During the tax season in the Philippines, you may be tasked with submitting a set of documents to the Bureau of Internal Revenue (BIR), leaving you questioning their necessity.

Among the various tax forms required, the BIR Form 2316 is one of the most important forms as it provides insight into the tax ratio for an individual employee, breaking down their payments into various categories. With the form deadline right around the corner, this guide aims to provide you with all the necessary information to gain a clearer understanding of the BIR Form 2316.

What is the BIR Form 2316?

The BIR Form 2316, also known as the Certificate of Compensation Payment or Income Tax Withheld, is an annual tax return form in the Philippines. It consolidates an employee’s gross income along with the corresponding taxes and government deductions withheld throughout the calendar year or relevant taxing period.

In other words, it acts as evidence that a salary underwent income tax deductions, aiding the BIR in verifying businesses’ tax compliance. Moreover, in the event of an employee quitting, it assists their new employer in calculating the taxes withheld for the remaining portion of the year and can serve as proof of financial eligibility for various applications.

Employers are required to issue this form to employees subject to a declaration of final tax or any salary or remuneration and submit it to the BIR. Additionally, it should be attached to the employee’s Annual Income Tax Return (AIR) if they file one or if they are not eligible for substituted filing.

To be specific, the BIR Form 2316 should be attached to the BIR form 1700 for employees receiving purely compensation income or BIR form 1701 for employees receiving mixed income.

Who Should Prepare the BIR Form 2316?

Employers are in charge of preparing the BIR Form 2316 for any employee who received a salary, wage, or any other forms of remuneration from the organization during the preceding year.

Once the forms are accurately filled, employers are in charge of submitting the BIR Form 2316 on behalf of its employees. It is essential to prepare three copies: the original form designated for the employee, a duplicate for the BIR, and an additional copy for record-keeping purposes, which employers must retain for the next ten years.

When to Prepare the BIR Form 2316

Employers are required to prepare the BIR Form 2316 after computing the annual taxes for the year. This means preparing the tax return form towards the conclusion of the financial year for employees whose taxes and gross incomes are implicated.

When is the Deadline for the Submission of BIR Form 2316?

Generally, employees must receive their BIR Form 2316 on or before January 31 of the succeeding year.

However, there are two other deadlines to be aware of:

- Employer filing: For employers required to file the BIR Form 2316 on behalf of your employees, the deadline for the submission is 28 February 2024.

- Duplicate copy submission: For employees who received a BIR Form 2316 from their employer, they are required to submit a duplicate copy to the BIR by 29 February 2024.

How to Submit the BIR Form 2316

To submit the BIR 2316, you should follow these steps. First off, head over to the BIR certificate pages and download the BIR form.

Then, collect the needed employee information in Part 1. You’ll need to enter the date, which should be January 1. The only exception is for employees who you’ve hired in the past year; the date for those is their tenure start date. Note that items nine to 11 apply to employees who earn minimum wages only.

Next, enter the required employer information in Part II. Fetch the Certificate of Registration (RIB form 2303), as it includes the data you need for items 12 to 15. Under Part II, you’ll either check Main Employer for full-timers or Secondary Employer for part-timers.

Part III is dedicated to previous employer information. For employees that you’ve hired in the past year, you’ll need to check that the details of their previous employer are accurate.

Now, in Part IV, you fill in all your employee benefits (taxable and non-taxable), government contributions, and remunerations. It’s divided into sections A for your employee’s financial summary and B for their compensation income and taxes withheld details. Afterward, consider items 29 to 33 only if your employee is a minimum wager.

Also, the authorized signatory must sign item 51. You’ll need to sign item 52 and enter your current Community Tax Certificate number or a valid ID number, the paid amount, and the place of issuance. Finally, note that items 53 and 54 apply only to employees eligible for substituted filing.

Don’t forget the signatures. You must sign on item 53, and your employee must sign on item 54. Then, create your three copies, and submit or store them (as mentioned above).

To illustrate, you’ll need to save the electronic copies individually on a USB drive, DVD, or DVD-R. They must be in a PDF file format with the file names alphabetically arranged in the DVD-R. To name them, follow this naming convention: EmployeesLastName_EmployeesTin_TaxablePeriod.

What are the Required Attachments for BIR Form 2316?

For any BIR 2316 form, you should submit the original copy of the following documents:

Notarized Sworn Declaration

This document is a sworn declaration to affirm that the soft copies of all the BIR 2316 in the DVD-R are complete and typical of the originals.

You swear:

That in compliance with the requirements of Revenue Regulations No. 02-2015, submitted herewith is/are one (1) DVD-R containing ___________ covering the period of 12/31/2023

That the contents of the DVD-Rs being submitted herewith conform to the conditions/specification requirements set by the Bureau of Internal Revenue.

That the soft copies of the BIR Form 2316 contained in the DVD-R/s being submitted herewith are the complete and exact copies of the original thereof.

Notarized Substituted Filing Declaration

This form is composed of a list of the employees that qualify for substituted filing. It’s a table including the following information about each employee working for you:

- Name of employee

- Taxpayer identification number

- Amount of compensation

- Tax due withheld and remitted

Then, you follow the list with this statement: “I declare under the penalties of perjury, that this declaration has been made in good faith, and to the best of my knowledge and belief to be true and correct.”

