There’s no one correct way to lead a team. Different circumstances call for different tactics, for example, a small organization designing toys for children is going to operate wildly different than a multi-national bank.

There are a variety of leadership styles that any manager or business leader can use to motivate and guide their employees. One of the more notable styles of leadership is transactional leadership.

The name really says it all — like a financial transaction, this style of leadership involves give and take; incentives and rewards for good behavior and performance, and punishment or discipline for falling short.

These days, transactional leadership is a little out of vogue — most organizations find more success in developing employee motivation and improving performance through intrinsic techniques like training, camaraderie, and collaboration.

But that doesn’t mean there isn’t a place for transactional leaders. Depending on the nature and size of your organization and the makeup of your team, transactional leadership theory may still offer value.

What is Transactional Leadership?

Born in the era of the industrial revolution as a source of competitive advantage, transactional leadership is a style of leadership that focuses on supervision, organization, and performance.

The origins: Max Weber describes rational-legal leadership

As Europe and other parts of the world rapidly industrialized, manufacturing industries were growing at incredible rates. This called for a new style of leadership that could help manage increasingly large and complex organizations and lead the people within them.

One of the key figures in the development of transactional leadership was Max Weber, a German sociologist who lived from 1864 to 1920.

Weber’s early work focused on the concept of rational-legal leadership, which placed an emphasis on the importance of rules and regulations, procedures, and formal authority in organizational management. In other words, a business could find success running with the same stringency as a government.

Weber thought that in large organizations, it was essential to have clear rules and procedures to ensure that everyone knew their role, what was expected of them, and have clearly defined metrics for success. He also believed that formal authority should be used to enforce these rules and ensure that everyone followed them.

If this is beginning to sound like the stereotypical depiction of the tough boss, it should. Weber was describing a rigid and authoritarian kind of leadership, one he felt was necessary for organizations that were large and growing and suffered the complexity inherent in that growth.

The evolution of transactional leadership theory

In effect, transactional leadership is the practical application of Weber’s ideas. If you’re a transactional leader, you use a range of rewards and punishments to motivate employees to meet their specific goals and follow firm organizational procedures.

This is based on the idea that employees are rational people – they’ll respond to incentives and can be motivated by the promise of rewards (or kept in check by the threat of punishment).

As the industrial revolution wrapped up, transactional leadership became increasingly popular.

During the 20th century, organizations became even larger and more complex, so organizational leaders needed a way to manage their employees and ensure that they were following established procedures and meeting their goals.

The best part? Transactional leadership is an incredibly simple approach and easy to institutionalize. It provides a clear and structured method to management that is easy to implement, measure, and doesn’t require tailoring to different team members.

This leadership style isn’t without its drawbacks, however. Its “one size fits all” approach isn’t well-suited to organizations that require a high degree of innovation or creativity.

Also, transactional leadership is often less effective at promoting long-term employee engagement or job satisfaction. Research is consistently pointing towards intrinsic factors having an outsized impact on employee motivation, which transactional leadership fails to account for.

Despite its limitations, transactional leadership remains a popular leadership style in many organizations. By understanding the history and characteristics of the transactional style of leadership, you can assess whether this style of leadership is appropriate for your organization.

Characteristics of transactional leadership

Transactional leadership has several distinct characteristics that make it unique from other leadership styles.

Clear goals

Transactional leaders set clear and specific goals for their employees. This helps to ensure that everyone works towards the same objective.

Monitoring

Transactional leaders monitor the performance of their employees closely to ensure that they are meeting the expected standards. While metrics differ depending on the organization, they are all tracked with the same rigor.

Rewards and punishments

Transactional leaders provide rewards to employees who meet or exceed their performance goals, such as bonuses, promotions, or recognition. But there’s a flip side — they also impose punishments on those who fail to meet expectations, like warnings, demotions, or termination. That can lead to a tough conversation, but one that can be leveraged to boost employee performance.

