A Harvard Business Review study of six Fortune 500 companies that transitioned to remote work in 2020 revealed that the remote workday was split into two windows: an eight-hour window from nine to five, and a longer 16-hour window.

During the first window, team members overlapped with 50-70% of their colleagues, suggesting active collaboration. In the longer “off-hours” window, this overlap decreased to 10-50%. This study reflects a global trend towards asynchronous work, which has become a necessary reality for businesses.

To maintain high employee performance levels, it is crucial to understand how to establish an asynchronous work environment and keep employees engaged.

What is Asynchronous Work?

Asynchronous work is a method of collaboration where individuals work independently and complete tasks without requiring real-time interaction with colleagues. Team members can work on their own schedules, using asynchronous communication tools to contribute and move projects forward.

With autonomy and no need for real-time collaboration, asynchronous work enables remote workforces to maximize their productivity and save time and resources. Not to mention, it gives employees some control over their working hours, eliminates the pressure of having to respond immediately, and gives them time to fine-tune their work.

Examples of Synchronous Work

Synchronous work refers to a work environment where individuals collaborate and complete tasks in real-time. Synchronous work typically spans the following:

- Brainstorming sessions

- Live presentations

- In-person or virtual meetings (like video calls on Zoom)

- Client negotiations

- Real-time chatting via instant messaging platforms (like Slack)

Examples of Asynchronous Work

Asynchronous remote work isn’t as cooperative, but you’ll find that some tools support both types. Asynchronous work examples include:

- Writing reports and proposals

- Completing individual tasks within a project

- Providing written feedback on documents

- Working on shared documents using collaborative tools (like Google Workspace)

Benefits of an Asynchronous Work Environment

Understanding the benefits of an asynchronous remote work environment can provide the motivation needed to make essential adjustments to your business operations. It also helps you identify when your efforts are yielding results.

Increased Flexibility

One of the known benefits of an asynchronous work environment is increased flexibility. Employees can complete tasks on their own schedules, regardless of location or time zone. Without the pressure of real-time collaboration, the team can focus on specific tasks without distractions or interruptions.

Accordingly, employees can achieve better work-life balance, exhibit better performance, tend to their personal responsibilities, and keep employee engagement high. For employers, it facilitates the hiring of individuals from diverse time zones, expanding the talent pool available.

Reduced Stress and Anxiety

Asynchronous work does away with the expectation that employees need to be available and responsive during fixed hours. Instead, they might be expected to respond within a reasonable timeframe (like 24 hours or 48 hours).

When employees understand that others might be offline at any time, it encourages the establishment of healthy boundaries between work and personal life. This allows remote employees to disconnect, reducing stress and anxiety. In short, asynchronous remote work promotes productive work habits and safeguards mental well-being by reducing the barrage of notifications and the risk of employee burnout.

Improved Focus and Productivity

Maintaining focus is difficult in our age of shrinking attention span, but achieving the flow state is even more elusive. This state is achieved when employees are most productive and fully immersed in their tasks, losing track of time and space. The question is, how are we able to preserve this flow?

Asynchronous work does so by eliminating constant interruptions, which means higher employee satisfaction and productivity levels. Employees can focus on their tasks without the need to respond to messages or requests while working, encouraging the flow state.

Additionally, asynchronous remote work increases productivity and focus by enabling employees to work during their most productive hours.

Greater Ownership and Accountability

Engaging in asynchronous work creates a sense of accountability in employees, motivating them to complete tasks on schedule and deliver successful outcomes.

This approach allows for seamless task handover to the next responsible individual. However, it is important to note the effectiveness of asynchronous remote work hinges on hiring individuals who are both independent and accountable.

Improved Diversity and Inclusion

Creating an asynchronous work environment removes borders on time zones and locations, expanding your access to a diverse talent pool, enhancing ethnic and racial diversity and fostering inclusivity within your company.

Moreover, asynchronous remote work supports inclusivity by accommodating working mothers, caregivers, and individuals with demanding personal responsibilities. Unlike synchronous work with its fixed hours, asynchronous work enables them to work flexibility around the clock.

Roadmap to an Asynchronous Work Environment

Now that we’ve established the benefits of an asynchronous work environment, these following steps can guide and foster an asynchronous remote work environment.

1. Assess your readiness

Consider whether your organization is ready for asynchronous work. Can you break up its business processes and assign smaller tasks to your employees individually? Are there tasks that must be done synchronously? Classify tasks accordingly.

Also, assess your employees’ readiness to work alone. Are they used to working individually or equipped for it? Which tools or resources would empower them to do so? Are they readily available?

