Summary. Payroll Singapore requires navigating complex regulations while maintaining accurate and timely processing to ensure employee engagement. The process begins with company setup through Bizfile+ and establishing a business bank account, followed by comprehensive employee data collection including salary information, hours worked, leave details, and personal information. Monthly payroll calculations must comply with the Employment Act, requiring payment within 7 days after the salary period and itemized payslips containing specific details. Singapore employers must manage various compliance requirements, including statutory submissions (Form IR8A and appendices) by March 1 each year, annual income tax reporting to IRAS, and ongoing employee data maintenance. The Singapore Employment Act governs employment relationships, covering working hours, rest days, leave entitlements, and termination guidelines. Singapore's income tax system differentiates between residents (taxed progressively up to 22%) and non-residents (flat rate taxation), with various deductions and reliefs available. Mandatory contributions include the Central Provident Fund (CPF) for Singaporeans and permanent residents, self-help group contributions, optional SHARE donations, the Skills Development Levy for all employees, and the Foreign Worker Levy for companies employing international staff.

Payroll is an essential function for every company, and a key driver of employee engagement and motivation. Yet navigating payroll Singapore requirements can be complicated, with various regulations, compliance requirements, and data collection. This comprehensive guide will walk you through a simplified guide to help you navigate the complexities of payroll in Singapore.

The Process of Payroll Singapore

Payroll Singapore processing requires accurate record keeping and well managed schedules to keep your business compliant. Understanding the process of setting up and collecting payroll data will ensure you pay your employees on time, keeping them motivated and engaged.

Payroll setup

If it’s your first time setting up payroll in Singapore, you’ll need to incorporate your local company or register a foreign branch online at Bizfile+, the filing portal of Singapore’s Accounting and Corporate Regulatory Authority (ACRA).

You’ll also need a business bank account in Singapore for your financial transactions with the Government.

Data collection

In order to meet the payroll Singapore requirements for processing, businesses must collect data and build profiles for each employee. Payroll data includes:

- Salary information

- Hours worked (if applicable)

- Overtime (if applicable)

- Annual leave (such as paid or unpaid vacation, sick leave, parental leave etc)

- Employment start date

- Visa or citizenship status

- Employee bank details

- Employee profile information such as legal name, date of birth, and legal address

Securely storing this data in a centralized location is essential to running a smooth payroll system. Whether you keep a spreadsheet, utilize an HRIS, or keep paper files, ensure that each employee profile is up-to-date and complete to avoid payroll delays.

Payroll calculation

Each month, HR teams must calculate payroll for their organization. In accordance with the Employment Act, the salary must be paid at least once a month within 7 days after the end of the salary period. Overtime pay, if applicable, must be paid within 14 days of the stipulated salary period. There is no requirement for bonus payment under the Employment Act of Singapore.

This calculation may include a combination of data including hours worked, leave taken, bonuses, and deductions or contributions for things like retirement funds. Calculation is ofcourse an essential part of the payroll Singapore process, and it’s essential that this data is error-free to avoid under or over payment and delays for your workforce.

The calculation process can be done in a variety of ways, and most modern companies rely on HR automation to ensure accuracy and timeliness to the process.

Payroll payment or payslip

Itemized payslips are required by payroll Singapore regulations to be administered to all employees in the first 7 days of the month following the most recent pay cycle. Payslips should include certain data, including:

- Basic salary value

- Date of payment

- Pay period

- Any deductions

- Net monthly salary

Omni tip: Don’t forget ad hoc payments, foreigner tax clearance, and other payments that don’t get issued at the beginning of the month.

Statutory submissions

Employers are required by law to prepare Form IR8A and Appendix 8A, Appendix 8B or Form IR8S (where applicable) for employees who are employed in Singapore by March 1 each year.

For more information on these forms, please refer to IRAS.gov for a complete breakdown of each form and its requirements.

Annual report for individual income tax

The deduction of taxes from employees’ salaries is the responsibility of employees! As an employer, you are only required to pay your own individual income tax.

Like the statutory submission, on the first of March, you’ll need to file income taxes to the Inland Revenue Authority of Singapore (IRAS), which includes the monthly payroll income and any benefits from the company.

