Finally, your company has begun to scale with its workforce increasing. However, it’s not long before you notice that your company’s growth comes with an increase in HR workload. How do you maintain consistency in hiring or keep up with accurate performance evaluations? This is where HR workflows come into play.

This post will explore how you can create effective HR workflows and transform how you manage HR tasks. Let’s begin by understanding HR workflows.

What is an HR workflow?

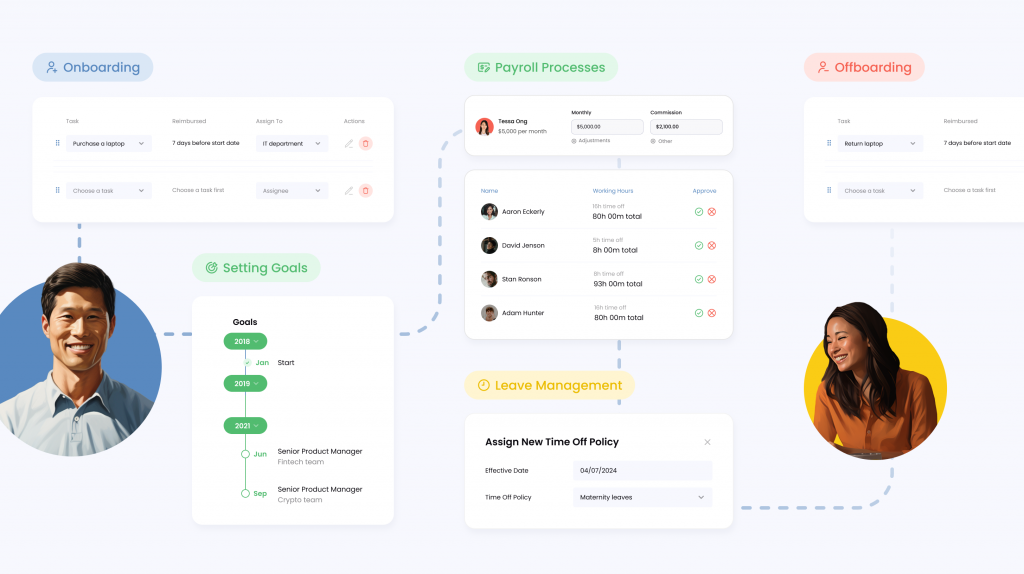

An HR workflow is a set of organized tasks or processes that automate your HR functions, ensuring they are efficient and error-free. They include automating tasks like employee onboarding, payroll processes, and other HR-related activities. To better grasp the meaning of workflows, let us consider the examples of HR workflows.

What are the examples of HR workflows?

