The Malaysia Payroll Process

The Malaysia payroll process is intricate, combining legal regulations, cultural considerations, and economic dynamics. At its heart is balancing factors like minimum wages, working conditions, and employee leave, all governed by a framework set by Malaysia’s Employment Act. Here’s what you need to know to navigate the ins and outs of Malaysia’s payroll process:

Minimum wages and working conditions

Malaysia’s minimum wage has gone through significant development throughout the years. Previously, the minimum wage varied depending on the location of the employer, with different rates for Peninsular Malaysia, Sabah, Sarawak, and the Federal Territory of Labuan. However, as of 1 May 2022, the minimum wage throughout Malaysia has now been aligned from RM1,200 to RM1,500 per month.

Working conditions are governed by Malaysia’s Employment Act, and range from considerations like rest days, to working hours and public holidays. In Malaysia, there are special provisions for women in the industrial or agricultural sector where they are not permitted to work between the hours of 10PM to 5AM.

An amendment to the Employment Act that occurred in 2022 entitles employees to apply for a flexible working arrangement to vary the hours, days, or place of work. The employer has 60 days to approve or refuse the request, and if refused, reasonable grounds for refusal must be provided.

Learn More: Understanding Malaysia’s Employment Act: Updates & FAQs in 2023

Working hours

General: The standard working hours are 48 hours per week, spread over five (or in some cases, six) working days. The typical workday in Malaysia is eight hours.

Overtime: If an employee works beyond the standard hours, they’re entitled to overtime pay. For most of the Malaysia payroll system, overtime rates are 1.5 times the normal hourly rate for work on normal working days and the first eight hours on a rest day or public holiday. For work beyond the eighth hour on a rest day or public holiday, the rate is usually double.

Working Week: In Malaysia, the workweek commonly runs from Monday to Friday. However, some industries or positions might require work on Saturdays. These include industries like retail, hospitality, and other service-based roles.

Employee Leave

Public holidays: Malaysia observes a range of public holidays, including both national and state-specific. The total number of public holidays varies by state. Employees are typically entitled to a day off with full pay on these holidays.

Sick leave: The Employment Act allows for a minimum of 14 days of sick leave with full pay in a calendar year, assuming the employee has been employed for at least four months.

Parental leave

- Maternity: Employed mothers are entitled to a maternity leave of 14 weeks.

- Paternity: Employed fathers are generally entitled to one week of paternity leave.

Payroll frequency

In the Malaysia payroll system, the most common pay structure is monthly (employees receive their salary payment at the end of each month). That said, variations can occur depending on the specific industry.

For instance, certain industries or specific companies might adopt a bi-weekly or even weekly payroll cycle, especially in sectors where contractual or temporary employment is common. These variations are usually outlined clearly in employment contracts or company policies to manage employee expectations.

13th-month salary

The 13th-month salary is a unique aspect of the Malaysia payroll landscape. It represents an additional month’s salary, usually paid out at the end of the calendar year.

It is a customary practice in Malaysia payroll and serves as a form of recognition for employees’ contributions throughout the year. While not mandatory, it has become a standard practice for many organizations, and contributes to the festive spirit of the holiday season, helping motivate employees and boost engagement. The amount may vary based on company policies, industry standards, or individual employment contracts.

Probation period

During the probation period in Malaysia (which typically lasts three to six months) employers take time to see if a new hire is a right fit for their role. The terms and conditions of employment during the probation period are outlined in the employment contract, covering aspects such as notice periods, performance expectations, and potential benefits.

Employees on probation often receive a prorated salary, and the employer has the flexibility to terminate the employment with less red tape than under standard employment.

Social Security and Statutory Contributions

Employer contributions

In the Malaysia payroll system, employers need to make contributions to the Employees’ Provident Fund (EPF) for their employees. The EPF manages employees’ retirement savings and employers are required to contribute a certain percentage of their employees’ monthly salary to the EPF.

Employee contributions

Employees in Malaysia are also obligated to contribute a portion of their monthly salary to the EPF. The employee’s share is deducted from their salary and alongside the employer’s contribution, it is deposited into the employee’s EPF account. The combined contributions form a substantial part of an employee’s retirement savings.