Employee payroll data maintenance

In this phase, you conduct routine data maintenance to keep your data updated and precise. In other words, you make changes, additions, and omissions to employee data to reflect changing circumstances. This includes the following:

- Extra pay

- Direct deposits

- General deductions

- Employee tax withholding information

- Information relating to employees with several jobs

In other words, you make changes, additions, and omissions to reflect changing circumstances. With data maintenance, rest assured that your payroll data will remain up-to-date and accurate!

Year-end payments

If you reward annual bonuses to your team, a year-end payment is the time to administer such benefits. This is a one-time payment made to reward employees and celebrate their contributions made throughout the year.

What is the Singapore Employment Act?

The Singapore Employment Act is a key piece of legislation that governs employment relationships and provides basic employment rights for workers in Singapore. The Employment Act covers most employees in Singapore, except for certain groups like domestic workers, seafarers, and government employees. It also sets out different provisions for managers and executives.

The Act outlines the fundamental terms of employment, including working hours, rest days, public holidays, and annual leave entitlements. It also addresses issues like salary payment frequency and overtime pay.

The Singapore employment act also sets guidelines and laws for other employment and payroll Singapore guidelines such as:

- Guidelines for termination of employment, including notice periods and compensation for wrongful dismissal.

- Various protections for employees, such as restrictions on deductions from wages, limits on working hours, and provisions for sick leave and maternity leave.

- Employment records requirements.

- Guidelines and restrictions on working hours and types of work for minors

- Workplace safety and health.

- Dispute resolution

- Trade Union rights

- Employment standards for fair treatment, wages, and benefits.

- Foreign worker requirements such as work permits.

It's important to note that the Employment Act is periodically updated and amended to reflect changes in the labor landscape and to better protect the rights of employees. Employers and employees in Singapore should familiarize themselves with the latest version of the Act and any related regulations to ensure compliance with the law. Additionally, some categories of employees, such as professionals, managers, and executives, may not be fully covered by the Act, and their employment terms may be subject to negotiation and contractual agreements.

Relevant reading: How HRIS Supports Compliance and Risk Management for FinTechs

Income Taxes Explained for Payroll Singapore

Singapore has a progressive income tax system, where the tax rate increases as an individual's income rises. Here's a brief overview of Singapore's income tax:

Resident vs. Non-Resident

Taxation in Singapore depends on your tax residency status. Residents are taxed on their worldwide income, while non-residents are generally taxed only on income earned in Singapore.

Progressive Tax Rates for Residents

Singapore's tax rates for residents are progressive, with higher income levels subjected to higher tax rates. As of my knowledge cutoff date in September 2021, the tax rates for residents ranged from 0% to a maximum of 22%.

Non-Resident Tax Rates

Non-residents are taxed at a flat rate on their Singapore-sourced income. The rate varies depending on the type of income, but it is generally higher than the resident tax rates. As of my last update, employment income for non-residents was taxed at rates ranging from 15% to 22%.

Tax Deductions and Rebates

Singapore provides various tax deductions, reliefs, and rebates to reduce the tax burden for individuals. Common deductions include those for employment expenses, contributions to approved pension funds, and donations to approved charities.

Personal Income Relief

Residents are eligible for personal income relief, which reduces their taxable income. This relief is based on factors such as age, marital status, and the number of dependents.

Tax Filing and Payment

Singapore's tax year is generally from January 1st to December 31st. Residents and non-residents may be required to file an income tax return, depending on their income level and other factors. The tax filing deadline is typically in April or May.

Employer's Role

Employers in Singapore play a significant role in income tax compliance. They are responsible for withholding tax from their employees' salaries (known as "tax deduction at source") and issuing tax forms (Form IR8A) summarizing the employee's income.

Tax laws and rates can change, it's advisable to consult with the Inland Revenue Authority of Singapore (IRAS) or a tax professional for the most up-to-date and detailed information regarding Singapore's income tax regulations and rates.