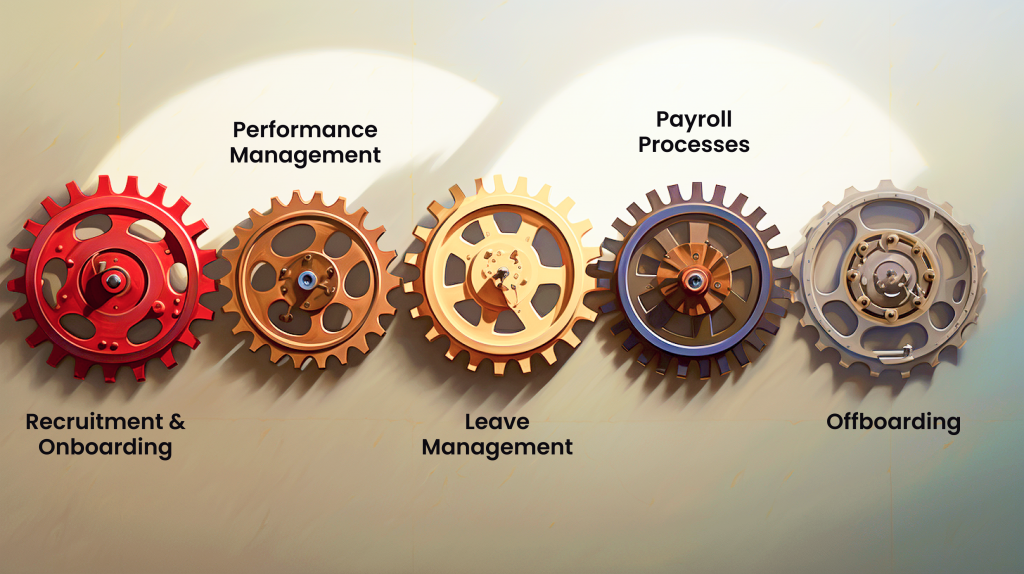

1. Recruitment and onboarding

A recruitment and onboarding workflow involves creating an ordered process to ensure the hiring and welcoming of new hires to your company is hassle-free. A recruitment and onboarding workflow includes the application process, collection of new hire’s paperwork, and onboarding tasks.

For instance, recruitment and onboarding workflows would involve setting up an applicant tracking system (ATS) that collects and organizes potential employees’ applications. Then, after your HR team reviews the submissions and selects a candidate, the workflow automatically transitions the candidate to the onboarding process, which includes completing all necessary paperwork and training sessions.

Read next: 10 Companies That Have the Best Employee Onboarding Experience (and You Can Too)

2. Performance management

Performance management workflows are organized processes you design to ensure your employees meet their goals. A performance workflow would contain key components including setting goals, conducting performance reviews, and providing feedback.

A performance management workflow would include setting measurable goals that align with your company’s objectives. Then, integrate systems that can automate the scheduling of employee performance reviews and ensure they receive prompt feedback.

3. Leave management

This type of HR workflow involves organizing a set of processes to handle the leave requests of your employees. An effective employee leave management HR workflow can submit and approve leave requests and update payroll systems.

For example, a leave management workflow would include setting up a time and attendance system that makes it easy for employees to submit their leave requests. Then, after you approve their requests, the workflow automatically updates the payroll system to reflect their leave.

4. Payroll processes

A payroll workflow is a sequence of organized tasks you create to ensure your employees are paid accurately and on time. This HR workflow makes it easy to calculate salaries, deduct taxes, generate payslips, and initiate payments.

The workflow would involve having software that calculates each employee’s gross salary. After that, it automatically deducts contributions such as taxes and health insurance premiums. Then, the payroll workflow ensures the software generates payslips that outline employees’ deductions and final take-home pay and then initiates direct deposits.

5. Offboarding

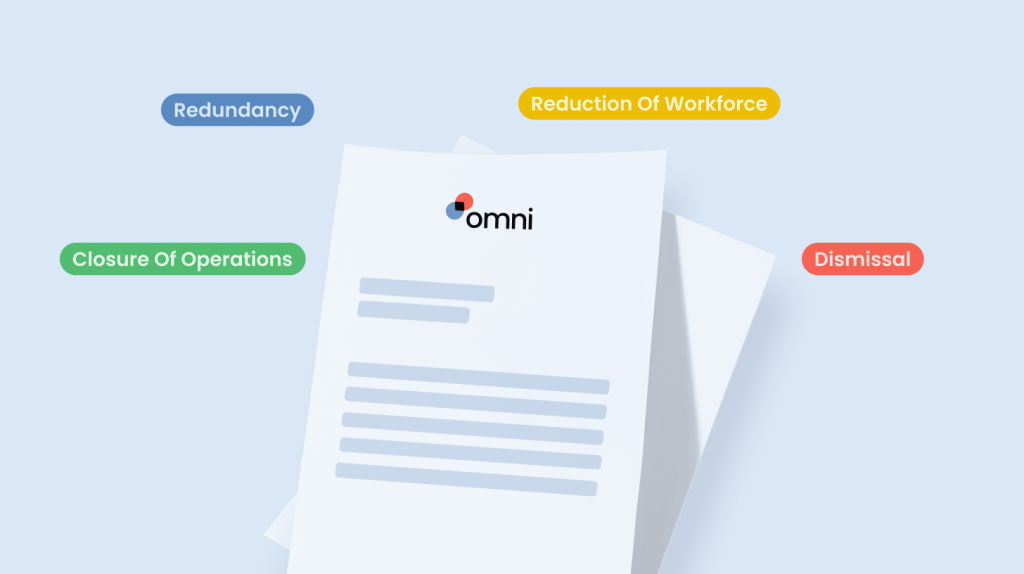

An offboarding process workflow involves creating an ordered process that smoothly and professionally manages the departure of employees from your company.

