According to a recent survey, 75% of employers admitted to hiring the wrong person, costing them nearly $17,000 on average. These bad hires failed to deliver quality work, had a negative attitude, or misrepresented their abilities.

Additionally, there are costly penalties for violating employment laws and regulations, many of which are not commonly known. Hiring in Singapore comes with many rules and regulations, especially if you are wondering how to hire foreign worker in Singapore.

This article aims to explore how to hire the right employees in Singapore to enhance productivity and retain them for longer durations.

Laying the Groundwork for Hiring in Singapore

Before we move on to the stages of hiring in Singapore, let’s lay the groundwork covering the legal frameworks, competitor analysis, and sourcing the right talent.

Understanding the legal frameworks

Here are certain legal frameworks you need to keep in mind when hiring in Singapore to ensure compliance and avoid penalties.

Employment Act

The Employment Act is Singapore’s main labor law, outlining the terms and conditions for all employees. By familiarizing themselves with this act, employers can understand their obligations, ensuring compliance and avoiding legal issues when hiring in Singapore.

The act covers minimum wages, working hours, annual leave entitlements, and termination procedures. It also outlines specific responsibilities towards employees, including maintaining a safe working environment, upholding fair employment practices, and ensuring timely salary disbursements. Adhering to these regulations will keep your employees engaged and your organization safe from legal issues.

Foreign Manpower Act

If you are a business in Singapore hiring foreigners, understanding the Foreign Manpower Act is crucial. This law outlines the responsibilities, offenses, and penalties related to hiring in Singapore.

For example, foreign employees are required to have an employment pass. Hiring without one can result in fines from S$5,000 to S$30,000 or up to one year of imprisonment.

The Act also covers salary, working hours, public holidays, and leave for foreign employees. Therefore, it’s crucial to review the Act thoroughly before hiring foreign workers to comply with regulations.

Personal Data Protection Act (PDPA)

Singapore’s Personal Data Protection Act (PDPA) sets rules for how personal information can be collected, used, and shared. Organizations must ask for permission before gathering or using personal details, which should be used for specific, valid purposes with consent.

Employees have the right to know why their data is used, access their information, and request corrections. Organizations are responsible for safeguarding data from unauthorized access or misuse. Non-compliance can lead to fines up to S$1 million.

Relevant read: 5 Ways Employee Database Software Elevates Your Business

Work Injury Compensation Act (WICA)

The Work Injury Compensation Act (WICA) in Singapore establishes a framework for compensating employees for work-related injuries or illnesses, regardless of fault.

Under the act’s provisions, employers are mandated to compensate affected employees to cover medical expenses, loss of earnings, and permanent incapacity arising from work-related incidents. Employers must notify the Ministry of Manpower (MOM) and their insurer of accidents resulting in more than three days of medical leave, hospitalization, serious injury, or death.

As for compensation, employees can file claims with their employer or the employer’s insurer. Employers are responsible for processing these claims and providing compensation per the WICA.

Assessing the market

When hiring in Singapore, it’s essential to stay informed about your competitors’ activities. Here’s how:

Competition

It’s vital to grasp how competitors attract, recruit, and retain talent to stay ahead in the market, whether it is businesses in Singapore hiring foreigners or locals. Begin by researching their websites, job postings, and social media profiles to uncover the roles they’re advertising, preferred skills, and employee benefits. Dive into their social media presence, noting recruitment posts, testimonials, and company culture insights.

Additionally, analyze employee reviews on platforms like Glassdoor and Indeed when hiring in Singapore. These insights enable you to refine your recruitment strategies for better competitiveness.

Additional reading: Recruitment Fees Explained: Types of Structures You Can Expect

Cultural nuances

Hiring in Singapore requires an understanding of diverse cultural preferences and norms to tailor job descriptions effectively. For instance, Singapore’s workforce includes individuals from various ethnicities, religions, and cultural backgrounds, making it important to understand the nuances of each.

This aspect becomes even more important as businesses in Singapore hiring foreigners rise. In such scenarios, employers who understand cultural nuances can implement recruitment strategies that celebrate diversity, attract candidates from different cultural backgrounds, and promote a sense of belonging within the organization.

Cost of living

Knowing the cost of living in particular locations is essential for setting an appropriate salary budget for your employees. Conducting salary benchmarking studies helps compare compensation packages with industry standards and local market rates.

Providing competitive salaries is crucial for attracting and retaining top talent in the organization. The cost of living in locations like Singapore is steadily increasing. Here’s a brief overview of the cost of living as of March 2024 for your reference.

