Are you looking to hire globally in Indonesia? We created this article to help your recruitment in Indonesia process a lot easier. Let’s get started with telling you about the global talent pool in Indonesia.

Indonesia is a culturally rich country situated in Southeast Asia. The country is believed to be the fourth most populous country in the world, with estimates showing that its population has already surpassed the 270-million mark. Its economy is among the largest in the region, propelled by strong manufacturing, agriculture, mining, and service sectors.

At the strategic location with a growing economy, Indonesia has now developed as a destination country to do business in, whereby one gets to tap into an available pool of talented people. Indonesia is characterized by a young and educated workforce, with high numbers graduating in key industries like engineering, IT, finance, and other professional courses.

Besides, the opening of recruitment in Indonesia to the international market through various trade agreements and participation in groups such as ASEAN makes it more accessible and attractive for global businesses. The Indonesian labor market provides companies with skilled and professional employees who can be reached through job channels and networks, making Indonesia a strategic location for the expansion of businesses and a thriving place for employment.

It’s also important to note there’s a step by step process for recruitment in Indonesia which you’ll learn in this guide. We will proceed with helping you understand the labor market, share details about recruitment in Indonesia, employee taxes, and information on managing your workforce.

Understanding the Indonesian Labor Market

Labor laws

When hiring foreigners in Indonesia, the Indonesian labor law protects the rights of both employers and employees. The main legislation governing employment terms, working hours, and employee rights is the Manpower Law No. 13 of 2003. Among others, it covers employment contracts, termination, and dispute resolution. In addition, the Law No. 11 of 2020 on Job Creation (Omnibus Law) brings significant amendments to labor laws on contract employment, severance pay, and outsourcing.

Read next: Indonesia Employment Law Explained

Minimum wage

Indonesia follows a minimum wage policy that varies from one province to another. The average wage is determined by the provincial government each year. It varies according to the living cost, inflation rate, and economic growth. This Indonesia average wage policy has to be followed by all employers in order to pay their employees fairly and ensure proper employee benefits Indonesia.

Working hours

The standard workweek in Indonesia is 40 hours per week, usually distributed in 8 hours of work daily for 5 days or 7 hours of work daily for 6 days. Overtime is possible but must be paid according to conditions, its working hours are up to four hours a day and 18 hours a week, with an exception in case of public holidays.

For recruitment in Indonesia, the collective labor agreement, company regulations, or employment agreement should clearly say in writing what type of position does not have the right to overtime pay; otherwise, workers will automatically have the right to this payment.

Social security

Under Indonesian law, each employer is required to enroll staff in national social security schemes organized by BPJS: Badan Penyelenggara Jaminan Sosial. The system provides a wide range of employee benefits in Indonesia, including health care, work-related accident cover, old age savings, and death benefits. Employers are obliged to pay contributions on behalf of employees.

Process for Recruitment in Indonesia

Recruitment in Indonesia is done carefully to ensure that the best talent is attracted and hired for your organization. Here is an overview of the process in steps:

Job description

Develop a detailed job description to attract the right candidates and set clear expectations. This can include the title and job scope, key responsibilities and duties, qualifications and competencies required, work environment, compensation and benefits, and company overview.

Recruitment channels

Identify effective channels of recruitment that reach a wider pool of talents. You can employ online job portals such as JobStreet, LinkedIn, and Indeed. Use the services of agencies specializing in recruitment in Indonesia and also partner with universities and colleges, social media, and employee referrals.

Screening and selection

Screen and select candidates through a multi-tiered process: review of applications and resumes to shortlist candidates, initial screen by phone/video, followed by HR and technical interviews. Final screening interviews with senior management are extended; followed by background checks.

Job offers

Once selected, extend an offer of employment. Give an offer letter with the details of the job and the terms of employment. Be prepared for negotiations and confirm the commencement date upon acceptance. Prepare the draft of the employment contract under Indonesian labor law and design the onboarding process to bring the new employees into the organization and that’s all for your recruitment in Indonesia.

Onboarding and Compliance for Hiring Foreigners in Indonesia

Hiring foreigners in Indonesia involves a few critical steps that are important for global compliance with local laws, as well as making onboarding as smooth as possible.

Employment contracts

While hiring foreign employees, you need to draft an exhaustive employment contract in line with Indonesian labor laws. It will contain the title of the job and a description, salary, working hours, annual leaves,conditions of termination, and employee benefits in Indonesia. The contract must be clear in its intent and legally bound to protect the employer and the employee. The employment contract must be either in Bahasa Indonesia or in a bilingual format in order for the contract to be legally valid.