Read next: Employer’s Manual for Taxation in Singapore

Contributions and Levies

Payroll Singapore law includes deduction requirements in the form of contributions and levies, applicable to all employers and employees in Singapore, let’s break down the various categories.

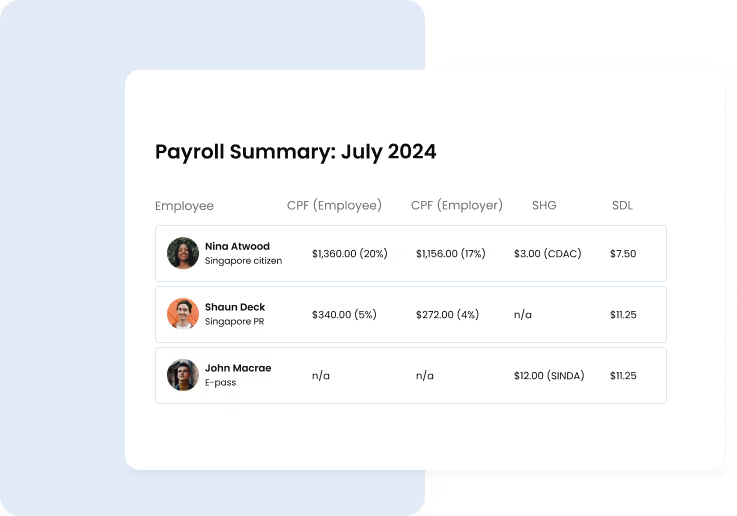

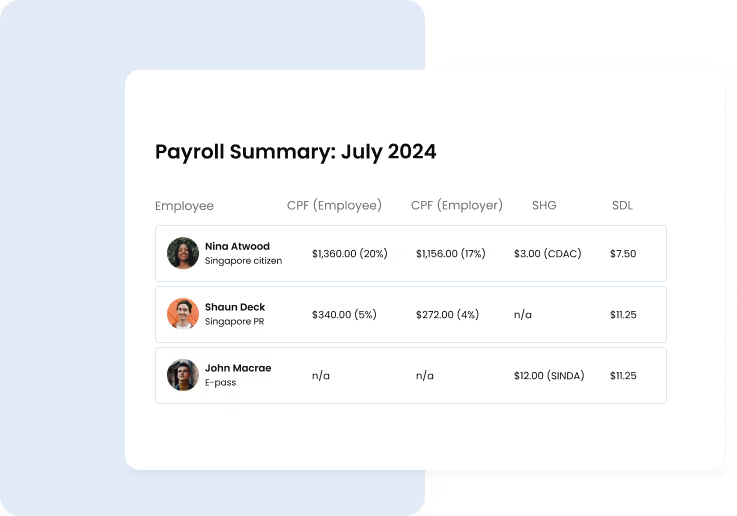

Central Provident Fund Contributions

Contributions are made to the Central Provident Fund (CPF), an employment-based scheme that serves as a compulsory savings plan for Singaporeans and Permanent Residents (PR). CPF contributions are made by both employers and employees at varying rates, depending on the employee's age and salary.

As you work and make CPF contributions, you accumulate savings in 3 accounts:

- Ordinary Account (OA)

- For retirement, housing, insurance and investment

- MediSave Account (MA)

- For hospitalization, medical expenses and approved medical insurance

- Special Account (SA)

- For old age investment in retirement-related financial products

At age 55, a Retirement Account (RA) is created for you, where you receive monthly retirement payouts.

Self-Help Groups Contributions

Self-Help Group Funds (SHGs) are contributions set up to uplift low-income households and the less privileged, in the Chinese, Eurasian, Muslim, and Indian communities in Singapore. The CPF Board collects SHG contributions on behalf of the SHGs. You’re expected to deduct SHG contributions from your employees’ wages.

SHARE Donations

SHARE is a voluntary monthly giving program run by Community Chest, the philanthropy and engagement arm of the National Council of Social Service.

The CPF Board collects your employees’ SHARE donations on behalf of Community Chest, from the employees’ wages made through the company payroll.

The Skill Development Levy and Foreign Worker Levy

There are 2 main types of levies present in Singapore tax law, the Skill Development Levy (SDL) and Foreign Worker Levy (FWL).

