Having a comprehensive understanding of your workforce is absolutely essential as an HR professional. As part of this, calculating a Full Time Equivalent (FTE) count is essential. It paints the full picture of working hours and labor at your organization and breaks it down to a simple number.

While the outcome is simple and easy to understand and use, the steps you need to take to actually calculate your Full Time Equivalent can be a bit complicated. Here, we break down the steps to do so with detailed examples, and a thorough understanding of the benefits of FTEs.

What is a Full Time Equivalent?

When used in HR, a Full Time Equivalent refers to the total number of working hours contributed by an employee or a group of employees on a full-time basis. Essentially, FTE represents the total workload (or the equivalent) of one full-time employee.

FTE is an incredibly useful metric for organizations looking to assess and quantify the total labor resources available within their workforce. It provides a standardized measurement that companies can use to compare the productivity and capacity of their different departments, teams, or projects.

As the name implies, calculating Full Time Equivalent involves converting the working hours of part-time or temporary employees into the equivalent of a full-time position. This calculation is necessary for accurate HR budgeting, resource allocation, and workforce planning purposes. By understanding the FTE count, organizations like yours can make informed decisions about staffing levels, hiring needs, and project allocations to meet all the goals your business has set out.

How is Full Time Equivalent Calculated?

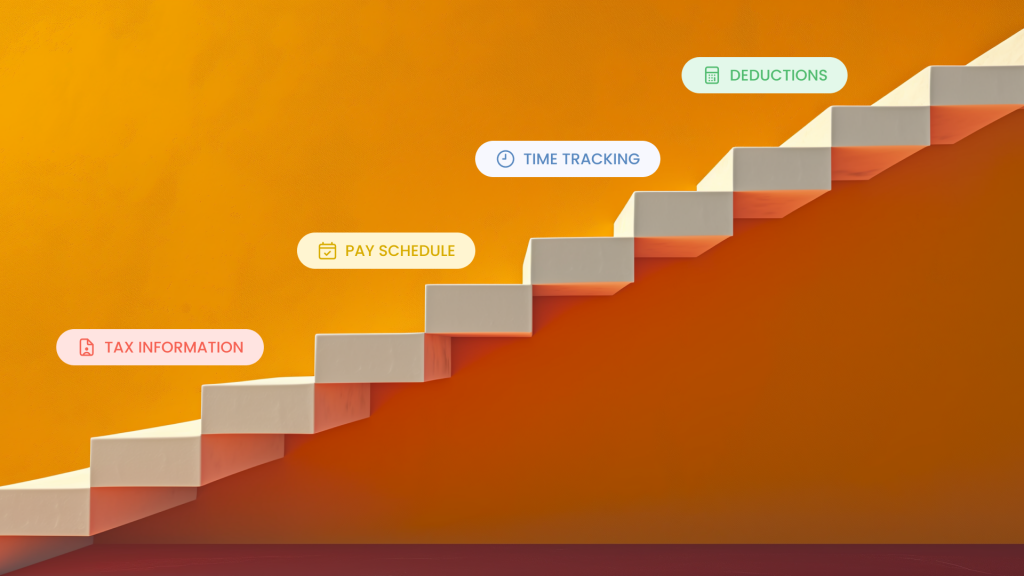

If you’re looking for an accurate accounting of your organization’s FTE, there are six steps you need to take, each one important for determining the organization’s workforce capacity. Here’s what you need to do for an accurate picture of your FTE:

- Compile a list of all employees and total hours worked: Gather data on all your employees, including full-time, part-time, and temporary workers. Record their total hours worked over a specific period, such as a week, month, or year.

- Define the total number of hours for a full-time position: Determine the standard number of hours constituting a full-time position in your organization. This typically ranges from 35 to 40 hours per week, depending on your company’s policies and local regulations.

- Calculate the annual hours worked for all employees: Multiply the total hours each of your employees worked by the number of weeks or months they worked during the period you’re looking at. This yields their annual hours worked.

- Add up annual hours worked for both full and part-time employees: Sum the annual hours worked for all your employees, regardless of their employment status (full-time or part-time).

- Determine the part-time FTE: Divide the total annual hours worked by part-time employees by the standard number of hours for a full-time position. This gives you the FTE value for your part-time employees.

- Calculate the total FTE: Sum the FTE values for both full-time and part-time employees. This provides the total FTE count for your organization, representing the equivalent number of full-time employees based on the total hours worked by all employees.

Example of Full Time Equivalent Calculation

To help you fully understand how Full Time Equivalent is determined, let’s take a look at a hypothetical example of FTE calculations and break down the math step by step.

Step 1: Compile a list of all employees and total hours worked

- Example: Suppose your organization has three employees:

- Employee A: Full-time, works 40 hours per week

- Employee B: Part-time, works 20 hours per week

- Employee C: Part-time, works 30 hours per week

Step 2: Define the total number of hours for a full-time position

- Example: Assuming a standard full-time workweek of 40 hours.

