. Understanding the landscape of common jobs is crucial in the context of ITR Philippines filing, as it helps identify who might be required to participate in this process.

While specific income thresholds determine the mandatory filing of ITRs in the Philippines, individuals earning above the minimum wage in various occupations are generally obligated to file their tax returns. Here are some examples of common jobs in the Philippines that fall under this category:

Agriculture

The Philippines is an agricultural country, with about 30% of the land area devoted to farming. The major crops are rice, corn, coconut, sugarcane, banana, pineapple, and mango. Agriculture employs about 24% of the labor force and contributes about 8.6% of the GDP.

Construction

The construction industry is one of the fastest-growing sectors in the Philippines, thanks to the government’s infrastructure program and the increasing demand for housing and commercial spaces. Construction employs about 8% of the labor force and contributes about 7.2% of the GDP.

Housework

Many Filipinos work as domestic helpers, either locally or abroad. Housework involves tasks such as cleaning, cooking, laundry, childcare, and elderly care. Housework employs about 4% of the labor force and contributes about 1.9% of the GDP.

Transportation

The transportation sector is vital for the movement of people and goods across the country. The common modes of transportation are jeepneys, buses, tricycles, taxis, trains, and airplanes. Transportation contributes about 3.6% of the GDP and this sector alone has a total of 209,919 workers.

BPO

Business process outsourcing (BPO) is the practice of contracting non-core business functions to a third-party provider. The Philippines is one of the leading BPO destinations in the world, offering services such as call centers, data entry, accounting, human resources, and information technology. In 2022, the Philippines IT-BPO industry emerged as the country’s leading employer, boasting over 1.44 million full-time employees and contributing about 6.3% of the GDP.

What is the Minimum Wage in the Philippines?

According to the Department of Labour and Employment, the national minimum wage in the Philippines is ₱610 per day. However, the salaries of Filipino workers vary according to their region, and sector. For instance, Metro Manila has the highest minimum wage, at ₱505.23 per day. Rural locations usually have the lowest salary ranges.

How to Compute Income Tax Return Philippines

When it comes to computing ITR Philippines, understanding the process is important. From determining your taxable income to applying deductions and credits, each step plays a vital role. Here is the breakdown of the key elements involved in calculating your ITR Philippines:

Gather documents

The first step to compute ITR Philippines is to gather all the necessary documents that will serve as the basis of your income and deductions. These documents include:

Income documents: These are the documents that show how much income you earned in a given year, such as the BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld), payslips, bank statements, invoices, receipts, etc.

Deduction documents: These are the documents that show how much expenses you incurred in relation to your income, such as BIR Form 2307 (Certificate of Creditable Tax Withheld at Source), official receipts, and vouchers.

Proof of tax payments: These are the documents that show how much taxes you already paid or withheld in a given year.

You should keep these documents organized and accessible, as you will need them to fill out the appropriate ITR Philippines forms and to support your tax declarations in case of an audit.

Determine your taxable income

The next step on how to compute income tax return Philippines is to determine your taxable income, which is the amount of your gross income used to calculate how much tax you owe in a given year.

(Tax Income = Gross income – allowable itemized or standard deductibles)

To determine your taxable income, you need to follow these steps:

Step 1: Choose your tax rate

Graduated Income Tax (GIT): This is the standard tax scheme based on your total taxable income. You can find the tax rates in the BIR’s tax table.

8% Preferential Tax Rate: This is a simplified scheme where you pay a flat 8% tax on your gross sales/receipts. However, this option is only available if your annual gross sales/receipts do not exceed ₱3,000,000.

Step 2: Calculate your gross income

Gross income or gross sales refers to the total income earned by an individual on a pay check before taxes and other deductions.

You can do this by adding up your income from all sources, such as compensation income, business income, passive income, etc.

Step 3: Calculate your allowable deductions (if applicable):

You can go for either a 40% Optional Standard Deduction (OSD) or itemized deductions.

40% OSD: This allows you to automatically deduct 40% of your gross income as business expenses without needing to provide individual receipts.