Recruitment in Indonesia also provides for the use of fixed-term employment contracts, commonly known as "Perjanjian Kerja Waktu Tertentu" or PKWT. In Indonesia, there are three types of fixed-term contracts: FTC based on the completion of work, FTC based on a period of time, and FTC related to non-permanent work.

These are mainly applied to special projects, seasonal work, or additional temporary requirements within a specific period. Because of this, all contract extensions cannot be for more than a prolonged period but are allowed to a maximum total duration of five years.

Work permits

Here are some of the work permits foreign employees need:

- RPTKA (Expatriate Placement Plan): An employer shall obtain approval from the Ministry of Manpower through an Expatriate Placement Plan. This means that the employer must state the reasons for employing a foreign employee, and the position of the employee within the company.

- IMTA (Work permit): Also during recruitment in Indonesia, the employer can apply for an IMTA once the RPTKA is approved. IMTA is a legal permit for foreigners working in Indonesia.

- KITAS: After the issuance of the IMTA, a foreign worker will have to apply for a KITAS. This will grant them the right to stay in Indonesia for the period of their respective employment contracts.

Learn more: Hiring in Indonesia: How to Prepare a Foreign Worker Utilisation Plan

Social security registration

As an organization in the process of recruitment in Indonesia, registration of foreign employees is compulsory within the national social security schemes provided through BPJS, including:

- BPJS Kesehatan: Health care benefits provided to employees and their families.

- BPJS Ketenagakerjaan: Compensation insurance related to work accidents, old-age savings, and death.

For all the above social securities, employers are required to pay contributions on behalf of their employees. These come under employee benefits in Indonesia.

Induction training

Induction training should include new hire orientations which will involve discussing the history of the company, its mission, values, and organizational chart. You can introduce them to the key team members and stakeholders they will be dealing with in due course.

During recruitment in Indonesia, training on company policy and procedures is done to ensure new employees get an understanding as to what is expected and what standards are required. Cultural awareness training on Indonesian culture, customs, and workplace etiquette can also be done to better understand the local surroundings and foster a diverse and positive workplace culture.

Managing Your Workforce

Indonesia payroll and benefits

Under Indonesian law, it is the duty and responsibility of every employer to make payroll processing accurate and on time. Global payroll processing includes the calculation of salary, including basic pay, allowance, bonus, and any other compensation.

Indonesia applies a minimum wage policy. The Indonesia average wage level depends on the region and is determined annually by the provincial government. A number of companies are adopting Indonesia payroll software for payroll automation to streamline the payroll process within recruitment in Indonesia. Compliance with the statutory requirement of minimum wage will be necessary, as well as statutory benefits related to health insurance (BPJS Kesehatan) and employment insurance (BPJS Ketenagakerjaan).

Leave management

You can use an HR management tool to track and manage various leave types.

- Annual leave can be taken by employees for a minimum of 12 days after one year of service.

- Public holidays are taken from the official calendar and as declared by the government.

- Sick leave can be taken as needed based on the medical attention needed.

- Parental leave will be provided in accordance with the company’s policies. Generally, maternity leave lasts for three months or six months for extended cases, while paternity leave goes on for two to three days.

Performance management

You can also indicate the key performance indicators for every position and conduct regular appraisals. Providing feedback and goal setting can improve employee performance.

Employee relations

You also need to keep open lines of communication. Handle employee grievances in a timely manner and strive toward a positive company culture.

Compliance

Organizations who are interested in recruitment in Indonesia must stay abreast with information about the Indonesian labor laws and regulations. Keeping all employees' records appropriately and relevant can help to avoid penalties easily and can be done with HR softwares.

Read next: The 2024 HR Compliance Checklist: APAC Edition

Taxes and Contributions

Employer obligations

Jaminan Sosial Nasional (JSN)

Employers will be required to register their employees for the national social security schemes under BPJS, covering health insurance and employment insurance This is compulsory on the employer on behalf of the employee.

Tax on wages (Pajak Penghasilan Pasal 21)

Employers are required to deduct income tax, Pajak Penghasilan Pasal 21, from the Indonesia average wages paid to employees, and must be calculated and deducted according to applicable tax rates for recruitment in Indonesia.