Sourcing and attracting talents

Hiring in Singapore becomes easier when you are aware of the best sources of attracting talent in your organization. If you are wondering how to hire foreign workers in Singapore and local workers who are efficient with their jobs, here are some best sources:

Local universities and institutions

According to Statista, Singapore recorded one of the highest unemployment rates compared to other countries in the Asia-Pacific region. In such a situation, partnering with local universities and institutions allows employers to connect with fresh graduates and entry-level talent. Institutions often offer specialized programs and courses tailored to specific industries or fields of study.

You can leverage these programs to recruit candidates with specialized skills, knowledge, and expertise that align with your hiring needs. Participating in career fairs, hosting recruitment events, or offering internships can help you attract promising candidates eager to kick-start their careers.

Professional networking

Attending industry events, conferences, seminars, and workshops allows you to meet new people and expand your network. Online platforms like LinkedIn also facilitate networking by connecting professionals globally and enabling you to join industry-specific groups and discussions.

For instance, you can join the Executives Global Network on Linkedin when hiring in Singapore. This network conducts frequent meetings and events that help build a professional network focused on learning and connecting.

Networking is more than just collecting business cards or forming superficial connections. It allows employers to reach a broader pool of potential candidates beyond traditional recruitment channels when hiring in Singapore. By connecting with professionals in their industry or related fields, employers can access passive candidates who might not be actively job hunting but possess the desired skills and experience.

Employer branding

Your organization’s reputation in the eyes of the outside world and potential candidates is crucial, especially when it comes down to how to hire foreign worker in Singapore. A strong employer brand focuses on creating a solid impression, essential for turning passive job seekers into active candidates when hiring in Singapore. Many companies overlook this aspect and make mistakes that can harm their reputation.

Focus on cultivating a positive reputation that reflects your company values, making it an attractive employer. Potential candidates are drawn to companies known for treating employees well, offering competitive salaries and benefits, and creating a supportive work environment.

Learn more: Top 5 AI Tools for Recruitment

Employment pass system

The Employment Pass (EP) system is a work visa scheme designed to smoothen the process for organizations in Singapore hiring foreigners. It’s designed for foreign professionals including managers, executives, and specialists. It allows them to live and work in Singapore for a set period, typically one to two years, with the option to renew.

- Eligibility: Candidates must meet a two-stage eligibility framework to qualify for EP applications. They need to earn an EP-qualifying salary, which is $S5,000 for most sectors and S$5,500 for the financial services sector. Additionally, they must pass the complementarity assessment framework (COMPASS) and score at least 40 points based on salary, qualifications, diversity, and support for local employment.

- Minimum salary requirements: The Singaporean government sets minimum salary thresholds for different Employment Pass categories. These thresholds are regularly reviewed to ensure competitive salaries based on skills and experience.

- Validity period: Employment Passes are typically issued for one to two years, depending on qualifications, job role, and employer’s track record. Renewal is subject to continued employment and meeting eligibility criteria.

- Employer sponsorship: An Employment Pass application must be sponsored by a registered Singaporean employer. Employers are responsible for submitting EP applications and ensuring compliance with immigration regulations.

Key Stages of Hiring in Singapore

Now that we’ve covered the basics, let’s explore the three key stages of hiring in Singapore:

1. Compliance

HR professionals in Singapore must comply with the Employment Act as mentioned previously. They also need to ensure compliance with Singapore’s work permit and visa requirements for foreign hires. Different types of work passes, such as EP and S Passes, have specific eligibility criteria and application processes.

Employee benefits, such as healthcare coverage, CPF contributions, and statutory leave, should comply with Singaporean regulations. It’s important to keep up with these laws as they are regularly updated.

Fair employment practices must be followed to prevent discrimination based on race, gender, religion, or nationality. Additionally, maintaining accurate records of all hiring-related documents, including job descriptions, resumes, interview notes, and employment contracts, is essential for showcasing compliance with legal requirements and facilitating audits if necessary.

2. Interviewing

During a screening interview when hiring in Singapore, HR professionals review candidates’ resumes and prepare questions tailored to the role’s requirements. Instead of asking typical questions, consider posing situational inquiries that prompt examples of problem-solving, teamwork, and leadership qualities. For instance, you can ask them these questions:

- Tell me about a time when you had to make a difficult decision under pressure. How did you weigh the options and arrive at a solution?

- Can you share an example of a conflict you encountered while working in a team? How did you handle it, and what was the outcome?

- Have you ever taken on a leadership role in a project or team? Can you describe the situation, your approach to leadership, and the results achieved?

- What aspects of our company culture resonate most with you, and why? How do you envision contributing to and thriving within our culture?

- In your opinion, what are the most important cultural aspects of a workplace? How do you ensure cultural alignment and harmony within a team or organization?

