Ensuring accurate and timely payroll is a cornerstone of any successful HR department. But what happens when an employee doesn’t work a full pay period? Understanding prorated salary meaning is essential for handling these scenarios effectively. This guide will break down everything you need to know about calculating and processing prorated salary.

What is a prorated salary?

A prorated salary, also known as pro rata salary, refers to a wage that is calculated based on the hours worked in relation to a full-time schedule. This can happen when someone starts or leaves mid-pay period, or takes unpaid leave. It is also a proportional payment system commonly used for part-time and contract jobs.

It is essential to have a clear understanding of the prorated salary meaning due to the following reasons:

Fairness and equity: Having a prorated salary structure ensures employees are paid fairly for time worked. Employees are paid in proportion to the time they invest in the work, ensuring they receive compensation that reflects their actual contribution to the role or project.

Encourages flexibility: By accommodating various arrangements, such as part-time work and temporary contracts, this gives more room for flexibility in the workplace. Offering a prorated salary provides a form of flexibility that can attract a diverse range of talent and meet the needs of both employees and employers, promoting work-life balance in the office.

Retains talent: For employees who may need temporary modifications to their work schedule or reduced hours due to personal circumstances, offering a prorated salary remains a useful tool in retaining these talents.

Read next: The Cost of Recruitment: HR’s Guide to Creating, Tracking and Implementing a Salary Budget

When will a salary be prorated?

There are several situations where an employer can use a pro rata salary, such aàs part-time work or when an employee doesn’t work a full year. In these cases, prorated salary meaning is calculated based on the amount of time worked compared to the amount of time a full-time employee would be expected to work. Further examples are shown below:

Starting new job in the middle of pay period

For new salaried employees who start working for a company in the middle of the pay period, the method of payment for the first paycheck would be a prorated salary.

Since they haven’t worked the entire pay period, their first paycheck will reflect the portion of the period they actually were employed. It’s essentially a partial payment until the next regular paycheck, which will cover a full pay period.

For example:

An employee starts a new job on 15 September. The company has a biweekly pay period (pays every two weeks). In this case, their first paycheck would be prorated for the second half of September (from 15 September to 31 September).

Leaving or terminated from a job in the middle of pay period

An employer is entitled to terminate the appointment of an employee in accordance with the terms of the relevant contract of employment. A periodic employee is one who receives a salary per calendar month. The common practice is that a periodic employee whose appointment is terminated in the course of a particular month receives a pro rata salary for the number of days they worked in the exit month.

Received a promotion or pay raise in the middle of pay period

In this case, an employee’s paycheck will likely reflect two different pay rates. The beginning portion will be based on their original salary, and the remaining part will reflect their new higher salary. This ensures a smooth transition in an employee’s pay, reflecting the raise.

For example, a team member gets promoted on 1 September, with a raise included. Their September paycheck would likely show two separate earnings amounts:

The first half would reflect their original salary for the days worked before the promotion (1 August to 31 August).

The second half would show their new, higher salary for the days worked after the promotion (from 1 September to 15 September, assuming a biweekly pay period).

Relevant reads: Understanding and Administering Salary Adjustments

Working part-time with a fixed salary

Working part-time requires an employee to work fewer hours than a full-time schedule. Since a full-time salary represents a set amount for a full workload, a part-time employee logically earns a proportional amount based on their reduced hours.

Shortened workweeks due to holidays

If there are holidays that fall within a pay period and cause a reduction in an employee’s scheduled work hours, they might receive a prorated salary to reflect the fewer hours worked due to the holiday.

However, this depends on your company’s policy for holiday pay. Some employers might provide paid holidays where your pay wouldn’t be affected.

Taking unpaid leave

Unpaid leave refers to time off where an employee does not accrue regular pay. Since the individual is not working during this period, they would receive a prorated salary from their employer which would account for the days they were on leave and didn’t work.

Calculating Prorated Salary

While determining the prorated salary meaning can be complex in certain situations, here’s a simplified step-by-step process employers and HR managers can use for calculating prorated salary meaning:

1. Divide annual salary by number of weeks in a year

In order to calculate prorated salary, you’ll need to determine the exact number of days the employee worked and multiply the findings by the daily pay rate.

Prorated salary = (number of days worked) × (daily pay rate)

However, you cannot jump right in by making the above calculations. To get the daily pay rate, you’d have to follow a number of steps.

This first step involves converting the annual salary into a weekly amount. Annual salary refers to the total amount of income earned in a year. You need to calculate the total pay of the employee for the entire pay period (the whole year) without making any adjustments.