All Singapore based companies will need to pay a SDL for all their employees (Local and Foreign) if they are hired on a permanent, part time, casual or temporary role. This levy is on top of the employer CPF contribution for local employees and FWL for foreign employees.

The FWL is a pricing mechanism to regulate the number of foreigners in Singapore. Employers must pay a monthly levy for Work Permit holders. The levy liability will start from the day the Temporary Work Permit or Work Permit is issued, whichever is earlier. It ends when the permit is canceled or expires.

Leveraging Technology to Streamline Payroll Singapore Processing

Managing payroll Singapore is a complex and detail-oriented task that demands a deep understanding of the region's unique legal requirements and a commitment to accuracy and compliance. That’s why it’s important to have the right technology on your side.

Omni offers a comprehensive payroll solution tailored to Singapore’s specific requirements. With features like support for SGD, automated tax calculations, and managed CPF contributions, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Omni’s suite of features makes the requirements for running a compliant and efficient payroll system in Singapore easy. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support payroll practices.

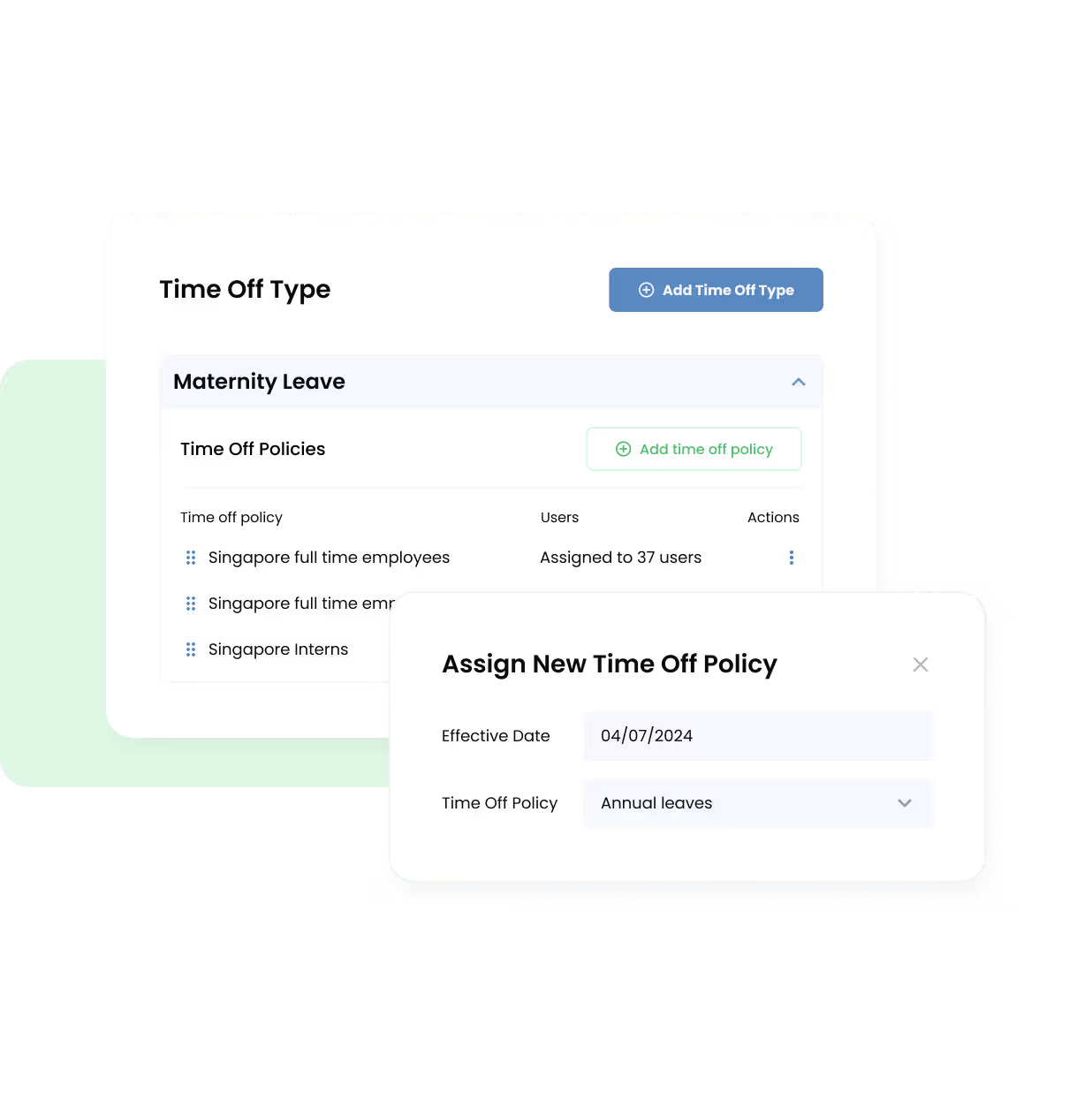

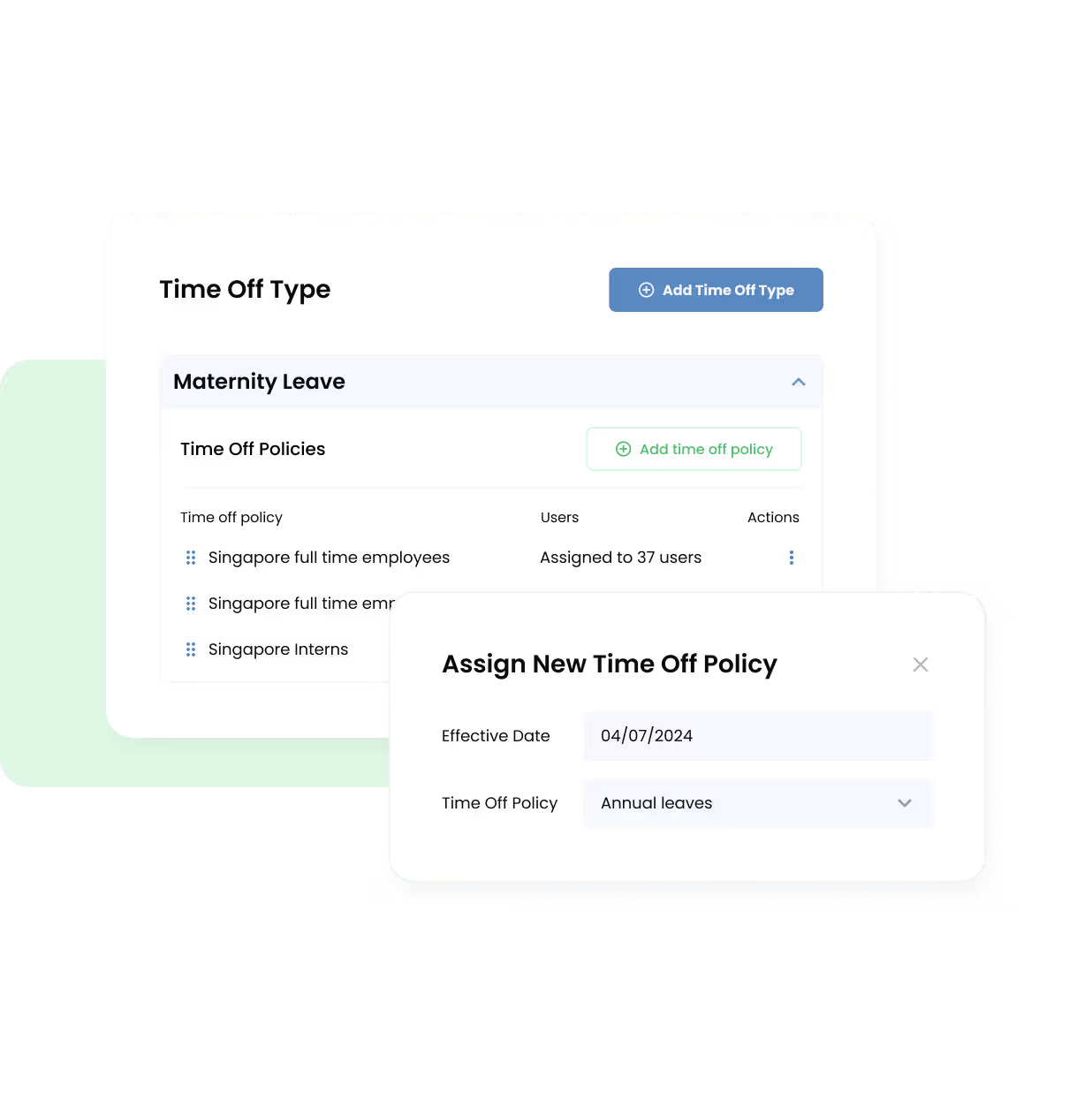

Our time-off and attendance features empower teams to automate data and produce accurate reports in minutes, making payroll calculations seamless and accurate. And with payroll solutions that support SGD and pay schedules, Omni offers an entire suite of solutions to make your payroll system Singapore seamless.

Managing more than one company? Omni helps you establish a dedicated payroll admin for each company, who have the power to enroll employees, manage company settings and easily process your payroll.