Your questions should motivate candidates to share stories that demonstrate the skills you are seeking. Candidates should not only match the skill-based aspects of the job but also align with the company’s values, culture, and work environment.

Read next: Build Impactful Teams: 10 Google Interview Questions to Inspire Your Hiring Process

3. Offer letter and contracts

When hiring in Singapore, it is important to draft a comprehensive offer letter outlining the job title, salary, benefits, start date, and any contingencies. Include clear instructions for accepting the offer.

Craft an employment contract that complies with Singaporean laws and reflects the agreed-upon terms, covering probationary periods, notice periods, termination conditions, and confidentiality agreements.

Have legal counsel review offer letters and contracts to ensure compliance with relevant regulations and mitigate legal risks.

Once everything looks good, communicate offer details clearly and promptly, allowing room for negotiation within reasonable boundaries. Maintain transparency throughout the process to build trust with the candidate.

Navigating Post Hiring in Singapore

After successfully hiring in Singapore, HR professionals must focus on effective onboarding and ongoing compliance for a smooth transition and adherence to legal requirements:

1. Onboarding

When it comes to how to welcome new employees, it’s all about making them feel like part of the family from the get-go by delivering the best onboarding experience. Start by introducing them to the company culture, values, and key team members. Provide thorough training on essential tools, systems, and processes relevant to their role to ensure they can contribute effectively from the start.

To prevent new employees from feeling left out or isolated, pairing them with a mentor or buddy can facilitate integration into the team and provide ongoing support. Encourage open communication and feedback to address any questions or concerns they may have. Celebrate their successes and milestones to foster a sense of belonging within the organization.

Additional resource: Download our free Onboarding Kit!

2. Ongoing compliance

Maintaining compliance post-hiring in Singapore requires staying updated with labor laws and regulations. Start by establishing clear policies and procedures that align with local legislation, covering areas like employee contracts, working hours, leave entitlements, and workplace safety. Regular audits and reviews of these policies help identify any gaps or updates needed.

Providing continuous training and education on compliance for employees and managers is also critical to maintaining adherence to regulations. Staying connected with legal experts or consultants who specialize in Singaporean labor laws can provide additional support in navigating any compliance challenges that may arise.

For a detailed guide on compliance areas to monitor, refer to our 2024 HR compliance checklist!

Achieving Strategic Advantage for Singapore Talent Acquisition

Navigating the complexities of hiring in Singapore requires a thorough understanding of the country’s labor laws and regulations. By following best practices and staying updated with legal requirements, HR professionals can ensure a smooth and compliant hiring process.