Step 3: Calculate the annual hours worked for all employees:

- Example:

- Employee A: 40 hours/week × 52 weeks = 2,080 hours/year

- Employee B: 20 hours/week × 52 weeks = 1,040 hours/year

- Employee C: 30 hours/week × 52 weeks = 1,560 hours/year

Step 4: Add up annual hours worked for both full and part-time employees

- Example: Total annual hours worked = 2,080 (Employee A) + 1,040 (Employee B) + 1,560 (Employee C) = 4,680 hours

Step 5: Determine the part-time FTE

- Example: Calculate the FTE for each part-time employee by dividing their annual hours worked by the standard full-time annual hours (2,080 hours):

- Employee B: 1,040 hours / 2,080 hours = 0.5 FTE

- Employee C: 1,560 hours / 2,080 hours = 0.75 FTE

Step 6: Calculate the total FTE

- Example: Add the FTEs of all employees:

- Full-time Employee A: 1 FTE

- Part-time Employee B: 0.5 FTE

- Part-time Employee C: 0.75 FTE

Total FTE = 1 + 0.5 + 0.75 = 2.25 FTE

By using the above example as a reference, and taking it step by step, you simply need to expand it to encompass your entire workforce, and you’re on track for an accurate look at your organization’s FTE.

Struggling to calculate your Full Time Equivalent?

Benefits of Calculating Full Time Equivalent

When it comes to workforce management, having comprehensive and accurate information is paramount. To make the right decisions, you need the right data, and a calculation of your Full Time Equivalent is an essential tool in your box. Benefits include:

Assess staffing needs

An FTE calculation will help your organization determine the right number of employees needed to meet the demands of your organization. This assessment helps prevent understaffing and overstaffing, ensuring cost-effective resource utilization, including recruitment fees.

Identify gaps and inefficiencies

By comparing actual Full Time Equivalent counts with targeted FTEs, your organization can identify gaps in its workforce coverage and weed out any inefficiencies. This insight allows you to address staffing imbalances, reducing potential burnout and enhancing productivity.

Analyze team performance

FTE data enables your organization to analyze team performance by comparing productivity levels across different departments or teams. This analysis helps you identify high-performing teams and areas requiring improvement, meaning you can make targeted interventions to enhance overall performance, without any major disruptions where there doesn’t need to be.

Relevant readings: How Managers Can Help Low-Performing Employees?

Cost analysis

Understanding FTE counts allows your organization to conduct cost analyses related to labor expenses, and ultimately update the recruitment budget accordingly. By calculating FTE-related costs such as salaries, benefits, and overhead expenses, your organization can optimize its budgeting and financial planning processes for the most efficient spending strategy.

Identify trends and growth opportunities

Tracking FTE calculation over time enables your organization to identify workforce trends and anticipate future staffing needs. This insight is very important for strategic workforce planning, expansion initiatives, and continued, sustainable growth over time.

Regulatory compliance

Many regulatory requirements, like compliance with labor laws and benefit programs, are based on Full Time Equivalent counts. Accurate FTE calculations ensure your organization remains compliant with legal obligations and eligibility criteria for government programs and support that look at FTE.

Improved communication

FTE data serves as a common metric for communication and decision-making across departments and organizational levels. Clear and consistent communication about staffing levels is important for a company culture of transparency and alignment with top-level strategic goals.

Read next: Strategies and Tools for Defining Culture in the Workplace

Frequently Asked Questions

1. What is the difference between full-time equivalent and full-time employee?

While a full-time employee typically works a standard number of hours per week, a Full Time Equivalent is a unit that measures the total workload of multiple part-time or full-time employees. FTE considers all of your employees, regardless of their hours worked, on a standardized scale to represent the equivalent of one full-time employee.

2. What is the difference between full-time equivalent and headcount?

Headcount refers to the total number of people employed by your organization, including both full-time and part-time employees. In contrast, FTE calculates the total workload based on the number of hours worked by employees, converting part-time hours into the equivalent of full-time hours to provide a standardized measure of workforce capacity.

3. Are interns taken into account when calculating FTE?

Interns may or may not be included in Full Time Equivalent calculations, depending on their employment status and your organization’s policies. If interns are considered employees and their hours contribute to your organization’s workload, they should be included in FTE calculations. That said, if interns are classified differently or their hours are not counted toward operational capacity, they should be excluded from your FTE calculations.

4. What does FTE 1.0 represent?

FTE 1.0 represents the workload equivalent to one full-time employee. It means that an employee is working the standard number of hours expected for a full-time position within your organization. FTE values that are greater than 1.0 represent a greater workload that goes beyond a single full-time employee, while values less than 1.0 represent part-time workloads.