Employees’ provident fund (EPF)

As noted above, the EPF is a key part of the social security framework in the Malaysia payroll system. The funds accumulated in an employee’s EPF account serve as a financial cushion during retirement. Employees can also use their EPF savings for housing, education, and medical purposes. The EPF is managed by the Employees’ Provident Fund Organization, and its policies and contribution rates are updated occasionally by the government to keep up with economic conditions and retirement needs.

Social Security Organization (SOCSO)

In addition to the Employees’ Provident Fund (EPF), the Malaysia payroll system has a comprehensive social security system managed by the Social Security Organization (SOCSO). SOCSO plays an important role in providing protection to employees in the unfortunate event of work-related injuries, illnesses, or disability. This social safety net has two main components:

- Employment Injury Insurance Scheme (EIIS):

- The EIIS is designed to provide coverage for employees who experience injuries or illnesses associated with their work. This includes accidents that occur during working hours or diseases contracted due to workplace conditions.

- The scheme is applicable to all Malaysian citizens, permanent residents, and foreign workers, with the exception of domestic servants.

- In the event of a work-related injury or illness, employees can seek compensation and financial support through the EIIS.

- Invalidity Pension Schemes (IPS):

- The IPS provides financial assistance to employees who become permanently disabled or die due to causes unrelated to their work. This coverage extends beyond work-related scenarios, offering protection for a wide range of life circumstances.

- In the case of permanent disability or death, the scheme provides financial support to the affected employee or their beneficiaries.

Employment Insurance Scheme (EIS)

The Employment Insurance Scheme (EIS) is another key component of the Malaysia payroll system’s social security framework. It focuses on providing financial assistance to employees who have lost their jobs involuntarily. Key features of the EIS include:

Unemployment Benefits: Employees who lose their jobs are eligible to receive financial assistance for a specified period. This support aims to help individuals during the time spent between jobs.

Job Search Allowance: The EIS also offers a job search allowance to assist unemployed people in covering expenses related to finding new employment.

Training Opportunities: The EIS provides opportunities for training to people facing unemployment, to help them develop employable skills and learn new technologies like AI.

Learn More: How to Apply, Claim, and Select Training Programs for HRDF Malaysia

Both SOCSO and the EIS are major parts of a broad safety net for employees, ensuring that they have financial support during challenging times. Employers are responsible for making contributions to these schemes on behalf of their employees, highlighting a shared commitment to employee well-being and social security.

Work Permits

The Malaysia payroll system has established several types of work permits to regulate the occupation of foreign professionals. Here’s what you need to know about the main categories of work permits:

Professional Visit Pass

The professional visit pass is for foreign nationals working in short-term professional activities or assignments in Malaysia. This pass is granted for short durations, often for specific projects or business meetings. It is relevant for employees involved in professional services, including consultancy, auditing, and attending conferences.

Temporary Employment Pass

This pass is geared towards foreign workers taking up temporary employment in Malaysia. It is issued for a set duration, with a possibility of renewal. The Temporary Employment Pass is for employees working in sectors with a temporary labor demand, such as construction and agriculture.

Employment Pass

The Employment Pass is targeted at skilled foreign professionals taking up long-term employment in Malaysia. It is issued for a longer duration (often over a year), and is usually tied to an employment contract. This pass requires employees to meet specific criteria related to qualifications, work experience, and job scope.

Work permits by region

Peninsular Malaysia: This region is the hub of economic activities and business centres in Malaysia, making it a focal point for work opportunities. The region is divided into three distinct zones: the Northern Zone, the Central Zone, and the Southern Zone.

Each zone has its own unique Malaysia payroll characteristics, and different regions within each zone might have specific considerations for work permits based on local demands and regulations. For example, the Northern Zone is known for its agricultural activities (which are usually associated with Temporary Employment Passes), while the Central Zone is home to the capital city of Kuala Lumpur, which is the centre of the country’s financial and commercial activities, and would more commonly have foreign workers seeking an Employment Pass.