If you're ready to take your payroll Singapore management to the next level, book a demo with us today. We’ll walk you through the platform's capabilities and demonstrate how Omni can transform your payroll processing, saving you time, reducing administrative burdens, and enhancing overall efficiency.

Payroll is an essential function for every company, and a key driver of employee engagement and motivation. Yet navigating payroll Singapore requirements can be complicated, with various regulations, compliance requirements, and data collection. This comprehensive guide will walk you through a simplified guide to help you navigate the complexities of payroll in Singapore.

The Process of Payroll Singapore

Payroll Singapore processing requires accurate record keeping and well managed schedules to keep your business compliant. Understanding the process of setting up and collecting payroll data will ensure you pay your employees on time, keeping them motivated and engaged.

Payroll setup

If it’s your first time setting up payroll in Singapore, you’ll need to incorporate your local company or register a foreign branch online at Bizfile+, the filing portal of Singapore’s Accounting and Corporate Regulatory Authority (ACRA).

You’ll also need a business bank account in Singapore for your financial transactions with the Government.

Data collection

In order to meet the payroll Singapore requirements for processing, businesses must collect data and build profiles for each employee. Payroll data includes:

- Salary information

- Hours worked (if applicable)

- Overtime (if applicable)

- Annual leave (such as paid or unpaid vacation, sick leave, parental leave etc)

- Employment start date

- Visa or citizenship status

- Employee bank details

- Employee profile information such as legal name, date of birth, and legal address