2. Set clear expectations and guidelines

As you steer your company towards a new direction, effective communication and transparency will make this transition as smooth as possible. It is pivotal to communicate and familiarize your employees with the guidelines and expectations that will define this shift to an asynchronous remote work environment. Here are three steps to achieve this:

Define core working hours

Core working hours are the fixed times when you expect your employees to be online or onsite. These are the designated hours for synchronous work (like meetings), outside of which employees have the flexibility to work whenever they want. If you have an international team, make sure these hours are during your team’s hours of overlap.

For example, setting two key days or hours in the late mornings or midday, which serve as core periods (when there is overlap). This working arrangement gives your employees plenty of time before or after these core hours for asynchronous work and personal obligations. Similarly, you can schedule these hours to help avoid rush hours if employees work from the office.

Outline communication protocols

What does communication look like in your asynchronous work model? Decide on suitable asynchronous work tools to make communication smooth.

On top of that, set policies detailing how much time employees are granted to deliver results, implement feedback, and respond to messages or inquiries. Also, state how long employees and managers should wait before sending a follow-up message.

For instance, you can establish an asynchronous remote work protocol where employees should make edits to projects within 24 hours of receiving feedback. If they don’t confirm that they’ve received the feedback within 12 hours, managers may send a follow-up message.

Read next: Navigating the Digital Divide: Enhancing Remote Team Communication

Establish meeting policies

A study found that nearly one-third of meetings are deemed unnecessary, significantly affecting the organization’s financial performance. Reducing the duration of meetings is one of the main pillars of asynchronous remote work, enhancing productivity and team effectiveness. It is important to reassess the needs and purpose of recurring and upcoming meetings.

Outline valid reasons for setting up meetings and determine which teams must attend. For instance, you can set guidelines or certain conditions for managers from holding meetings for status updates, documenting processes, providing information, or discussing other meetings, and direct them to alternative communication methods. Additionally, essential meetings should be scheduled within the core working hours, mentioned above.

To illustrate, you can eliminate meetings for project updates and instead, utilize OKR management tools to monitor progress. However, if a conversation between employees involves extensive back-and-forth and is time consuming, it may be more efficient to address it in a meeting during core hours.

Another method is to set policies for optional meetings. Instruct team leaders to attach an agenda to each meeting invitation so that individuals are able to get context before the meeting and opt out if it doesn’t pertain to them. Similarly, individuals who cannot attend can contribute input or questions beforehand and catch up afterward. Lastly, establish policies regarding post-meeting documentation, meeting agendas, and assign responsibility for these tasks.

3. Foster asynchronous communication

Once you’ve established clear expectations and guidelines, it is important to empower employees to use asynchronous communication channels. Asynchronous work prioritizes documentation and transparency over repetitive real-time communication. Therefore, having a single source of accurate information is essential for employees to easily keep track of tasks and projects.

Encourage managers to utilize unified channels for sharing insights and project updates. Similarly, motivate employees to utilize them, creating transparent communication for all. Emphasize the importance of transferring key information from emails and other tools to the designated collaborative space. These steps enhance the level of asynchronous communication within your organization.

Omni Tip for asynchronous work:

It’s crucial for managers to follow the communication protocols you have established, thereby encouraging employees to do the same. This helps create a conducive asynchronous environment!Learn more: HR’s 2024 Guide to Singapore Maternity Leave

4. Build trust and team cohesion

Enabling employees to work according to their preferences in terms of how, when, and where they work requires a level of trust from you and your team leaders. It is essential to empower them to make decisions autonomously.

To establish a successful asynchronous remote work system, set accurate and effective key performance indicators (KPIs) so that managers can oversee projects while allowing employees the freedom to work independently. Over time, witnessing positive outcomes will build trust in the process and among team members, boosting employee morale.

Team cohesion refers to the ability of a team to collaborate effectively toward a common objective. Building a cohesive team requires members to have a close relationship and trust one another. Understanding the significance of team cohesion in asynchronous work is important, as it entails setting clear goals, defining individual tasks, promoting personal accountability, and ensuring successful project delivery.

5. Continuously adapt and improve

As you move towards fostering an asynchronous work environment, it is beneficial to utilize KPIs for tracking performance, analyzing time spent in synchronous meetings, and other relevant metrics.

Additionally, seek employee feedback via employee engagement surveys and other tools designed to protect their well-being. This approach allows you to assess what strategies are effective and which ones require improvement, while also providing valuable insights.

However, it also presents new challenges that could require adaptation. For example, you may designate eight to ten in the morning as core working hours, only to observe an increase in absenteeism or presenteeism, along with a decline in productivity and engagement thereafter. Through employee surveys, you may discover that ten to noon could be more suitable as core hours.

By experimenting with different approaches until you find the optimal solution, you can cultivate the asynchronous work culture you aspire to achieve.

Read next: Strategies and Tools for Defining Culture in the Workplace

Paving the Way to Success in an Asynchronous Work Environment

Embracing an asynchronous work environment can bring about numerous benefits to an organization, including increased productivity, flexibility and employee satisfaction. By encouraging employees to work at their own pace and schedules, organizations can tap into a diverse talent pool and accommodate different working styles and preferences.