East Malaysia (Sabah and Sarawak): These regions, known for their unique cultural and economic characteristics, may have distinct requirements for work permits. Sabah is known for its ecotourism industry, while Sarawak is home to the largest cave chamber in the world and is a major producer of timber, industries where Temporary Work Passes would be more common. Both employers and employees need to be aware of regional differences to make sure they are compliant with the Malaysia payroll law when applying for work permits.

Documentation Requirements:

Securing a work permit in Malaysia comes with its complexities, and requires careful documentation. Both employers and employees must adhere to requirements that are designed to facilitate a smooth application process. Here are the documents you need to be aware of:

- Passport and Visa: A valid passport and visa are the basic requirements for any work permit application.

- Employment Contract: A detailed employment contract specifying terms and conditions of employment.

- Educational and Professional Certificates: Proof of educational qualifications and professional certifications relevant to the job.

- Letter of Offer: A formal letter from the employer offering the job to the foreign national.

- Health Examination: In some cases, a health examination report might be required to make sure the applicant is healthy and fit for work (mainly for jobs with demanding physical labor like construction).

It is important to verify the specific documentation needed for the nature of employment. Working closely with immigration authorities or legal professionals is a good way to help streamline the application process and avoid obstacles.

Tax

Understanding the tax landscape in the Malaysia payroll system is necessary for both employers and employees to have a clear view of total compensation, and maintaining compliance. Here’s a breakdown of the key aspects related to employer and employee taxes:

Employer Tax

Employers in Malaysia are responsible for deducting income tax from their employees’ salaries through the Monthly Tax Deduction (MTD) system. The deducted amount is then transferred to the Inland Revenue Board (IRB).

Employee Tax

For Residents: The Malaysia payroll system employs a progressive tax system for residents, where tax rates increase with higher income brackets. This ensures that those with higher earnings contribute more to the tax revenue based on their means.

For Expatriates: Higher-income expats might benefit from a flat tax rate on their employment income, which is applicable for a specific duration, typically up to five years. This acts as an incentive for skilled professionals to work in Malaysia.

Tax Return Form

Both residents and expatriates are required to file their income tax returns annually. The Malaysian government encourages using the e-Filing system, which is a convenient and efficient way to submit tax returns online. This system makes the tax process easier and more efficient, reducing paperwork, and ensuring accurate reporting.

Severance Pay

In the Malaysia payroll system, severance pay (also known as termination or retrenchment benefits) is another major part of the employment safety net. It serves as financial protection for employees facing involuntary job loss, and protects their well-being after finding themselves unexpectedly unemployed.

Severance pay in the Malaysia payroll system is not mandated for voluntary resignations. But for involuntary terminations, the Employment Act 1955 and the Industrial Relations Act 1967 govern the compensation process. For most employees who lost their jobs, employers are required to offer termination benefits.

Calculating severance pay depends on factors such as length of service, nature of termination, and terms outlined in an employment contract. Most often, employees with longer service are entitled to more substantial severance packages than employees who worked for shorter stints.

Streamline Your Payroll Services with Omni

Navigating the ever-evolving regulations of Malaysia payroll can be challenging, and staying up to date with the latest mandates is crucial for HR teams to remain compliant.