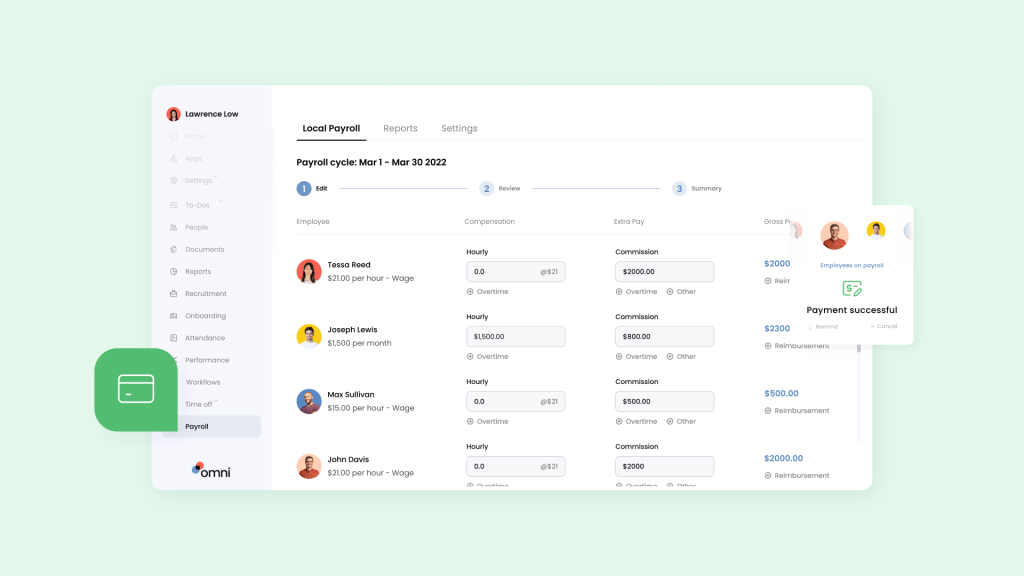

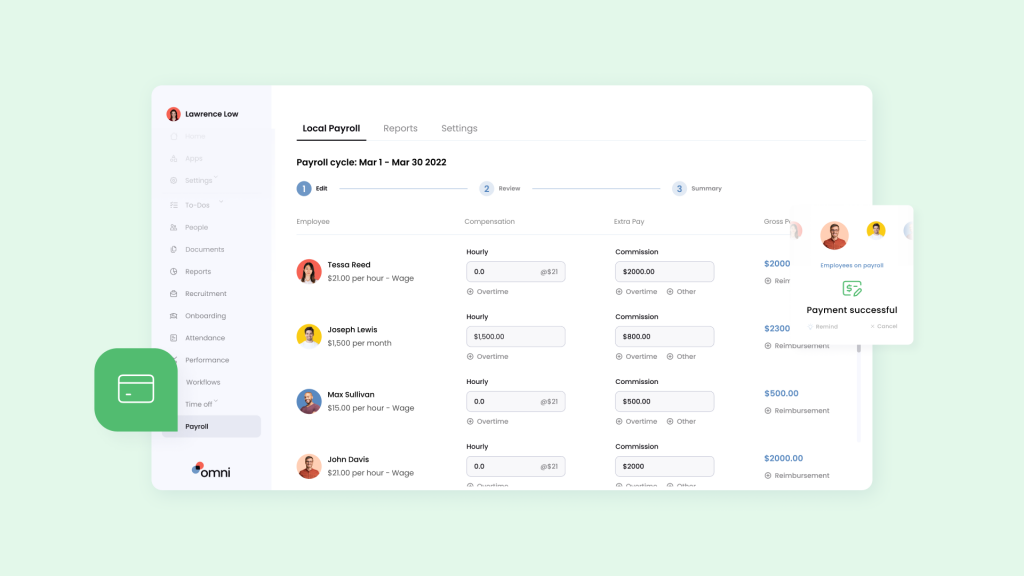

5. How does FTE impact the payroll process?

Full Time Equivalent calculations are an important part of the payroll process because they help determine the total cost of labor being spent by your organization. Payroll calculations look at FTE values to determine employee compensation, benefits eligibility, and payroll taxes. FTE data also informs decisions related to staffing levels, budgeting, and resource allocation.

FTE Calculations Made Easy with Omni

Full Time Equivalent calculations are crucial for determining staffing needs and optimizing resource allocation. By leveraging HRIS like Omni, organizations can elevate this process to the next level.

Omni helps you track, analyze and gain actionable insights from employee data through an automated and digitized platform. Easily and quickly gather the data you need to calculate your organization’s FTE so you can spend more time on the strategic planning necessary to drive business outcomes.

For more support in calculating your organization’s Full Time Equivalent, download our free FTE Template and streamline your staffing calculations for efficient resource allocation.

If you’re ready to take your workforce management to the next level, book a demo with us today. We’ll walk you through the platform’s features and demonstrate how Omni can transform your processes, saving you time, reducing administrative burden, and enhancing overall efficiency for your team.