Securely storing this data in a centralized location is essential to running a smooth payroll system. Whether you keep a spreadsheet, utilize an HRIS, or keep paper files, ensure that each employee profile is up-to-date and complete to avoid payroll delays.

Payroll calculation

Each month, HR teams must calculate payroll for their organization. In accordance with the Employment Act, the salary must be paid at least once a month within 7 days after the end of the salary period. Overtime pay, if applicable, must be paid within 14 days of the stipulated salary period. There is no requirement for bonus payment under the Employment Act of Singapore.

This calculation may include a combination of data including hours worked, leave taken, bonuses, and deductions or contributions for things like retirement funds. Calculation is ofcourse an essential part of the payroll Singapore process, and it’s essential that this data is error-free to avoid under or over payment and delays for your workforce.

The calculation process can be done in a variety of ways, and most modern companies rely on HR automation to ensure accuracy and timeliness to the process.

Payroll payment or payslip

Itemized payslips are required by payroll Singapore regulations to be administered to all employees in the first 7 days of the month following the most recent pay cycle. Payslips should include certain data, including:

- Basic salary value

- Date of payment

- Pay period

- Any deductions

- Net monthly salary

Omni tip: Don’t forget ad hoc payments, foreigner tax clearance, and other payments that don’t get issued at the beginning of the month.

Statutory submissions

Employers are required by law to prepare Form IR8A and Appendix 8A, Appendix 8B or Form IR8S (where applicable) for employees who are employed in Singapore by March 1 each year.