The next thing is to divide the employee’s yearly salary by the number of weeks in a year (typically 52 weeks). This gives you their weekly equivalent pay.

2. Divide weekly salary by the number of days employee normally works in a week

Next, you need to determine the employee’s daily pay rate. To do this, you’ll have to divide the weekly salary obtained in step 1 by the number of days the employee usually works in a week.

3. Multiply employee’s daily rate by the number of days employee worked in the pay period

This is where you get the prorated salary meaning amount. Multiply the daily rate (just calculated above) by the number of days the employee actually worked in the pay period.

Hence, we’ve arrived at our formula from the beginning:

Prorated salary = (number of days worked) × (daily rate)

Although there are some additional factors to consider, the steps outlined above are not a one-size-fits-all approach to calculating prorated salary meaning, due to varying circumstances.

For example, the steps above indicate that you’re prorating for a specific pay period, such as a biweekly paycheck. The timeframe may vary and adjustments may be necessary if prorating for a different period.

Also, if the employee took an unpaid leave during the pay period, you’ll need to factor that into the number of days or hours worked when understanding the prorated salary meaning.

Let’s look at further examples of how an employee’s pro rata salary can be calculated considering each factor listed above.

Example 1: New Employee – Biweekly Pay

Sarah is a new employee who starts on a Wednesday in the middle of a pay period. Sarah’s annual salary is $60,000, and your company uses a biweekly (every two weeks) pay schedule. Employees typically work 5 days a week (40 hours).

Step 1: Annual Salary to Weekly Salary

Weekly Salary = $60,000 / 52 weeks/year = $1,153.85

Step 2: Weekly Salary to Daily Rate

Daily Rate = $1,153.85 / 5 days/week = $230.77

Step 3: Daily Rate to Prorated Pay (since she starts mid-pay period)

Sarah worked three days (Thursday, Friday, and Tuesday of next week) in this biweekly pay period.

Sarah’s pro rata salary for her first biweekly pay period would be:

Prorated Salary = $230.77/day × 3 days = $692.31

Example 2: Employee Taking Unpaid Leave – Monthly Pay

Jeremy is a salaried employee who makes $72,000 annually and is paid monthly. Jeremy usually works 20 days a month, but he will be taking 3 unpaid vacation days during the upcoming pay period.

Step 1: Annual Salary to Monthly Salary

Monthly Salary = $72,000 / 12 months/year = $6,000

Step 2: Monthly Salary to Daily Rate

Daily Rate = $6,000 / 20 days/month = $300

Step 3: Daily Rate to Prorated Pay (considering unpaid leave)

Jeremy will be working 17 days (20 total – 3 vacation days) during this pay period.

Jeremy’s pro rata salary for this period will be:

Prorated Salary = $300/day × 17 days = $5,100

Additional reading and tool: Payroll Template and Guide for HR Teams

Will statutory deductions be prorated?

Statutory deductions are mandatory contributions withheld from an employee’s salary by law. These typically include income tax, social security, and other government programs.

The deduction is prorated when an employee’s pro rata salary covers a portion of a pay period, such as starting a new job mid-month or leaving one mid-month. The general rule is that deductions will be calculated based on the proportion of the pay period during which they worked.

Here’s a complete breakdown of the process:

- Gross Salary: The individual’s total pay before deductions.

- Pay Period: The timeframe their salary covers (e.g., biweekly, monthly).

- Days Worked: The number of days an employee worked within the pay period.

How to prorate statutory deductions?

There’s no one-size-fits-all method, but here are some common approaches:

Daily basis: Divide the monthly statutory deduction amount by the number of working days in the month and multiply by the number of days the employee worked.

Percentage basis: Calculate the percentage of the month in which the employee worked and apply that percentage to their monthly statutory deduction.

However, the specifics of statutory deductions and proration will vary depending on the country, employer, and type of deduction. For example, in Singapore prorated salaries are subject to income tax and Central Provident Fund (CPF) contributions. Employees who receive prorated salaries must declare their income accurately and file their tax returns on time with the Inland Revenue Authority of Singapore (IRAS). Therefore, It’s important to consult your local employment laws and regulations for any specific requirements regarding prorated salaries.

Read next: Payroll Singapore Reference Guide: Everything You Need to Know

Easily Navigate Prorated Salary with Omni Payroll

Book a demo with our team today!

Prorated salary ensures fairness and transparency, boosting employee motivation and employee satisfaction, leading to higher productivity and reduced attrition rates. Given its benefits, implementing a pro rata salary structure is crucial for modern growing businesses. Thankfully, managing it doesn’t have to be complicated, thanks to HR tools.

