The Philippines is quickly cementing itself as a leading commercial hub in Asia, thanks to its business-friendly laws and large English-speaking workforce. While it is undoubtedly a great country to have a business in or hire remotely from, you need to consider the relatively intricate payroll taxes system in the Philippines.

From social security contributions, to housing subsidies, there are many different taxes employers need to consider, with more than a few exemptions on top. Remaining compliant to these regulations needs to be top priority, so that legal challenges and fines don’t eat into your bottom line.

Here’s everything you need to know to navigate the intricacies of payroll taxes in the Philippines:

How is Payroll Calculated in the Philippines

In the Philippines, calculating payroll is a fairly meticulous process. Many factors are considered, reflecting the country’s specific regulations and requirements. Payroll calculation encompasses not only the basic salary but also allowances, deductions, and statutory contributions. The simplest way to express this calculation is take your employees’ gross pay, and add to it the entirety of the payroll taxes you must contribute on top (which we’ll get into further down).

Understanding the local tax landscape is necessary as it directly impacts an employee’s take-home pay and your company’s compliance with the law. From the intricacies of income tax to the nuances of mandatory deductions, a comprehensive grasp of how payroll is calculated will give you the tools and confidence you need to manage it successfully.

What are the Payroll Taxes in the Philippines

Payroll taxes in the Philippines are a primary source of revenue for the government, and are taken seriously due to the value they bring to the country and its people. These taxes are levied on employees’ income and play a fundamental role in funding public services and initiatives.

Like most places, the Philippine government operates with a tiered tax system, where the rate of taxation increases with income. This helps distribute the tax burden fairly, helping to create a fair and sustainable method.

In the Philippines, employers are responsible for deducting payroll taxes from their employees’ salaries, reflecting the goal for a collective contribution to national development. Payroll taxes in the Philippines serve as a financial foundation for essential government functions, and employers play a major role in helping that revenue stream flow smoothly.

Key Components of Payroll Taxes

As mentioned above, the payroll taxes in the Philippines encompasses a few key components. This will help you and your employees know why money is being deducted, where it’s going, and ensure everything is paid in full.

Taxable Income and Exemptions

In the Philippines, determining taxable income requires a thorough and nuanced assessment of an employee’s earnings, considering things like basic salary, allowances, bonuses, and benefits. Basically, employers need to consider their workforce’s entire earnings, not just the recurring salary they make.

There are several exemptions, including for dependents, certain allowances (such as the 13th Month Pay which serves as a form of recognition for employees’ contributions throughout the year is often untaxed up to a certain amount), and specific benefits (like small-value uniform or rice allowances, called De Minimis Benefits). Just like employers need to ensure they are deducting enough tax, they also have to make sure not to miss income or allowances that are exempt.

Social Security System (SSS) Contributions

The Social Security System in the Philippines is a comprehensive program designed to provide financial protection to employees and their beneficiaries. It encompasses contributions for retirement, disability, sickness, maternity, and even death benefits. Employers and employees contribute specific percentages of the employees’ monthly salary to the SSS fund. Understanding the intricacies of these contributions is vital for both employers and employees, ensuring comprehensive social security coverage.

PhilHealth Contributions

PhilHealth, the national health insurance program, mandates contributions from both employers and employees to maintain national health-related benefits. The contributions are calculated based on a percentage of an employees’ monthly salary, with a set income ceiling.

These funds are a major pillar of support for the healthcare needs of employees and their dependents, which is why accurate and timely PhilHealth contributions are so important.

Home Development Mutual Fund (Pag-IBIG) Contributions

The Pag-IBIG Fund, managed by the Home Development Mutual Fund, focuses on providing housing loans and financial assistance to its members. Both employers and employees contribute to this fund, which for many, plays a major role in helping them afford adequate housing.

It is a good idea to take the time and help your employees understand how they can access housing-related benefits, which can be a major contribution to their well-being and appreciate the taxes they pay.

Challenges in Complying with Payroll Taxes in the Philippines

It’s clear that payroll taxes in the Philippines aren’t exactly simple to understand, with many different kinds of deductions and exemptions. Here are some key challenges you can expect to face, and how to overcome them:

Changing Payroll Taxes Regulations

Like elsewhere, the tax rules in the Philippines is an ever-evolving system. Frequent changes in tax laws, amendments, and updates require an agile and consistent approach to ensure you remain compliant.

Staying up to date with these changes requires dedicated efforts to interpret and implement new regulations accurately. You should establish a process, or dedicated personnel for monitoring updates and have plans in place to swiftly automate and adapt your payroll processes to remain compliant, and avoid any legal complications or fines.

Complex Payroll Taxes Calculations

The complexity of calculating payroll taxes, considering various components such as taxable income, exemptions, and contributions to SSS, PhilHealth, and Pag-IBIG, adds another layer of intricacy to the compliance process.

