With remote technology allowing us to connect across vast distances and collaborate globally with ease, many organizations are reaping the benefits of a global workforce. Without the constraints of hiring locally and ability to tap into new markets, global operations may sound tempting. There’s just one hitch—managing global payroll.

International payroll can be tricky business as it involves many moving parts. Developing a system that can respond quickly to changes around the world will set your organization up for success on the world stage, without running into compliance mistakes or incurring other penalties.

Here, we’ll dive into obstacles to avoid, benefits you can expect, and all the ins and outs of global payroll processing.

What is global payroll?

It’s exciting to imagine your company’s expansion—new opportunities, global talent, and a diverse culture. But it also means dealing with a whole new level of complexity when it comes to paying your employees. Different countries have different laws, currencies, tax systems, and cultural expectations. That’s where global payroll processing comes in.

Global payroll is the overarching tool that manages your international workforce’s salaries and benefits. It’s more than just converting currencies or sending out paychecks, it’s about ensuring everyone gets paid accurately and on time, while complying with all the local regulations and requirements. That involves:

- Calculating salaries and benefits: This includes everything from base pay and bonuses to pensions and healthcare contributions.

- Tax withholding and reporting: Making sure the correct amount of taxes are deducted and reported to the relevant authorities in each country.

- Compliance with local laws: Navigating the ever-changing labor laws and regulations in different countries can be complicated. Global payroll helps you stay on top of it all.

- Managing different currencies and payment methods: Paying employees in their local currency and preferred payment method, whether it’s direct deposit, checks, or mobile payments.

- Dealing with cultural differences: Understanding the nuances of pay practices and expectations in different countries can help you avoid costly misunderstandings and build a positive employee experience.

What are the challenges of global payroll?

As you probably gleaned from the above, there’s a lot of moving parts to effectively managing a global payroll. Here are a few of the major hurdles you might encounter:

Tax laws and compliance

Every country has its own unique tax laws, which can be complex and constantly changing. Staying compliant can be a major headache, especially if you’re operating in multiple countries. Failure to comply with tax laws can lead to hefty fines and other penalties, so getting it right is crucial.

Currency fluctuations

Paying employees in different currencies means you’re constantly exposed to fluctuations in exchange rates. This can affect your overall payroll costs and make budgeting a challenge. Unexpected currency changes can lead to losses if not properly managed.

Language barriers and time zones

Communicating effectively with employees and payroll providers across different time zones and languages can be difficult. Misunderstandings can easily arise, leading to errors and delays. Ensuring payroll is processed accurately and on time across multiple locations can be a logistical challenge you’ll need to overcome.

Benefits Administration

Employee benefits vary widely across cultures and countries. Understanding and managing these expectations can be complex. Each country has its own laws regarding employee benefits, such as pension plans and healthcare. Ensuring compliance requires careful research and understanding of local regulations.

What are the benefits of an efficient global payroll processing?

Investing in an efficient global payroll system can bring a whole host of benefits that impact your entire organization, from your bottom line to your employees’ satisfaction. Here are a few of the benefits you can look forward to:

Increased accuracy and efficiency

Fewer manual errors: Automated international payroll systems reduce the risk of human error, ensuring accurate calculations and payments. This means fewer discrepancies, less time spent fixing mistakes, and happier employees.

Streamlined processes: By automating repetitive tasks, you can save time and resources. This frees up your HR and finance teams to focus on more strategic initiatives.

Real-time data and reporting: With centralized data and analytics, you can easily track payroll costs, identify trends, and make informed decisions.

Ensure compliance

Stay up-to-date with local laws: International payroll systems are designed to stay on top of ever-changing tax laws and regulations in different countries. This minimizes the risk of costly penalties and legal issues.

Reduce the burden on your team: Instead of trying to become experts on international labor laws, you can rely on your payroll provider to ensure compliance.

Focus on core business processes

Outsource the complexity: By partnering with a global payroll processing provider, you can offload the burden of managing complex payroll processes. This allows you to focus on your core business activities and strategic goals.

Increased agility: With payroll taken care of, you can be more responsive to changes in the market and seize new opportunities.

Improved employee satisfaction

Timely and accurate payments: Nothing frustrates employees more than late or incorrect paychecks. An efficient global payroll system ensures everyone gets paid on time and in full.

Transparent communication: Clear communication about pay and benefits helps build trust and transparency with your employees.

Improved employee experience: When employees feel valued and financially secure, they’re more likely to be engaged and productive.

In short, an efficient global payroll system is a win-win for both your company and your employees. It streamlines operations, reduces risk, and boosts employee morale, allowing your business to thrive in the global marketplace.

What are the ways of managing global payroll?

When it comes to managing your global payroll processing, there isn’t a one-size-fits-all solution. You have a few different options to consider, each with its own advantages and disadvantages. Here’s a quick look at the most common approaches:

Internal payroll department

How it works: You handle everything in-house, with a dedicated team managing payroll for all your global employees.

Advantages:

- Full control: You have complete control over the entire payroll process, which can be appealing if you have specific needs or preferences.

- Customization: You can tailor your payroll processes to your company’s unique requirements.

Disadvantages:

- High costs: Setting up and maintaining an in-house global payroll team can be expensive, especially if you have employees in many countries.

- Expertise required: You’ll need a team with in-depth knowledge of international labor laws, tax regulations, and payroll systems.

- Time-consuming: Managing international payroll can be a complex and time-consuming process, potentially distracting your team from other important tasks.

Payroll outsourcing

How it works: You partner with a third-party payroll provider who specializes in international payroll. They handle everything from calculations and payments to compliance and reporting.

Advantages:

- Cost-effective: Outsourcing can be more affordable than building an in-house team, especially for smaller companies.