For more information on these forms, please refer to IRAS.gov for a complete breakdown of each form and its requirements.

Annual report for individual income tax

The deduction of taxes from employees’ salaries is the responsibility of employees! As an employer, you are only required to pay your own individual income tax.

Like the statutory submission, on the first of March, you’ll need to file income taxes to the Inland Revenue Authority of Singapore (IRAS), which includes the monthly payroll income and any benefits from the company.

Employee payroll data maintenance

In this phase, you conduct routine data maintenance to keep your data updated and precise. In other words, you make changes, additions, and omissions to employee data to reflect changing circumstances. This includes the following:

- Extra pay

- Direct deposits

- General deductions

- Employee tax withholding information

- Information relating to employees with several jobs

In other words, you make changes, additions, and omissions to reflect changing circumstances. With data maintenance, rest assured that your payroll data will remain up-to-date and accurate!

Year-end payments

If you reward annual bonuses to your team, a year-end payment is the time to administer such benefits. This is a one-time payment made to reward employees and celebrate their contributions made throughout the year.

What is the Singapore Employment Act?

The Singapore Employment Act is a key piece of legislation that governs employment relationships and provides basic employment rights for workers in Singapore. The Employment Act covers most employees in Singapore, except for certain groups like domestic workers, seafarers, and government employees. It also sets out different provisions for managers and executives.

The Act outlines the fundamental terms of employment, including working hours, rest days, public holidays, and annual leave entitlements. It also addresses issues like salary payment frequency and overtime pay.

The Singapore employment act also sets guidelines and laws for other employment and payroll Singapore guidelines such as:

- Guidelines for termination of employment, including notice periods and compensation for wrongful dismissal.

- Various protections for employees, such as restrictions on deductions from wages, limits on working hours, and provisions for sick leave and maternity leave.

- Employment records requirements.

- Guidelines and restrictions on working hours and types of work for minors

- Workplace safety and health.

- Dispute resolution

- Trade Union rights

- Employment standards for fair treatment, wages, and benefits.

- Foreign worker requirements such as work permits.

It's important to note that the Employment Act is periodically updated and amended to reflect changes in the labor landscape and to better protect the rights of employees. Employers and employees in Singapore should familiarize themselves with the latest version of the Act and any related regulations to ensure compliance with the law. Additionally, some categories of employees, such as professionals, managers, and executives, may not be fully covered by the Act, and their employment terms may be subject to negotiation and contractual agreements.

Relevant reading: How HRIS Supports Compliance and Risk Management for FinTechs

Income Taxes Explained for Payroll Singapore

Singapore has a progressive income tax system, where the tax rate increases as an individual's income rises. Here's a brief overview of Singapore's income tax:

Resident vs. Non-Resident

Taxation in Singapore depends on your tax residency status. Residents are taxed on their worldwide income, while non-residents are generally taxed only on income earned in Singapore.

Progressive Tax Rates for Residents

Singapore's tax rates for residents are progressive, with higher income levels subjected to higher tax rates. As of my knowledge cutoff date in September 2021, the tax rates for residents ranged from 0% to a maximum of 22%.

Non-Resident Tax Rates

Non-residents are taxed at a flat rate on their Singapore-sourced income. The rate varies depending on the type of income, but it is generally higher than the resident tax rates. As of my last update, employment income for non-residents was taxed at rates ranging from 15% to 22%.

Tax Deductions and Rebates

Singapore provides various tax deductions, reliefs, and rebates to reduce the tax burden for individuals. Common deductions include those for employment expenses, contributions to approved pension funds, and donations to approved charities.

Personal Income Relief

Residents are eligible for personal income relief, which reduces their taxable income. This relief is based on factors such as age, marital status, and the number of dependents.

Tax Filing and Payment

Singapore's tax year is generally from January 1st to December 31st. Residents and non-residents may be required to file an income tax return, depending on their income level and other factors. The tax filing deadline is typically in April or May.

Employer's Role

Employers in Singapore play a significant role in income tax compliance. They are responsible for withholding tax from their employees' salaries (known as "tax deduction at source") and issuing tax forms (Form IR8A) summarizing the employee's income.