Itemized deductions: This involves listing and providing receipts for all your actual business-related expenses. This option might be beneficial if your expenses exceed 40% of your income.

Step 4: Subtract deductions from gross income to get your taxable income

Subtract any allowable deductions from your income, such as personal and additional exemptions, optional standard deduction (OSD), itemized deduction, etc. The result you get is your taxable income which is further used to compute ITR Philippines.

The following is the formula used to compute ITR Philippines:

Taxable Income = (Monthly Basic Pay + Additional Pay) – (SSS + PhilHealth + PAG-IBIG + Deductions Due to Absences/Tardines)

- Identify Your Tax Type: Are you a resident or non-resident taxpayer? This affects your tax obligations.

- Refer to the BIR Tax Table: This table shows the tax rates for different income brackets under the GIT scheme.

Find your tax rate

The tax rates and brackets vary depending on your tax type and income type. For example, for individual compensation income earners, the tax rate is based on a progressive system, where the higher your taxable income, the higher your tax rate. The tax rates range from 0% to 35%, with six brackets.

For corporate income earners, the tax rate is based on a flat system, where the tax rate is the same regardless of your taxable income. The tax rate is 30% for domestic and resident foreign corporations, and 35% for non-resident foreign corporations.

Calculate tax due

- Multiply next taxable income by the tax rate from the table: Once you identify your tax bracket, find the corresponding tax rate. Multiply your taxable income by this tax rate. This gives you the basic tax liability before further adjustments.

- Subtract any tax credits or withheld taxes: If applicable, subtract any tax credits you’re eligible for from your basic tax liability. These credits can reduce your overall tax owed. Additionally, if your employer withholds income tax from your salary, subtract the amount withheld from your basic tax liability. This reflects the tax already paid on your behalf.

If your tax due is positive, it means that you have to pay the difference to the government. If your tax due is negative, it means that you have a tax refund or a tax credit that you can use for future tax payments.

Preparing for Income Tax Return Philippines

To compute ITR Philippines, we have outlined the necessary steps needed in preparation for it.

1. Determine the forms you need: Tax returns are generally prepared using forms prescribed by BIR. Depending on your income type and situation, you may need BIR Form 1701, 1701A, or 1700 as an Individual taxpayer.

- Form 1701 can be used if you’re a mixed-income individual, that is you are earning from employment and a side profession or business (e.g freelancer, consultant)

- Form 1701A can be used if you are receiving income from your profession or business.

- Form 1700 can be used for individuals who are earning based on employment income. This remains solely their only source of income.

For Corporate taxpayers, the forms available are:

- Form 1701Q is used for reporting quarterly income.

- Form 1702-MX is used to report mixed income subject to varying tax rates.

- Form 1702-RT is used when reporting income subject to a regular or fixed tax rate.

2. Gather necessary documents: As outlined in the computation process above, once you have determined the forms needed, collect all required income, deduction, and payment proofs.

3. Choose your filing method: To successfully compute ITR Philippines, you need to determine which filing method is right for you. There are two filing methods available:

- Online: This is done through the electronic filing and payment system (eFPS) and electronic BIR forms (eBIRForms). If you want to compute ITR Philippines via eFPS, it requires taxpayers to pay taxes online through the convenience of an Internet banking service via debit from their enrolled bank account. eBIRForms is a tax preparation software that allows taxpayers to fill out their tax forms, by submitting their papers to the system.

- Offline: This is done manually by preparing and submitting a physical ITR form at your Revenue District Office (RDO).

4. Calculate your taxes: Use the steps mentioned above to determine your tax liability.

5. Pay your taxes (if applicable): To avoid penalties and interest charges, it is important to pay taxes on time. If you have them due, make the payment through authorized channels before the deadline.

The deadline for computing ITR Philippines falls on the 15th of April every year following the close of a taxable year.

Tools to Improve ITR Philippines Processing

There are many tools and strategies to improve the processing of ITR Philippines. From digital platforms to software solutions, various tools can streamline and enhance the efficiency of ITR processing. Here are some of the key tools that you can implement to simplify and improve your ITR Philippines processing:

Spreadsheets

Spreadsheets have been a go-to tool for managing data, which is also used when individuals and entities compute ITR Philippines. This tool allows you to compute your income and deductions along with the tax figures manually.