- Expert support: Payroll providers have specialized knowledge and experience in global payroll, ensuring compliance and reducing risk.

- Scalability: It’s easy to scale your payroll services as your business grows.

Disadvantages:

- Less control: You’ll have less control over the payroll process compared to an in-house team.

- Dependence on provider: You’ll need to choose a reliable provider with a proven track record and good communication.

- Cultural differences: Working with external vendors might mean dealing with a different company culture, potentially causing friction.

Read next: The Ultimate Guide to Switching Payroll Providers

Employer of Record (EOR) services

How it works: An EOR acts as the legal employer of your employees in a foreign country. They handle all payroll, benefits, and compliance issues, while you maintain day-to-day control over your employee’s work.

Advantages:

- Simplified expansion: EORs make it easier and faster to hire employees in new countries without having to set up local entities.

- Risk mitigation: EORs take on the legal and financial responsibility of employment, minimizing your risks.

Disadvantages:

- Higher costs: EOR services can be more expensive than other options, especially for long-term employment.

- Less direct control: You’ll have less direct control over the employment relationship with the employee.

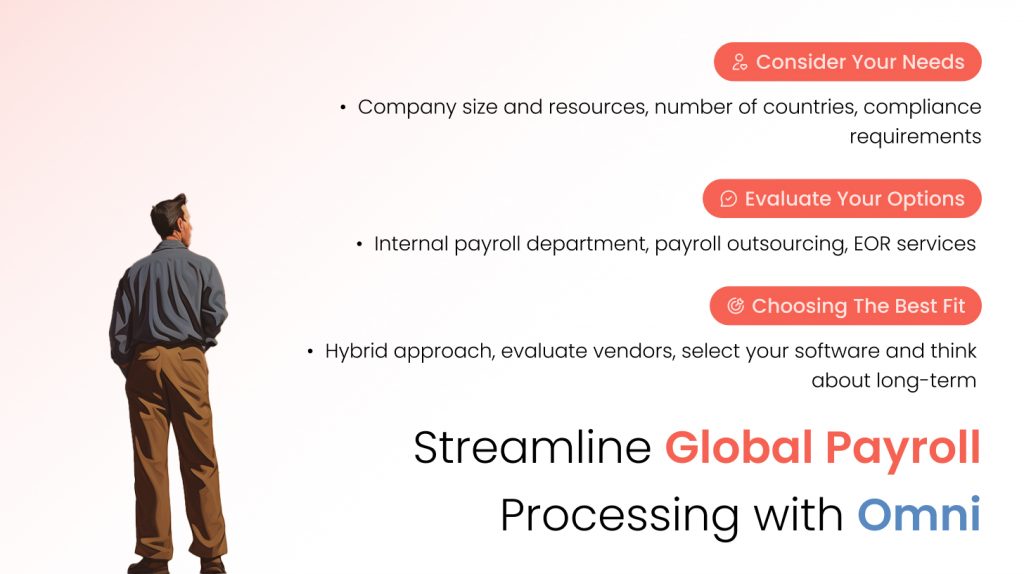

How to choose the right global payroll processing solution?

Selecting the right global payroll solution for your company is a big decision that can significantly impact your operations, compliance, and employee satisfaction. Here’s a roadmap to guide you through the process:

1. Consider your needs

Company size and resources: How many employees do you have? What’s your budget for payroll management? Are you a small startup or a large multinational corporation? Your size and resources will influence your choice of solution.

Number of countries: Are you operating in a few countries or many? The more countries you have employees in, the more complex your payroll needs will be.

Compliance requirements: Different countries have varying labor laws, tax regulations, and reporting requirements. Make sure your chosen solution can handle the complexities of each location.

2. Evaluate your options

Internal payroll department: As we discussed earlier, this involves managing everything in-house. It offers full control and customization, but it can be costly and time-consuming.

Payroll outsourcing: Partnering with an international global payroll provider gives you access to expertise and can be more cost-effective. However, you’ll have less control over the process.

Employer of Record (EOR) services: If you’re expanding into new countries quickly, an EOR can streamline the process and take on legal and financial responsibilities. But it’s typically the most expensive option.

3. Choosing the best fit

Hybrid approach: Many companies find a hybrid approach works best. They might outsource payroll for some countries while managing others in-house, or use an EOR for initial expansion and then transition to outsourcing.

Evaluate vendors: If you decide to outsource or use an EOR, research different vendors carefully. Look for experience, expertise in the countries you operate in, strong customer service, and a track record of success.

Select your software: If you’re managing payroll in-house, choose payroll software that meets your specific needs. Look for features like automation, integration with other systems, and multi-currency support.

Think long-term: Consider your future growth plans. Will your chosen solution be able to scale as your company expands into new markets?

Streamline Global Payroll Processing with Omni

Omni makes it easy to support employees across multiple countries, time zones, and currencies.

Affordable, functional, and suitable for modern growing businesses— Omni is the payroll provider that your business can rely on. With a comprehensive payroll solution tailored to various countries specific requirements with features like support for HKD, SGD, and MYR, automated tax calculations, and managed contributions, HR teams can simplify their payroll processes while ensuring adherence to regulatory standards.

Our centralized document management solution makes gathering the necessary data required to apply for employment passes, rental schemes, and other country-specific initiatives seamless and timely. With customized workflows and automated reminders, HR can help empower employees to manage the deadlines and documentation requirements for applications. And centralized documents and real-time data makes it easy for employees to access salary information and produce reports and documents necessary for verification.

Additionally, Omni’s customizable dashboard allows your teams to set and manage calendars pre-loaded with country or region specific holidays and timezones, seamlessly onboarding individuals in various locations.

Book a demo with our team to learn more about how Omni can support your international workforce.