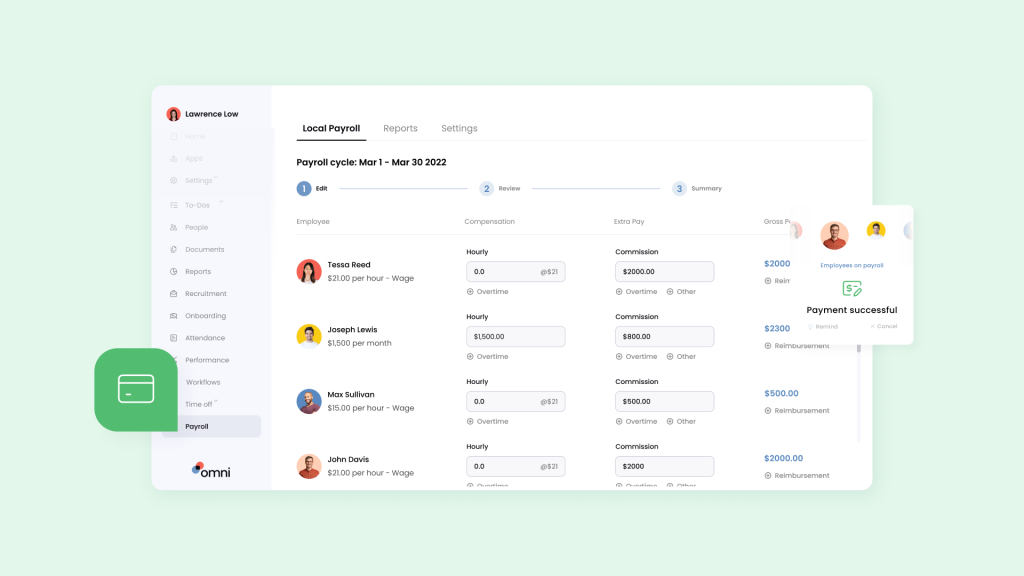

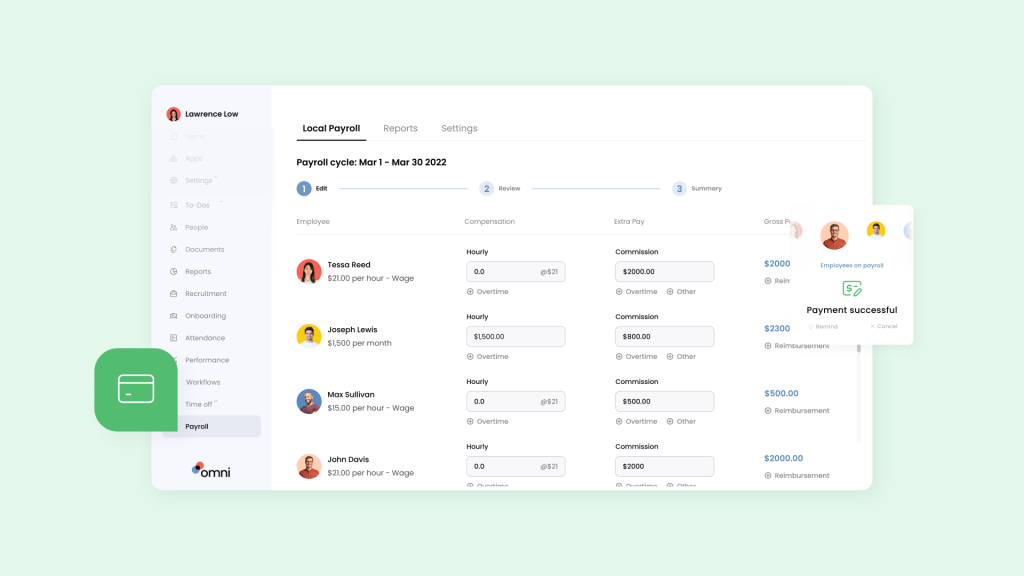

All-in-one HR software like Omni provides support for creating an asynchronous work environment through communication, collaboration and performance tracking tools. Omni helps you track, analyze and gain actionable insights from performance data through an automated and digitized platform. Easily and quickly gather the data you need so you can spend more time on the strategic planning necessary to drive business outcomes.

Our full suite of modules provide support for every aspect of your business through an intuitive and fully customizable platform that integrates with your team’s favorite tools for a seamless and timely adoption.

By leveraging Omni’s automated processes and embracing asynchronous work practices, organizations can build a more agile and resilient workforce, primed for success in today’s dynamic business environment.

To join the 83% of Omni customers who have unlocked new, actionable insights after using our modern HR software solution, book a demo with us today!