While spreadsheets offer a free and customizable option, the manual effort involved in data entry, formula creation, and error checking can be significant, especially for individuals or businesses with complex tax situations. The risk of errors can also lead to inaccurate calculations and potential tax liabilities.

Tax software

Tax software presents itself as a modern solution to compute ITR Philippines in an effective manner. This tool offers a user-friendly and efficient alternative to manual spreadsheets.

However, it’s often separate from existing systems, meaning your HR department has to input information from various sources. Every time data needs to be transferred from one system to another, there’s a chance for errors. Manual data entry, even with careful review, can introduce typos, inconsistencies, and missed information.

These errors can have significant consequences, like underpaying or overpaying taxes, leading to penalties and audits. Additionally, investing in tax software incurs an extra cost, which might not be feasible for all organizations.

HR automation

With HR automation, the chances of human error are minimized and accurate results are ensured. This tool is designed to compute ITR Philippines easier and faster.

It streamlines the process, making filing your income tax return more efficient. There’s no need for additional data input when using HR tools. Your information is already stored within the system, reducing errors and speeding up the process. Plus, it integrates seamlessly with your existing HR processes, making information easily accessible when you need it most.

Read next: Top 6 HRIS Philippines for 2024

Stay Ahead of the Philippines Tax Season with Omni

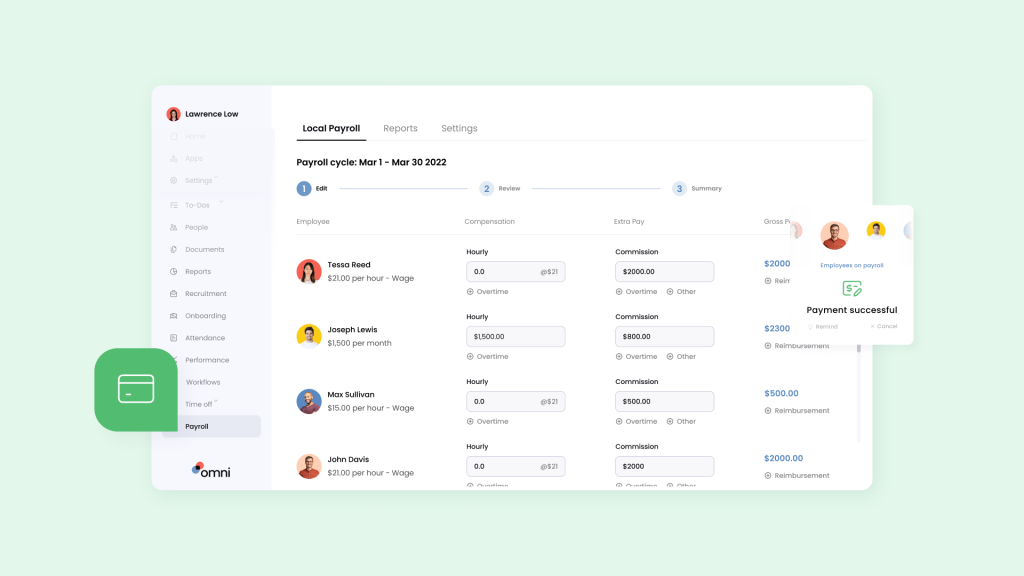

Navigating the complexities of ITR Philippines can be overwhelming, but with the right tools, such as Human Resources Information System (HRIS), organizations can streamline the process.

HRIS like Omni can automate data collection, calculation, and submission, ensuring accuracy and compliance with tax laws. Omni offers a comprehensive payroll solution tailored to Philippines specific requirements.

With features like support for Philippine peso, automated tax calculations, and managed SSS, PhilHealth and PAG-IBIG contributions, Omni can help HR teams simplify ITR Philippines processing and ensure compliance with ease.

Book a demo with us today and see how Omni can simplify the intricacies and complexities of preparing and submitting for income tax reporting in the Philippines and minimize the costs associated with common errors.