Tax compliance

For recruitment in Indonesia, all employers must comply fully with Indonesian taxation laws through proper calculation, withholding, and remittance to the relevant tax authority:

- Payroll processing: Payroll should be processed accurately and promptly. Employers are supposed to calculate wages, benefits, and deductions correctly and ensure that these are paid out accurately to the employees.

- Record keeping: The employers are obliged to maintain correct and full records concerning Indonesia payroll, taxes, and employee information. These records shall be made available for inspection at all times by relevant authorities.

- Tax filing: Indonesian tax laws require employers to file periodic reports and returns with the relevant tax authorities. This will involve monthly and annual filings in respect of income tax and social security contributions.

Employee obligations

Jaminan Sosial Nasional (JSN)

Employees are required to be registered for the national social securities: BPJS Kesehatan and BPJS Ketenagakerjaan. Contributions to these are partly withheld from the employees' salaries.

Income tax (Pajak Penghasilan)

When it comes to recruitment in Indonesia employees are obliged to pay income tax (Pajak Penghasilan) from the income they make. Usually, such tax is withheld from the employee's salary by the employer and then transferred to the relevant taxation institutions. The employees should also take care of the updates on taxation information to avoid any discrepancies.

Below is a table summarizing the income tax rates for employees in Indonesia:

Additional reading: Helping Employees Prepare for Income Tax Indonesia

Optimize Your Indonesia Hiring Strategy Today

Managing recruitment in Indonesia requires meticulous attention to legal requirements and thorough documentation. You should strive to minimize human error by leveraging automation to ensure accuracy and compliance.