Performance feedback

Transactional leaders provide frequent feedback to their employees about their performance. They highlight areas of improvement and recognize areas of success.

Hierarchical structure

Transactional leadership is based on a hierarchical structure, a structured environment where the leader has ultimate authority over decision-making (and this ladders up through the organization). The leader assigns tasks and responsibilities to employees and expects them to follow through.

While lots of other leadership styles employ a variety of these characteristics (such as clear goals and performance feedback) it’s the in-built rigidity, consistent application across an entire organization, and the outcome that defines transactional leadership.

Pros and Cons of Transactional Leadership

Like any leadership style, transactional leadership has its advantages and disadvantages, many of which depend on the setting it’s applied in.

Pros of transactional leadership

Clear expectations

Transactional leaders provide employees with clear expectations and guidelines for their work. There’s not a lot of room for confusion and plenty of opportunities to course-correct. This helps to increase efficiency and productivity.

Motivation

Transactional leaders use rewards and punishments to motivate their employees; a simple but often effective system. This creates a sense of competition among employees and drives them to perform more effectively.

Accountability

Employees are held accountable for their actions and performance by effective transactional leaders. This can help to ensure they take their responsibilities seriously and seek to improve in areas they’re falling short, or limited in.

Stability

With rigidity and consistency at its core, transactional leadership provides stability and predictability for employees. This can create a sense of security and comfort in the workplace for employees who appreciate the carrot/stick model of motivation.

Cons of transactional leadership

Lack of creativity

Transactional leadership stifles creativity and innovation. Everything is designed to be cut and dry — not only is experimentation discouraged, but if done unsuccessfully an employee could be punished for the attempt. Employees may be afraid to take risks or suggest new ideas for fear of being reprimanded.

Limited autonomy

Transactional leaders limit the autonomy of employees. They are expected to follow rules and procedures set by the leader, which can lead to a lack of initiative and independence, both factors that could impact an employee’s job satisfaction.

Short term focus

Transactional leaders tend to focus on short term goals and results. Keeping the goals boxed in can make them more clear-cut and attainable, but not necessarily put an organization on a long-term roadmap for success. This can lead to a lack of strategic thinking and long-term planning.

Resistance to change

Resistance to change is inevitable under a leadership system that puts such an emphasis on predictability and repetition. Employees may be hesitant to change their behavior or adopt new, improved methods if they are not explicitly rewarded for doing so.

The value of transactional leadership is often organization-dependent

Let’s say you’re launching a tech startup. You’re breaking new ground, and looking to catch the eye of creative talent looking to grow with the company. In this case, where experimentation is necessary, predictability is difficult to achieve, and where a long-term strategic vision is paramount, a transactional leadership style simply won’t work.

On the flip side, if you’re a leader at a large insurance company with thousands of employees, many of whom want to spend the majority of their career at one company, providing a predictable workplace focused on achieving quarterly goals makes far more sense for transactional leaders.

In other words, the pros and cons of this leadership style will depend on the setting in which they’re applied.

The Effects of Transactional Leadership on Employee Performance

There’s been tons of research conducted to determine the effects of both transactional and transformational leadership on employee performance. And the consensus is that transactional leadership’s shortcomings may outweigh its positive aspects.

One study found that transactional leaders had a positive effect on employee performance in the short term but had no significant effect on long-term performance, something that tracks with the short term focus of the transactional leadership style.

This suggests that transactional leadership may be effective in achieving short term goals but that such leaders may not be effective in promoting sustained employee performance.

Another study found that transactional leadership was associated with lower levels of employee job satisfaction and higher levels of employee turnover.

While the transactional leadership model may be effective in achieving goals, it comes at a cost to employee well-being and retention. If you’re a leader that prioritizes your team’s wellness over output, transactional leadership might not be for you.

Transactional Leadership vs. Transformational Leadership

As we discussed above, transactional leadership is based on the exchange of rewards and punishments in exchange for employee performance.

The transactional leader sets clear expectations and goals for their employees and provides rewards for meeting or exceeding those goals while punishing those who fail to meet them.