An offboarding workflow would include having a Human Resource Information System (HRIS) that automates the scheduling of exit interviews to gather feedback from employees leaving the company. Then, the workflow notifies your IT team to revoke the employee’s access to the company’s data and communicates with the payroll team to process any outstanding payments.

With an understanding of the examples of HR workflows and how you can easily create one for your business, let us explore why you must have these workflows in place.

Why is it important to have an effective HR workflow?

Having effective HR workflows aids you as an HR manager in reducing your workload and automating manual and repetitive tasks. Workflows give you more time to concentrate on aspects of human resources that matter. Further, here are some reasons it’s important for your organization:

Improve efficiency and accuracy

HR workflows include the use of structured systems and automation, reducing the risk of errors from reliance on manual or paper-based processes. Using workflows saves you time and improves efficiency.

Ensure compliance

HR workflows aid you in complying with legal requirements like the Labor Code regulations. Workflows ensure you correctly record the documentation of your HR processes, preventing compliance violations and potential legal issues.

Streamline communication

Workflows make communication within the HR department and the entire organization easy. It also streamlines communication and ensure your employees have a satisfied experience from onboarding to offboarding.

Reduce costs

Workflows improve employee engagement and reduce the high costs of recruitment and training new staff. Additionally, it automates repetitive tasks like data entry and applicant tracking that would otherwise be handled by humans, thereby cutting costs.

Remember, having effective HR workflows make it easier for you to handle HR processes by automating tasks. This reduces the risk of errors and keeps your HR process effective.

What are the steps to create an effective HR workflow?

When creating your HR workflow, it’s a continuous process of looking out for areas of improvement and optimizing your process. Here are five steps to developing effective workflows:

1. Identify processes for improvement

The first step when creating your HR workflow is to evaluate your current processes and identify bottlenecks that need improvement. Some effective methods for assessing your current HR processes include;

- Surveys and feedback: Use employee satisfaction surveys to get feedback from employees and managers helps you spot areas of your current process that may be slow or confusing.

- Process mapping: Creating visual diagrams (flowcharts) of your current HR workflows helps you understand each step of the process and identify where errors occur.

- Data analysis: Observing patterns in delays and errors from your existing workflows helps you analyze your HR metrics and performance data. This data provides evidence of where your current HR workflows need improvement.

2. Define the workflow scope

The next step when building out your HR workflow is defining the scope of the workflow. Here’s how to define your workflow scope:

- Clearly outline what your new workflow aims to achieve to guide its design and implementation.

- Specify the essential tasks and milestones within the workflow. This helps you keep it comprehensive and focused.

- Engage relevant stakeholders like HR team members and employees from the beginning of the planning process.

By defining your workflow scope, you create a clear roadmap for developing and implementing the new HR process.

3. Develop clear guidelines

The third step when creating your workflow is to develop easy-to-follow guidelines that outline each step of the workflow.

Clear guidelines ensure stakeholders are aware of their responsibilities within the workflow and that they correctly execute them.

To develop clear guidelines, you must:

- Ensure your documentation describes each step of the workflow and is in simple language so it’s easily understandable for all users.

- Clearly define the roles and responsibilities of each stakeholder involved in the workflow. This ensures there is accountability and no misunderstandings.

- Include visual aids such as diagrams and flowcharts to assist your users in understanding complex processes and grasping the workflow quickly.

- Develop standard operating procedures (SOPs) to ensure users correctly perform each task within the workflows.

4. Leverage technology and automation

The next step when creating an effective HR workflow is utilizing HR automation tools like employee self-service portals and application tracking systems. Leveraging technology assists you in automating manual and repetitive tasks.