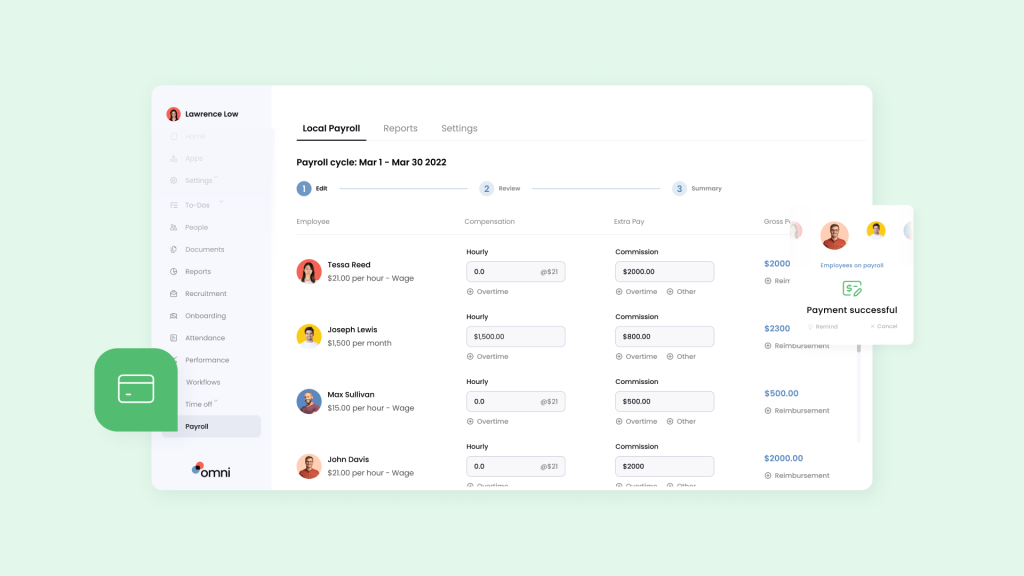

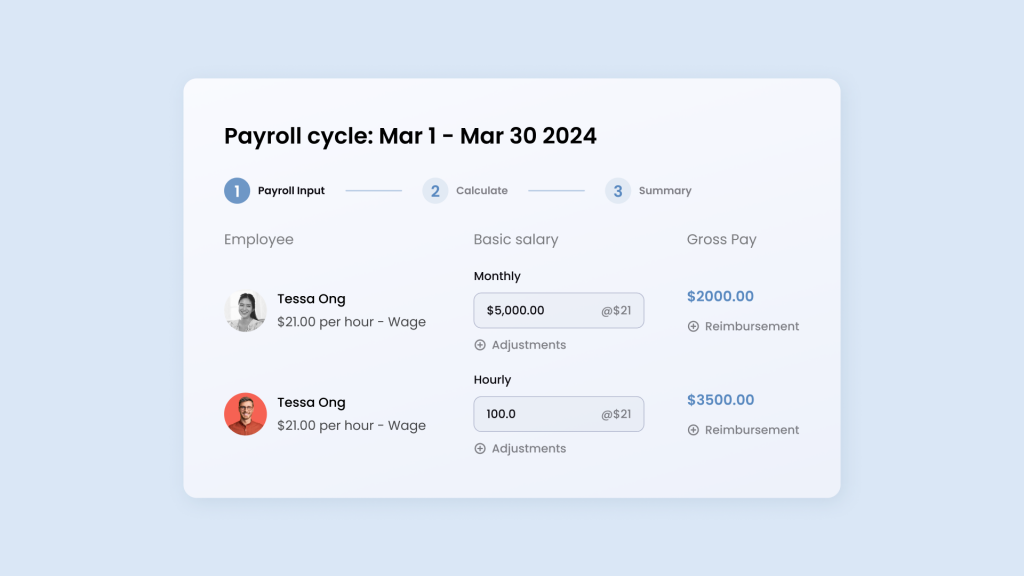

All-in-one HR softwares like Omni can help you and your company efficiently tackle the pro rata salary process. By streamlining processes and gathering valuable insights through data analytics, our software can provide an ideal framework for businesses invested in creating a fair and transparent workplace culture.

Omni makes it easier than ever to calculate accurate employee prorated salary payments and tax calculations through automation that saves time and reduces errors. And with automated payroll information synchronization, end of month processing becomes a streamlined and seamless effort.

Our expert support and assistance is tailored to your businesses unique requirements and local regulations. Chat with the Omni team to learn more about how our HRIS solution can help you supercharge your business operations as you grow.