Transactional leadership focuses on maintaining order and stability within the organization. But there’s another popular leadership style that steps outside this framework.

In contrast, transformational leadership is focused on inspiring and motivating employees to achieve a shared organizational vision.

Transformational leaders are often charismatic and use their influence to encourage employees to work towards a common goal. This style of leadership empowers employees to take ownership of their work and provides them with the support they need to succeed.

In terms of its impact on employee performance, transformational leadership is more effective than transactional leadership in promoting employee engagement, job satisfaction, and long-term performance. It fosters a sense of purpose and meaning in work, which can lead to greater levels of motivation and commitment, and, of course, higher employee retention.

Not every leader is naturally charismatic, which limits the universality of this leadership style. That said, finding opportunities for charismatic leadership to motivate your team to a shared vision they can pursue with a degree of autonomy could offer organizational value in the long run.

Transform Employee Performance with Omni

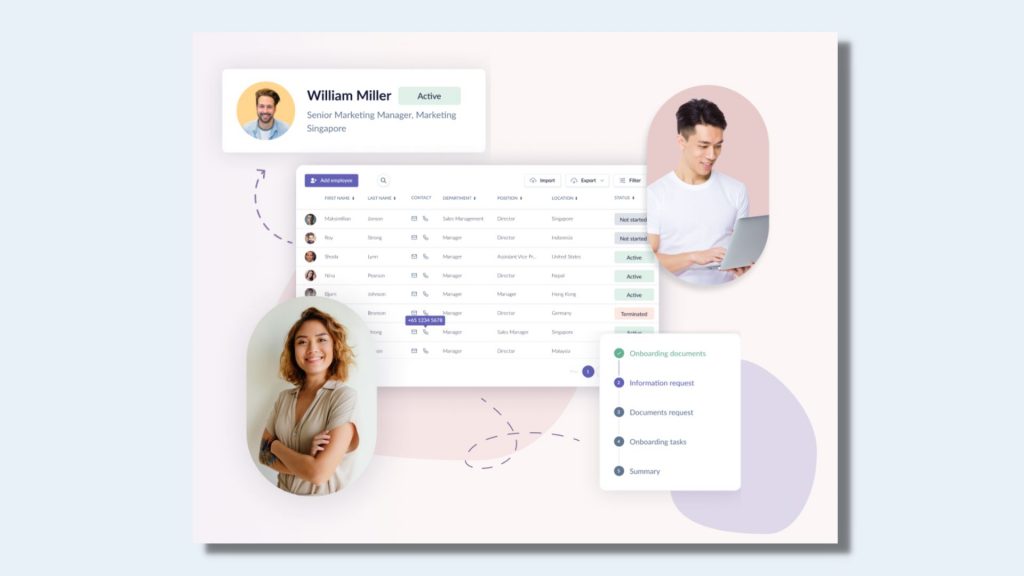

Omni is a cloud-based platform that helps organizations to improve employee performance by providing the tools and solutions necessary to manage the entire end-to-end employee lifecycle and get the best from your team. Whether you’re using transactional leadership or another leadership approach, Omni can help you achieve organizational success.

Our all-in-one HR suite can overcome the limitations of transactional leadership. Omni’s goal-setting capabilities help leaders to set and track clear, well-defined goals for their employees, ensuring that everyone is working towards the same objective. Whereas Omni’s performance monitoring helps leaders gather valuable insight into their employee’s performance; helping make identifying areas of strength and opportunities for improvement easy and time efficient. With Omni, you can pinpoint performance pain points early on, saving time and resources while building an effective and productive team.

Omni’s recognition feature helps leaders provide frequent, targeted feedback and recognition to their employees to foster a positive work environment and improve employee morale, something that can be harder to achieve under transactional leadership.

Transform the way you manage employee performance with Omni. Our team can show you how Omni’s platform can be customized to meet the unique needs of your organization. Book a demo today to learn more.