Manual calculations are prone to errors, and the risk increases with the complexity of the tax structure. Investing in advanced payroll software and ensuring that your employees who are responsible for tax computations are well-trained can help to mitigate this challenge.

Read next: Your Guide to Successfully Pitching HR Software to Leadership

Implementing Robust Record-Keeping Systems

Robust record-keeping systems are essential for ensuring accurate payroll tax compliance. Employers should invest in digital record-keeping solutions that efficiently capture and organize relevant payroll data. These systems should enable easy retrieval of records, regardless of age, ensuring that your organization can provide the necessary documentation if you ever face an audit or inquiry.

Regular internal audits of record-keeping practices help identify discrepancies or gaps in data, allowing you to address issues proactively. Consider cloud-based storage solutions that offer accessibility and security, making sure that records are not only comprehensive but also protected from potential data loss.

Regular Audits and Internal Controls

Conducting regular internal audits is an important proactive step you can take to identify and fix potential issues in payroll tax compliance. Internal controls should be established to monitor the accuracy of your payroll calculations and tax deductions. These controls should include periodic reviews by designated employees.

Internal audits provide an opportunity to take a look at the effectiveness of your payroll procedures, identify areas for improvement, and confirm that you remain compliant with tax regulations. By establishing a culture of continuous improvement through regular audits, your organization can fortify their payroll tax compliance framework, and stay resilient to change or challenges that might come down the road.

While these steps cannot account for every single challenge that could arise from administering payroll taxes, each one is a major step towards streamlining your process and reducing errors. This isn’t just useful from an efficiency standpoint—following these steps should reduce overall workload, avoid fines, and ultimately benefit your business’ bottom line.

Payroll Taxes in the Philippines Made Simple

Managing payroll taxes in the Philippines is a complex and detail-oriented task that demands a deep understanding of the region’s unique legal requirements and a commitment to accuracy and compliance. That’s why it’s important to have the right technology on your side.

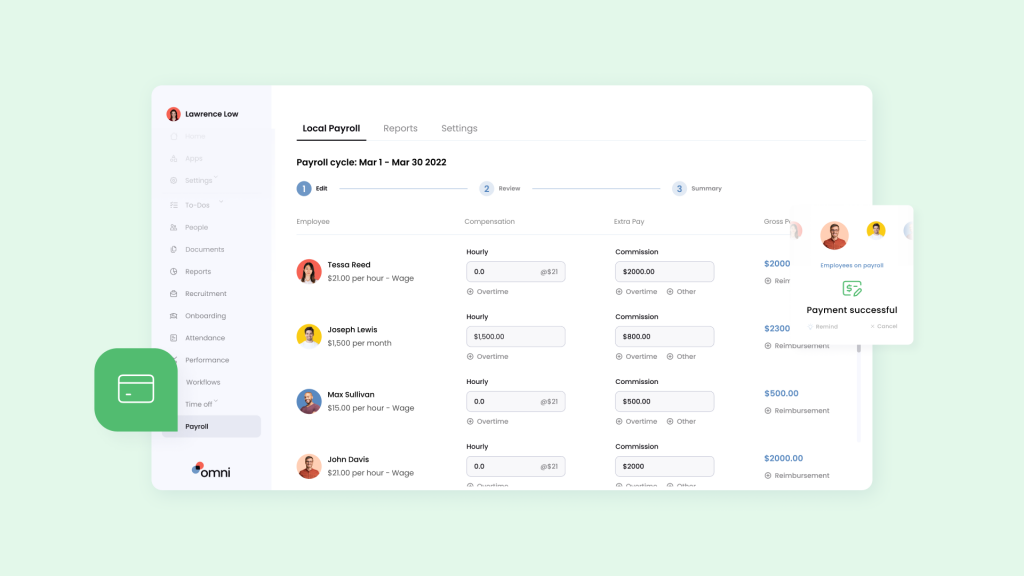

Omni offers a comprehensive payroll solution tailored to Philippines specific requirements. With features like support for Philippine peso, automated tax calculations, and managed SSS, PhilHealth and PAG-IBIG contributions, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Omni’s suite of features makes the requirements for running a compliant and efficient payroll system and taxes in the Philippines easy. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support payroll practices.

Our time and attendance features empower teams to automate data and produce accurate reports in minutes, making payroll calculations seamless and accurate. And with payroll solutions that support Philippine peso and pay schedules, Omni offers an entire suite of solutions to make your payroll taxes in the Philippines seamless.

If you’re ready to take your payroll taxes management to the next level,

We’ll walk you through the platform’s capabilities and demonstrate how Omni can transform your payroll processing, saving you time, reducing administrative burdens, and enhancing overall efficiency.