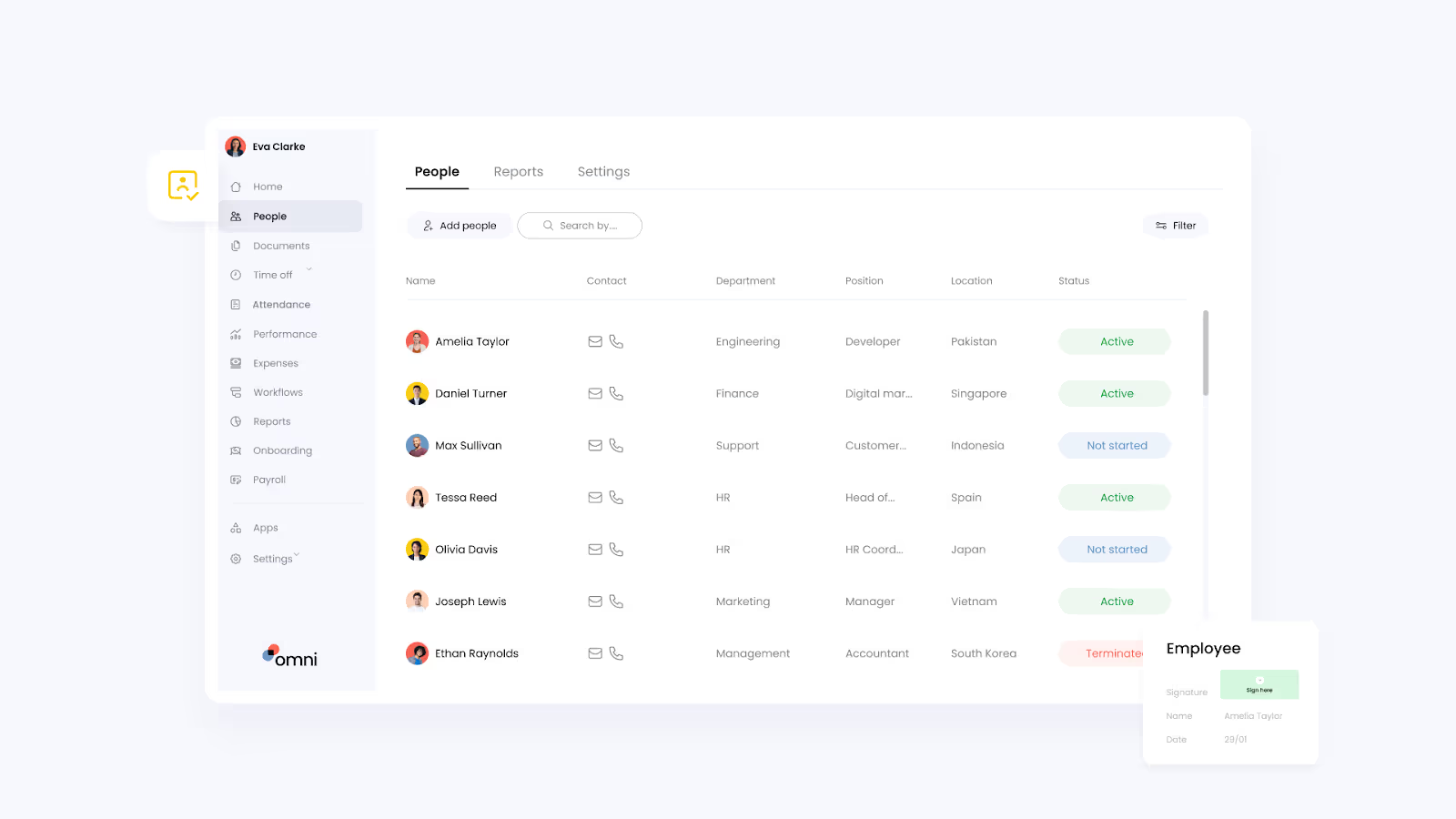

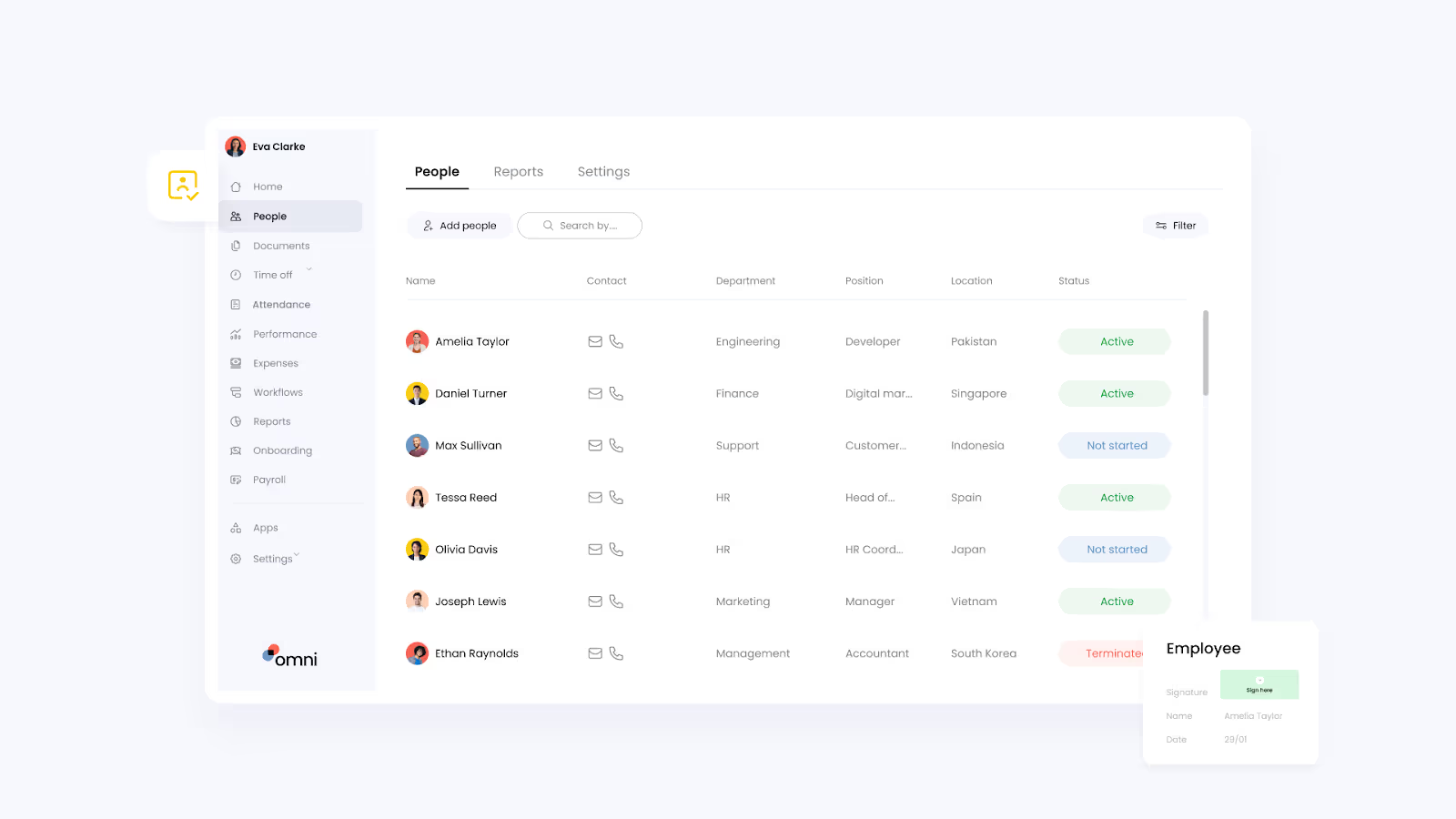

Omni’s suite of features makes hiring foreigners in Indonesia efficient and compliant. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support recruitment in Indonesia practices.

For leave management, our time off management capabilities allows managers to approve leave applications on the go, and keep track of who’s in and out of the office with at-a-glance scheduling. Our employee self-service portal allows employees to submit their employee time off request, which automatically routes to the appropriate manager thanks to customizable approval workflows. With automated calculations, employees and managers can easily view leave balances in real-time, and track how many vacation days they have left without having to go through HR.

When it comes time for payroll and tax processing, Omni offers a comprehensive payroll solution tailored to Indonesian specific requirements. With features like support for Indonesian rupiah and automated tax calculations, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Book your product tour with our team today to learn more about how Omni can simplify your recruitment in Indonesia.

Are you looking to hire globally in Indonesia? We created this article to help your recruitment in Indonesia process a lot easier. Let’s get started with telling you about the global talent pool in Indonesia.

Indonesia is a culturally rich country situated in Southeast Asia. The country is believed to be the fourth most populous country in the world, with estimates showing that its population has already surpassed the 270-million mark. Its economy is among the largest in the region, propelled by strong manufacturing, agriculture, mining, and service sectors.

At the strategic location with a growing economy, Indonesia has now developed as a destination country to do business in, whereby one gets to tap into an available pool of talented people. Indonesia is characterized by a young and educated workforce, with high numbers graduating in key industries like engineering, IT, finance, and other professional courses.

Besides, the opening of recruitment in Indonesia to the international market through various trade agreements and participation in groups such as ASEAN makes it more accessible and attractive for global businesses. The Indonesian labor market provides companies with skilled and professional employees who can be reached through job channels and networks, making Indonesia a strategic location for the expansion of businesses and a thriving place for employment.

