Savvy businesses recognize the value of operating in Hong Kong, a city where innovation and tradition combine in a potent way. But to thrive in this city, businesses need to rely on a skilled workforce to propel them forward. Behind every high-performing employee is a well-managed payroll system ensuring their hard work is rewarded promptly and accurately.

However, managing the payroll Hong Kong requires isn’t a straightforward task. The city’s payroll landscape is governed by a web of legal requirements and unique regulations that must be navigated with precision. HR professionals play a pivotal role in ensuring the smooth operation of payroll Hong Kong processes.

In this article, we’ll offer insight that HR professionals, payroll administrators, and business owners can use to better understand the ins-and-outs of managing payroll in Hong Kong. Whether you’re new to payroll Hong Kong or seeking ways to enhance your existing processes, we’re here to guide you through every step, from legal requirements to best practices and the latest technology solutions.

Preparing For Payroll Hong Kong Processing

Payroll processing is a crucial aspect of any organization’s operations, ensuring that employees are compensated accurately and on time. In Hong Kong, managing payroll comes with its unique intricacies and legal requirements. HR professionals in Hong Kong must navigate these complexities diligently to ensure compliance and maintain the trust of their employees.

Understanding Legal Requirements

Hong Kong has several laws and regulations governing payroll, which you must navigate to ensure compliance. We’ve covered these in greater depth in our Understanding the Payroll System Hong Kong Runs On post, but here is an overview for your reference:

Mandatory Provident Fund (MPF) Scheme: Under Hong Kong’s Mandatory Provident Fund (MPF) scheme, both employers and employees are required to make regular contributions to a retirement fund.

Inland Revenue Ordinance (IRO): The Inland Revenue Ordinance (IRO) in Hong Kong governs income tax. Accurate tax compliance ensures both employees and employers fulfill their fiscal responsibilities.

Employment Compensation Ordinance (ECO): The Employment Compensation Ordinance (ECO) is designed to safeguard the rights of employees in the event of work-related injuries or fatalities. Employers must be aware of ECO provisions and take appropriate measures to provide compensation and support to affected employees and their families.

Personal Data (Privacy) Ordinance (PDPO): The Personal Data (Privacy) Ordinance (PDPO) is relevant in terms of employee data privacy. It dictates how employers collect, handle, and protect employees’ personal data, including payroll-related information.

While navigating this network or ordinances isn’t always straightforward, it’s essential to avoid compliance issues and penalties. Hong Kong’s payroll regulations can be complex, so it’s advisable to seek legal counsel or work with a payroll provider well-versed in local laws to ensure accurate and lawful payroll processing.

Payslips and Tax Filings

Like elsewhere in the world, payslips and tax filings are integral components of the payroll Hong Kong system. These elements not only ensure that employees are fairly compensated but also play a crucial role in maintaining transparency and compliance with tax regulations.

Payslips in Hong Kong: Payslips are more than just documents that detail an employee’s earnings, they also serve as records that demonstrate an employer’s adherence to legal requirements. In Hong Kong, employers are obligated to provide employees with a payslip every time they are paid. These payslips must contain specific information, including the employee’s name, employment period, wages, deductions, and the employer’s name.

Tax Filings: Accurate tax filings are fundamental to the payroll Hong Kong runs on. Employers are responsible for calculating the correct amount of income tax to withhold from employees’ salaries and subsequently submitting these withholdings to the Inland Revenue Department (IRD) as part of the tax filing process. These filings must be completed in a timely manner to ensure compliance with Hong Kong’s tax regulations.

Tax Returns: Employees in Hong Kong are required to file their tax returns annually, detailing their sources of income and allowable deductions. It’s essential for both employers and employees to collaborate in this process, as it ensures that tax liabilities are correctly reported and addressed.

Employers should take the responsibility of providing employees with the necessary documentation for their tax filings, including the IR56B form, which outlines the salaries and bonuses paid to employees in a tax year.

In Hong Kong, payslips and tax filings are seen as more than just administrative drudgery. Properly maintained records and accurate reporting of these financial transactions contribute to smooth payroll Hong Kong processing and mitigate the risk of compliance issues.

Valid and Secure Documentation

In payroll Hong Kong management, documentation serves as the backbone of transparency, compliance, and accountability. For HR professionals handling the payroll Hong Kong requires, maintaining valid and secure documentation is more than a best practice—it’s a legal obligation.

Employee Contracts: Every employment relationship in Hong Kong begins with an employment contract. It’s a mandatory legal requirement for employers to provide a written employment contract to their employees within the first month of employment.