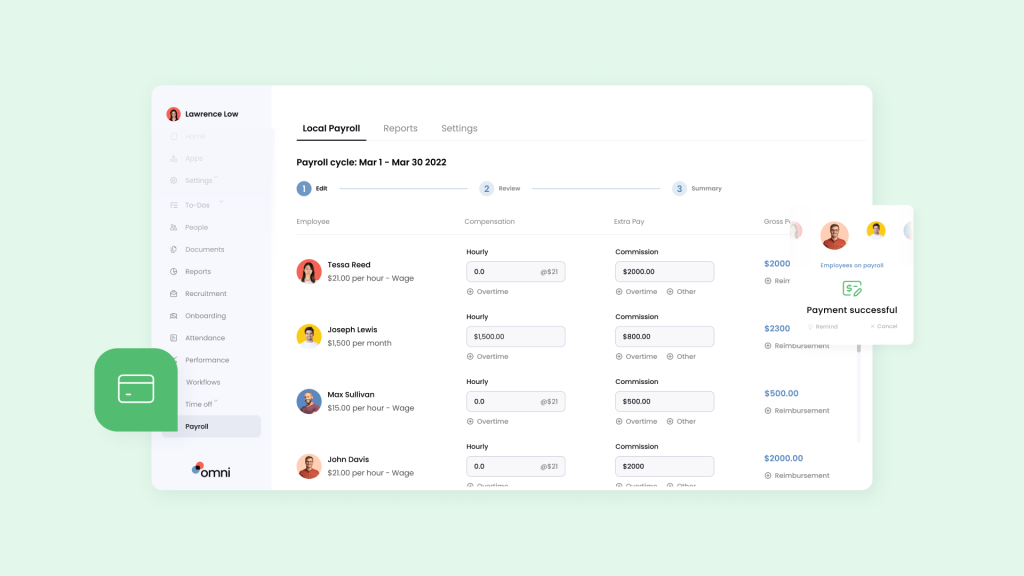

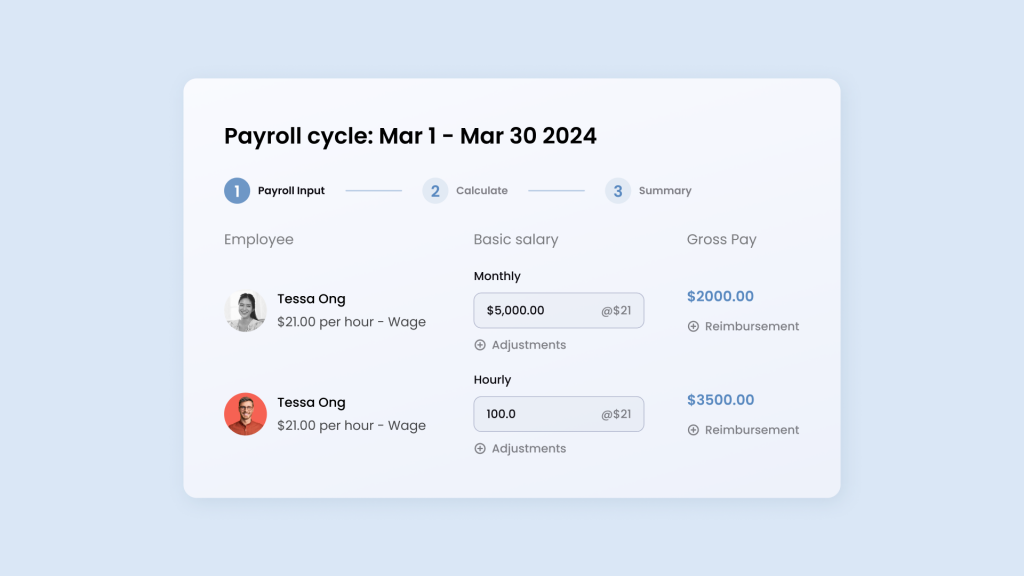

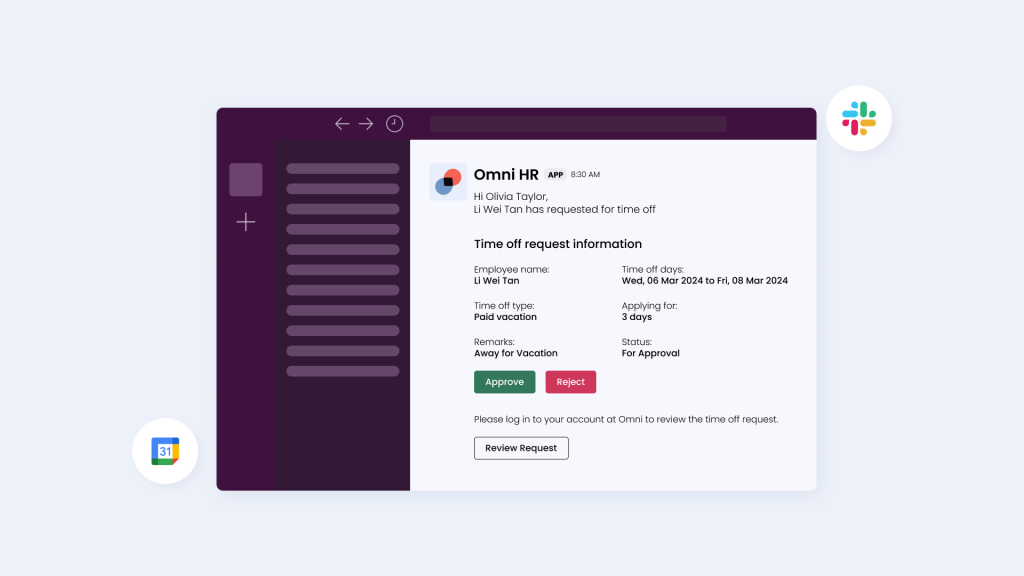

Omni helps you streamline and automate your process of hiring in Singapore, enabling you to attract, screen, and hire the best talent. Our platform allows you to sync all candidate applications in one place and easily collaborate with hiring managers to schedule interviews, send impactful communications, and analyze interview feedback.

With Omni’s recruitment workflows, you can send offers or rejections with just a few clicks, coordinate candidate interviews, share candidate feedback among management, and swiftly transition successful candidates into the onboarding process to ensure top performance and engagement.

Omni manages and automates time-consuming manual tasks to allow you and your recruitment team to focus on what’s really important: crafting impactful interview questions, establishing parameters to interpret responses, and ultimately hiring award-winning candidates.

Book a demo with our team today to learn more about how Omni can help revolutionize your Singapore hiring process.