It’s also important to note there’s a step by step process for recruitment in Indonesia which you’ll learn in this guide. We will proceed with helping you understand the labor market, share details about recruitment in Indonesia, employee taxes, and information on managing your workforce.

Understanding the Indonesian Labor Market

Labor laws

When hiring foreigners in Indonesia, the Indonesian labor law protects the rights of both employers and employees. The main legislation governing employment terms, working hours, and employee rights is the Manpower Law No. 13 of 2003. Among others, it covers employment contracts, termination, and dispute resolution. In addition, the Law No. 11 of 2020 on Job Creation (Omnibus Law) brings significant amendments to labor laws on contract employment, severance pay, and outsourcing.

Read next: Indonesia Employment Law Explained

Minimum wage

Indonesia follows a minimum wage policy that varies from one province to another. The average wage is determined by the provincial government each year. It varies according to the living cost, inflation rate, and economic growth. This Indonesia average wage policy has to be followed by all employers in order to pay their employees fairly and ensure proper employee benefits Indonesia.

Working hours

The standard workweek in Indonesia is 40 hours per week, usually distributed in 8 hours of work daily for 5 days or 7 hours of work daily for 6 days. Overtime is possible but must be paid according to conditions, its working hours are up to four hours a day and 18 hours a week, with an exception in case of public holidays.

For recruitment in Indonesia, the collective labor agreement, company regulations, or employment agreement should clearly say in writing what type of position does not have the right to overtime pay; otherwise, workers will automatically have the right to this payment.

Social security

Under Indonesian law, each employer is required to enroll staff in national social security schemes organized by BPJS: Badan Penyelenggara Jaminan Sosial. The system provides a wide range of employee benefits in Indonesia, including health care, work-related accident cover, old age savings, and death benefits. Employers are obliged to pay contributions on behalf of employees.