This contract outlines essential terms and conditions of employment, such as job responsibilities, compensation, working hours, leave entitlements, and termination procedures. Ensuring that these contracts are in place and compliant with local labor laws is crucial to avoid legal complications.

Employee Records: The meticulous upkeep of employee records is paramount. HR departments should maintain comprehensive personnel files for each employee, including personal particulars, job-related documents, and relevant correspondence. These records should be kept securely and readily accessible for auditing and compliance purposes.

Right to Work Verification: Hong Kong employers are obligated to verify their employees’ eligibility to work in the region. This verification process includes checking employees’ Hong Kong Identity Cards or valid work permits. Employers should also document these verifications as part of their HR records.

Data Protection Compliance: Hong Kong has stringent data protection laws, primarily governed by the Personal Data (Privacy) Ordinance (PDPO). HR professionals must ensure that employees’ personal data, such as identification numbers and bank account details, are collected and stored securely. Compliance with PDPO is critical to protect employees’ privacy and maintain legal compliance.

Immigration Documentation: For foreign employees, employers must keep records of their immigration status, including valid work visas and relevant permits. Compliance with immigration regulations ensures that employees are legally authorized to work in Hong Kong.

These documents serve as a trail of evidence, ensuring compliance with labor laws, data protection regulations, and immigration requirements. When HR professionals diligently manage these records, they contribute to a smooth and legally sound payroll Hong Kong process.

Ensuring Accurate and Timely Payments

Few areas of attention for running a business are as important as timely and accurate payments to your team, and this remains true in Hong Kong. Employees compensated consistently are definitely more likely to be highly engaged. Here are 3 best practices to uphold in the pursuit of accurate and timely payroll processing:

Centralize Data Management: One effective way to streamline payroll processing and minimize errors is to centralize data management. Implementing a robust Human Resource Information System (HRIS) allows you to store and manage employee data in a unified platform. This centralized approach helps eliminate data discrepancies and reduces the risk of manual errors when transferring data between various systems.

Automate Payroll Calculations: Leveraging automation tools (like Omni!) for payroll calculations significantly reduces the margin for error. Payroll software tailored for Hong Kong’s specific regulations can automatically calculate taxes, contributions, and deductions. By automating these complex calculations, you can save time, enhance accuracy, and ensure compliance with local tax laws.

Regular Reconciliation and Audit: To maintain the accuracy of payroll records, regular reconciliation and audit processes are essential. Your team should conduct periodic reviews of payroll data, cross-referencing it with financial records. This practice helps identify and rectify discrepancies promptly. Additionally, annual audits by external professionals can provide an extra layer of assurance regarding payroll accuracy and compliance.

Avoiding Common Errors

To ensure accurate and compliant payroll Hong Kong processing, you must be vigilant about avoiding common errors. Here are some of the most frequent pitfalls and strategies to steer clear of them:

Misclassification of Employment Status: One common error is misclassifying employees as full-time or part-time workers, which can impact their entitlements and benefits. To avoid this, your team should regularly review employment contracts and update them as necessary to reflect the correct status.

Inaccurate Tax Calculation: Hong Kong’s tax laws can be intricate, leading to errors in tax calculations. Using payroll software that is updated to accommodate changes in tax rates and deductions is crucial. Regularly verifying tax calculations and consulting with tax experts can help avoid inaccuracies.

Late or Incorrect MPF Contributions: Mishandling contributions to the Mandatory Provident Fund (MPF) is a significant compliance risk. Your team should ensure timely and accurate MPF contributions for all eligible employees, avoiding penalties and legal complications.

Non-Compliance with Statutory Leave Entitlements: Hong Kong has specific regulations governing leave entitlements. You should stay updated on these regulations to avoid inadvertently violating employees’ rights to statutory leave.

By proactively addressing these common errors and implementing sound payroll practices, you can ensure compliance with Hong Kong’s payroll regulations and minimize potential risks and liabilities. The careful avoidance of these pitfalls not only protects the organization but also contributes to employee satisfaction and trust.

Leveraging Technology to Streamline Payroll Hong Kong Processing

Managing payroll Hong Kong is a complex and detail-oriented task that demands a deep understanding of the region’s unique legal requirements and a commitment to accuracy and compliance. That’s why it’s important to have the right technology on your side.