Tax laws and rates can change, it's advisable to consult with the Inland Revenue Authority of Singapore (IRAS) or a tax professional for the most up-to-date and detailed information regarding Singapore's income tax regulations and rates.

Read next: Employer’s Manual for Taxation in Singapore

Contributions and Levies

Payroll Singapore law includes deduction requirements in the form of contributions and levies, applicable to all employers and employees in Singapore, let’s break down the various categories.

Central Provident Fund Contributions

Contributions are made to the Central Provident Fund (CPF), an employment-based scheme that serves as a compulsory savings plan for Singaporeans and Permanent Residents (PR). CPF contributions are made by both employers and employees at varying rates, depending on the employee's age and salary.

As you work and make CPF contributions, you accumulate savings in 3 accounts:

- Ordinary Account (OA)

- For retirement, housing, insurance and investment

- MediSave Account (MA)

- For hospitalization, medical expenses and approved medical insurance

- Special Account (SA)

- For old age investment in retirement-related financial products

At age 55, a Retirement Account (RA) is created for you, where you receive monthly retirement payouts.

Self-Help Groups Contributions

Self-Help Group Funds (SHGs) are contributions set up to uplift low-income households and the less privileged, in the Chinese, Eurasian, Muslim, and Indian communities in Singapore. The CPF Board collects SHG contributions on behalf of the SHGs. You’re expected to deduct SHG contributions from your employees’ wages.

SHARE Donations

SHARE is a voluntary monthly giving program run by Community Chest, the philanthropy and engagement arm of the National Council of Social Service.

The CPF Board collects your employees’ SHARE donations on behalf of Community Chest, from the employees’ wages made through the company payroll.

The Skill Development Levy and Foreign Worker Levy

There are 2 main types of levies present in Singapore tax law, the Skill Development Levy (SDL) and Foreign Worker Levy (FWL).

All Singapore based companies will need to pay a SDL for all their employees (Local and Foreign) if they are hired on a permanent, part time, casual or temporary role. This levy is on top of the employer CPF contribution for local employees and FWL for foreign employees.

The FWL is a pricing mechanism to regulate the number of foreigners in Singapore. Employers must pay a monthly levy for Work Permit holders. The levy liability will start from the day the Temporary Work Permit or Work Permit is issued, whichever is earlier. It ends when the permit is canceled or expires.

Leveraging Technology to Streamline Payroll Singapore Processing

Managing payroll Singapore is a complex and detail-oriented task that demands a deep understanding of the region's unique legal requirements and a commitment to accuracy and compliance. That’s why it’s important to have the right technology on your side.

Omni offers a comprehensive payroll solution tailored to Singapore’s specific requirements. With features like support for SGD, automated tax calculations, and managed CPF contributions, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Omni’s suite of features makes the requirements for running a compliant and efficient payroll system in Singapore easy. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support payroll practices.

Our time-off and attendance features empower teams to automate data and produce accurate reports in minutes, making payroll calculations seamless and accurate. And with payroll solutions that support SGD and pay schedules, Omni offers an entire suite of solutions to make your payroll system Singapore seamless.

Managing more than one company? Omni helps you establish a dedicated payroll admin for each company, who have the power to enroll employees, manage company settings and easily process your payroll.

If you're ready to take your payroll Singapore management to the next level, book a demo with us today. We’ll walk you through the platform's capabilities and demonstrate how Omni can transform your payroll processing, saving you time, reducing administrative burdens, and enhancing overall efficiency.

Full HR & Payroll coverage for Philippines, Singapore, Malaysia, Hong Kong, and Indonesia. Each market has local support teams and built-in compliance features.

Starting at $3/employee/month for core features. Volume-based discounts are available for growing teams. Book a demo for custom pricing.

Enterprise-grade security with ISO 27001, GDPR certifications, and local data residency options.

4 weeks average. Includes free data migration, setup, and team training. No hidden fees.

Built specifically for Asia with local payroll processing, same-day support in Asia time zones, and 40% lower cost than global alternatives.

.avif)

.avif)

.avif)