Process for Recruitment in Indonesia

Recruitment in Indonesia is done carefully to ensure that the best talent is attracted and hired for your organization. Here is an overview of the process in steps:

Job description

Develop a detailed job description to attract the right candidates and set clear expectations. This can include the title and job scope, key responsibilities and duties, qualifications and competencies required, work environment, compensation and benefits, and company overview.

Recruitment channels

Identify effective channels of recruitment that reach a wider pool of talents. You can employ online job portals such as JobStreet, LinkedIn, and Indeed. Use the services of agencies specializing in recruitment in Indonesia and also partner with universities and colleges, social media, and employee referrals.

Screening and selection

Screen and select candidates through a multi-tiered process: review of applications and resumes to shortlist candidates, initial screen by phone/video, followed by HR and technical interviews. Final screening interviews with senior management are extended; followed by background checks.

Job offers

Once selected, extend an offer of employment. Give an offer letter with the details of the job and the terms of employment. Be prepared for negotiations and confirm the commencement date upon acceptance. Prepare the draft of the employment contract under Indonesian labor law and design the onboarding process to bring the new employees into the organization and that’s all for your recruitment in Indonesia.

Onboarding and Compliance for Hiring Foreigners in Indonesia

Hiring foreigners in Indonesia involves a few critical steps that are important for global compliance with local laws, as well as making onboarding as smooth as possible.

Employment contracts

While hiring foreign employees, you need to draft an exhaustive employment contract in line with Indonesian labor laws. It will contain the title of the job and a description, salary, working hours, annual leaves,conditions of termination, and employee benefits in Indonesia. The contract must be clear in its intent and legally bound to protect the employer and the employee. The employment contract must be either in Bahasa Indonesia or in a bilingual format in order for the contract to be legally valid.

Recruitment in Indonesia also provides for the use of fixed-term employment contracts, commonly known as "Perjanjian Kerja Waktu Tertentu" or PKWT. In Indonesia, there are three types of fixed-term contracts: FTC based on the completion of work, FTC based on a period of time, and FTC related to non-permanent work.

These are mainly applied to special projects, seasonal work, or additional temporary requirements within a specific period. Because of this, all contract extensions cannot be for more than a prolonged period but are allowed to a maximum total duration of five years.

Work permits

Here are some of the work permits foreign employees need:

- RPTKA (Expatriate Placement Plan): An employer shall obtain approval from the Ministry of Manpower through an Expatriate Placement Plan. This means that the employer must state the reasons for employing a foreign employee, and the position of the employee within the company.

- IMTA (Work permit): Also during recruitment in Indonesia, the employer can apply for an IMTA once the RPTKA is approved. IMTA is a legal permit for foreigners working in Indonesia.

- KITAS: After the issuance of the IMTA, a foreign worker will have to apply for a KITAS. This will grant them the right to stay in Indonesia for the period of their respective employment contracts.

Learn more: Hiring in Indonesia: How to Prepare a Foreign Worker Utilisation Plan

Social security registration

As an organization in the process of recruitment in Indonesia, registration of foreign employees is compulsory within the national social security schemes provided through BPJS, including:

- BPJS Kesehatan: Health care benefits provided to employees and their families.

- BPJS Ketenagakerjaan: Compensation insurance related to work accidents, old-age savings, and death.

For all the above social securities, employers are required to pay contributions on behalf of their employees. These come under employee benefits in Indonesia.

Induction training

Induction training should include new hire orientations which will involve discussing the history of the company, its mission, values, and organizational chart. You can introduce them to the key team members and stakeholders they will be dealing with in due course.

During recruitment in Indonesia, training on company policy and procedures is done to ensure new employees get an understanding as to what is expected and what standards are required. Cultural awareness training on Indonesian culture, customs, and workplace etiquette can also be done to better understand the local surroundings and foster a diverse and positive workplace culture.

Managing Your Workforce

Indonesia payroll and benefits

Under Indonesian law, it is the duty and responsibility of every employer to make payroll processing accurate and on time. Global payroll processing includes the calculation of salary, including basic pay, allowance, bonus, and any other compensation.

Indonesia applies a minimum wage policy. The Indonesia average wage level depends on the region and is determined annually by the provincial government. A number of companies are adopting Indonesia payroll software for payroll automation to streamline the payroll process within recruitment in Indonesia. Compliance with the statutory requirement of minimum wage will be necessary, as well as statutory benefits related to health insurance (BPJS Kesehatan) and employment insurance (BPJS Ketenagakerjaan).