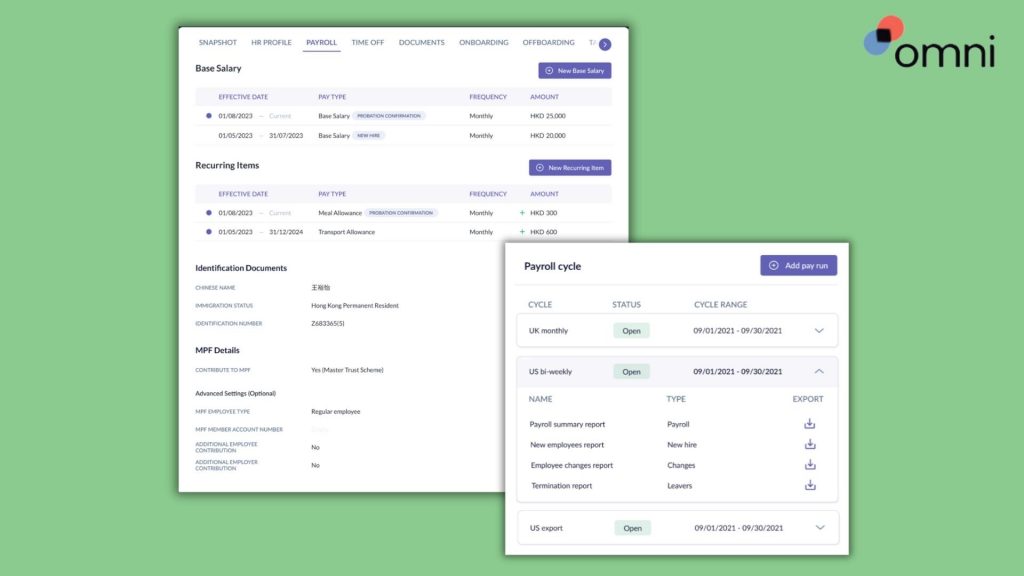

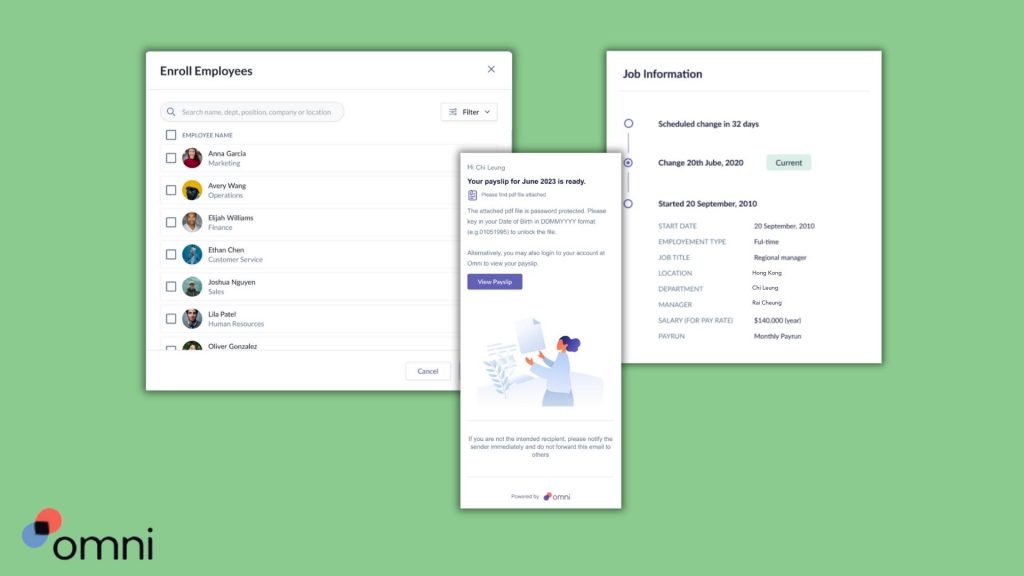

Omni offers a comprehensive payroll solution tailored to Hong Kong’s specific requirements. With features like support for HKD, automated tax calculations, and managed MPF contributions, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Omni’s suite of features makes the requirements for running a compliant and efficient payroll system in Hong Kong easy. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support payroll practices.

Our time and attendance features empower teams to automate data and produce accurate reports in minutes, making payroll calculations seamless and accurate. And with payroll solutions that support HKD and pay schedules, Omni offers an entire suite of solutions to make your payroll system Hong Kong seamless.

Manage more than one company? Omni helps you establish a dedicated payroll admin for each company, who have the power to enroll employees, manage company settings and easily process your payroll.

If you’re ready to take your payroll Hong Kong management to the next level, book a demo with us today. We’ll walk you through the platform’s capabilities and demonstrate how Omni can transform your payroll processing, saving you time, reducing administrative burdens, and enhancing overall efficiency.