Some technologies you can leverage when building your workflows include:

- Performance management tools

- Payroll softwares

- Applicant tracking systems

5. Implement and test the workflows

The final step is implementing and testing your workflows, ensuring it meets the intended goals.

Here’s how to effectively implement and test your workflows:

- Pilot phase:

First, launch your new HR workflow on a small scale within a specific group of employees. Launching at a small scale makes it easier for you to monitor the process closely and identify any issues before the full-scale implementation.

- Collect feedback:

During the pilot phase, ensure you collect feedback about the experience and challenges of users interacting with the new workflow. At this stage, pay attention to quantitative data such as time-saved and qualitative feedback like ease of use.

- Incorporate feedback:

Using the feedback you’ve gathered, refine and optimize your workflows. Incorporating user feedback ensures you address practical concerns and issues, making the adoption of your workflow easier.

- Full implementation:

After making necessary adjustments by incorporating user feedback, implement your new HR workflows across the organization. Remember to provide training sessions to ensure all stakeholders understand their roles and responsibilities within the workflow.

- Continuous evaluation:

The implementation of your workflow should not be a one-time event. After implementation, ensure you continuously monitor the performance of your workflow using KPIs such as user satisfaction, processing time, and error rate.

Leverage Effective HR Workflow with Omni

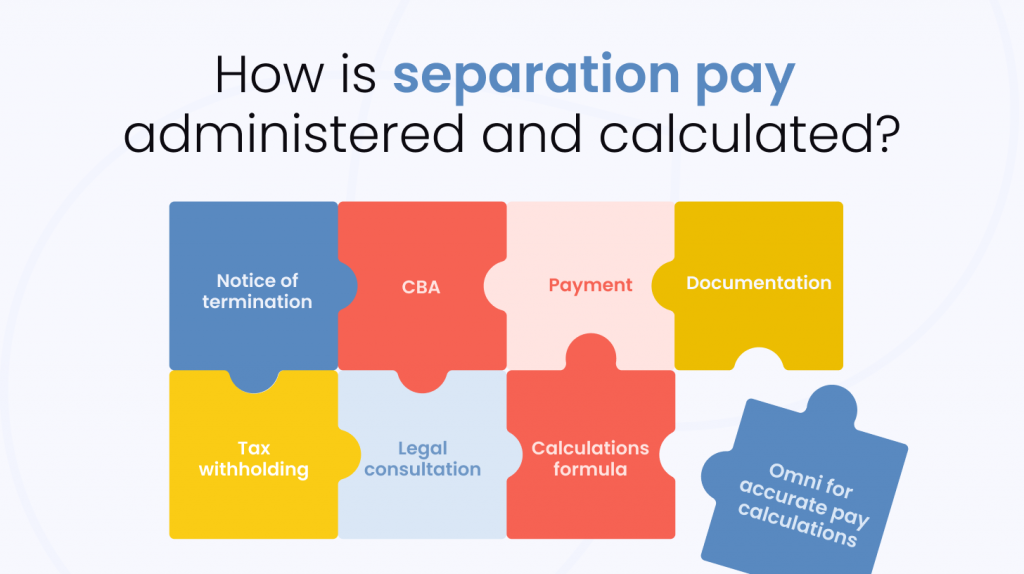

HR automation helps save significant time and reduce costs associated with the various manual tasks performed every day by HR and leadership. Studies have shown HR automation can decrease administrative costs by 30% for HR professionals and 49% for employers.

Routine HR workflows, such as data entry, employee onboarding, leave management, and payroll processing, are streamlined and automated, freeing up HR teams to focus on more strategic and value-added activities that drive productivity and profitability for your organization.

What’s more, HR automation tools like Omni provide clear and timely insights into your organization’s spending, helping you build and audit your HR budget backed by real data.

Learn how Omni users like Influur saved time and reduced costs by leveraging HR automation tools.

If you’re ready to make that jump and take charge of your HR workflows,