Transmittal Form

This form includes a list of all the employees with the BIR Form 2316 in the submitted DVD or USB drive. Simply, it contains the employees whom you’re submitting the BIR Form 2316 on behalf of. Also, it includes the tax identification number and taxing period covered in the income tax withheld form.

What is Substituted Filing?

Understanding the eligibility criteria will help you submit exactly the needed forms according to the BIR, which should make the tax filing process as smooth as possible. Substituted filing applies to employees who:

- Receive purely compensation income of any amount

- Have one employer only in the Philippines for the calendar year

- Have a spouse who complies with the above conditions

Another eligibility aspect relates to you. For your employee to not have to file their own AITR and to rely on the BIR Form 2316, you must:

- Withhold the taxes of your employees properly

- File the BIR Form 1604-C for them

- Issue the latest version of the BIR Form 2316 for them

Are Electronic Signatures Allowed in the BIR Form 2316?

Yes, electronic signatures are allowed on the BIR Form 2316. Based on the Revenue Memorandum Circular (BCM) No. 29-2021 issued by the BIR on February 26, 2021, e-signatures are permitted for four forms including the BIR Form 2316. This includes digital signatures among other methods.

This decision was necessary to address the difficulties that COVID-19 posed and comply with the mandates of Republic Act (RA) No. 11032 or the “Ease of Doing Business and Efficient Government Service Delivery Act of 2018.” In the past, you and your employee would’ve needed to sign the BIR Form 2316 manually or in wet ink for it to be valid and binding.

What is the Purpose of the BIR Form 2316 From Previous Employer?

Employers typically request that their new hires provide them with the BIR Form 2316 for two reasons. It’s proof of their previous income and the taxes withheld (during the taxable year) by their previous employer. This way, new employers don’t deduct the same taxes already withheld by the former employer.

If your employee requests the BIR Form 2316 when leaving, you are obliged to provide them a copy on their last payday or back pay.

Other Use Cases of BIR Form 2316

BIR Form 2316 is beneficial to the HR department, as it makes it easier to conduct payroll processing. The most common use case of BIR Form 2316 is for BIR to monitor businesses’ tax compliance as it proves that the right taxes were withheld from your employees’ total income.

Other use cases include an employee proving their financial eligibility for a loan, credit card, visa, or scholarship. By presenting the BIR Form 2316, they can prove that they meet the requirements. Likewise, government agencies and private organizations may demand this form as part of certain applications.

Another use case concerns expats. Expatriates living or working in a country other than their own can submit this BIR Form 2316 to prove that they are paying taxes. This way, they can avoid getting taxed for the same income source in their home country.

Automate Your Compliance Process with Omni

Completing the BIR Form 2316 can be a daunting task for many organizations due to its complexity and the meticulous detail it requires. However, with the right tools and systems in place, this process can be significantly simplified.

Omni helps HR teams stay up to date with the latest laws and regulations while streamlining the end-to-end employee management lifecycle. With secure and centralized employee records, HR teams can easily store, update, and communicate employee information across departments and with employees.

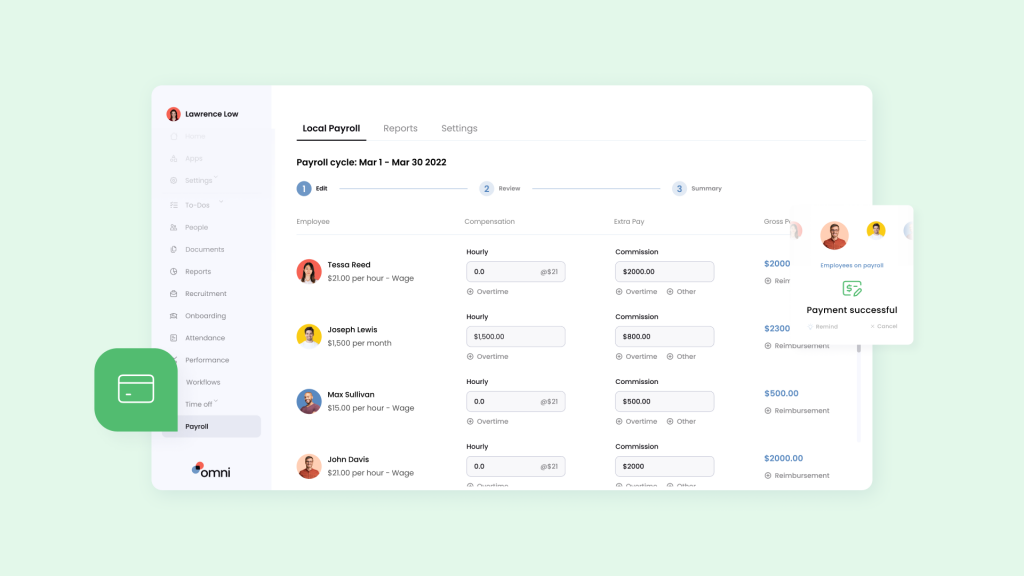

Our solution offers a comprehensive payroll solution tailored to Philippines specific requirements. With features like support for Philippine peso, automated tax calculations, and managed SSS, PhilHealth and PAG-IBIG contributions, Omni can help HR teams simplify their payroll processing and ensure compliance with ease.

Start your 14 days free trial and see how Omni can simplify the intricacies and complexities of preparing and submitting the BIR Form 2316 and minimize the costs associated with common errors.