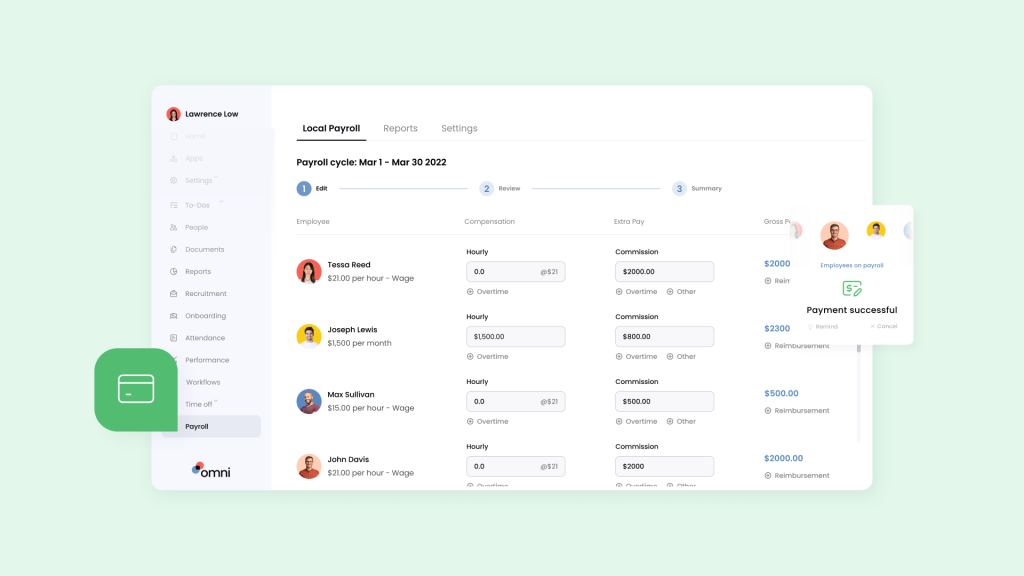

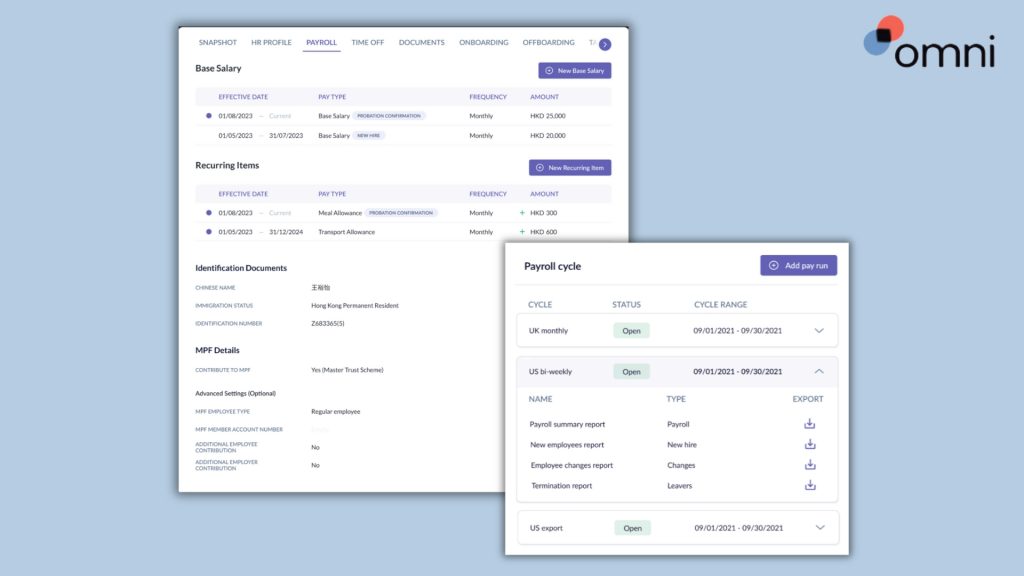

Omni helps HR teams stay up to date with the latest laws and regulations while streamlining the end-to-end employee management lifecycle. Our comprehensive payroll solution is tailored to Malaysia’s specific requirements. With features like support for MYR, automated tax calculations, and instant payroll reports, Omni can help HR teams simplify their payroll processing while ensuring compliance.

Omni handles more than just payroll, with our dynamic time off management feature, managers and HR teams can swiftly navigate employee leave management. Our employee self-service portal allows employees to submit their time off requests directly to HR without any intervention and with automated calculations and real-time leave balance tracking, HR teams can effortlessly calculate paid time off and hours worked for payroll purposes.

For organizations with global teams, Omni’s comprehensive employee database facilitates easy tracking of immigration details, visa status, and ensures compliance with local minimum wage requirements. Our automated localized calendars further guarantee that you honor local holidays, no matter where your teams are based.

Start your free trial today and see how Omni can simplify the intricacies and complexities of Malaysia payroll processes and minimize the costs associated with common errors.