Leave management

You can use an HR management tool to track and manage various leave types.

- Annual leave can be taken by employees for a minimum of 12 days after one year of service.

- Public holidays are taken from the official calendar and as declared by the government.

- Sick leave can be taken as needed based on the medical attention needed.

- Parental leave will be provided in accordance with the company’s policies. Generally, maternity leave lasts for three months or six months for extended cases, while paternity leave goes on for two to three days.

Performance management

You can also indicate the key performance indicators for every position and conduct regular appraisals. Providing feedback and goal setting can improve employee performance.

Employee relations

You also need to keep open lines of communication. Handle employee grievances in a timely manner and strive toward a positive company culture.

Compliance

Organizations who are interested in recruitment in Indonesia must stay abreast with information about the Indonesian labor laws and regulations. Keeping all employees' records appropriately and relevant can help to avoid penalties easily and can be done with HR softwares.

Read next: The 2024 HR Compliance Checklist: APAC Edition

Taxes and Contributions

Employer obligations

Jaminan Sosial Nasional (JSN)

Employers will be required to register their employees for the national social security schemes under BPJS, covering health insurance and employment insurance This is compulsory on the employer on behalf of the employee.

Tax on wages (Pajak Penghasilan Pasal 21)

Employers are required to deduct income tax, Pajak Penghasilan Pasal 21, from the Indonesia average wages paid to employees, and must be calculated and deducted according to applicable tax rates for recruitment in Indonesia.

Tax compliance

For recruitment in Indonesia, all employers must comply fully with Indonesian taxation laws through proper calculation, withholding, and remittance to the relevant tax authority:

- Payroll processing: Payroll should be processed accurately and promptly. Employers are supposed to calculate wages, benefits, and deductions correctly and ensure that these are paid out accurately to the employees.

- Record keeping: The employers are obliged to maintain correct and full records concerning Indonesia payroll, taxes, and employee information. These records shall be made available for inspection at all times by relevant authorities.

- Tax filing: Indonesian tax laws require employers to file periodic reports and returns with the relevant tax authorities. This will involve monthly and annual filings in respect of income tax and social security contributions.

Employee obligations

Jaminan Sosial Nasional (JSN)

Employees are required to be registered for the national social securities: BPJS Kesehatan and BPJS Ketenagakerjaan. Contributions to these are partly withheld from the employees' salaries.

Income tax (Pajak Penghasilan)

When it comes to recruitment in Indonesia employees are obliged to pay income tax (Pajak Penghasilan) from the income they make. Usually, such tax is withheld from the employee's salary by the employer and then transferred to the relevant taxation institutions. The employees should also take care of the updates on taxation information to avoid any discrepancies.

Below is a table summarizing the income tax rates for employees in Indonesia:

Additional reading: Helping Employees Prepare for Income Tax Indonesia

Optimize Your Indonesia Hiring Strategy Today

Managing recruitment in Indonesia requires meticulous attention to legal requirements and thorough documentation. You should strive to minimize human error by leveraging automation to ensure accuracy and compliance.

Omni’s suite of features makes hiring foreigners in Indonesia efficient and compliant. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support recruitment in Indonesia practices.

For leave management, our time off management capabilities allows managers to approve leave applications on the go, and keep track of who’s in and out of the office with at-a-glance scheduling. Our employee self-service portal allows employees to submit their employee time off request, which automatically routes to the appropriate manager thanks to customizable approval workflows. With automated calculations, employees and managers can easily view leave balances in real-time, and track how many vacation days they have left without having to go through HR.

When it comes time for payroll and tax processing, Omni offers a comprehensive payroll solution tailored to Indonesian specific requirements. With features like support for Indonesian rupiah and automated tax calculations, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Book your product tour with our team today to learn more about how Omni can simplify your recruitment in Indonesia.

Full HR & Payroll coverage for Philippines, Singapore, Malaysia, Hong Kong, and Indonesia. Each market has local support teams and built-in compliance features.

Starting at $3/employee/month for core features. Volume-based discounts are available for growing teams. Book a demo for custom pricing.

Enterprise-grade security with ISO 27001, GDPR certifications, and local data residency options.

4 weeks average. Includes free data migration, setup, and team training. No hidden fees.

Built specifically for Asia with local payroll processing, same-day support in Asia time zones, and 40% lower cost than global alternatives.

%20(1).avif)

.png)

.png)