The modern workplace is no longer confined to a single office. Distributed teams, with members scattered across different locations and time zones, are becoming increasingly common.

While this flexibility offers a wealth of benefits, managing these teams effectively requires a different approach.

This cheat sheet equips HR professionals with the tools and strategies to build strong, successful distributed teams.

What are distributed teams?

Distributed teams refers to a flexible working arrangement in which team members work from different geographic locations, across time zones, and continents. For example, a software development company might have developers in the United States, project managers in Europe, and quality assurance testers in Asia.

The traditional office environment is no longer the sole domain of business. We’re witnessing a surge in companies adopting the distributed work model, where employees collaborate remotely from diverse locations.

The rise in adoption of distributed teams are fueled by several major drivers:

- Employees’ increasing need for work-life balance.

- Technological advancement such as the presence of high-speed connectivity, cloud computing, and collaboration tools like Slack, Microsoft Teams, and Trello.

- Companies expand their reach across multiple markets and time zones, necessitating a workforce that can operate effectively without being constrained by physical office locations.

- Cost savings approach in which overhead costs associated with maintaining large office spaces are minimized.

Examples of successful companies who rely on distributed teams:

- Zapier, a company that provides automation for web applications, operates with a fully distributed team across 17 time zones. This setup allows Zapier to hire from a diverse talent pool and offer employees greater flexibility, leading to higher job satisfaction and retention.

- Buffer is a social media platform that operates with a fully distributed team of 80 members spanning 53 cities across 20 countries. Joel Gascoigne, Buffer’s CEO and Co-founder, highlights in this article how this model enhances their work operations, particularly customer service. With team members spread across various time zones, Buffer can diligently monitor customer satisfaction and respond swiftly. Despite serving over a million users, they manage to reply to 80% of emails within just one hour.

From this pattern, it is clear that distributed teams are here to stay and we would continue to see many businesses embrace this work trend in the future.

Distributed Team vs Remote Team

Distributed team and remote team models have their similarities and differences.

In the similarity aspect, they both offer employees flexibility in terms of work location and hours. Also, technology is a major factor into how distributed teams and remote teams operate. Because of the virtual setting, they require digital tools for communication and collaboration.

However, if you want to offer your team flexible working options, you’d have to know the difference between both models.

Distributed teams consist of employees who collaborate while being spread across various locations. In this setup, there is no central location. This model emphasizes location independence, meaning the focus is on the output rather than where the work is done.

Alternatively, a remote team setting includes some employees working from a central location like a main office or headquarters while others get to work from home. Remote work allows employees to work from various locations such as homes, cafes, or co-working spaces. This model maintains a physical office presence but allows some team members the flexibility to work remotely.

In summary:

- In a distributed team, there is no main office, and everyone is working from various locations.

- In a remote team, there is a main office where some employees work, but others have the option to work remotely.

Benefits of Distributed Teams

Adopting a distributed team model offers numerous advantages for both employers and employees. Here, we explore these benefits in detail.

For employers

Access to top talent

Using a distributed team working model means companies get to hire the best talents from all over the world, giving them access to a wider talent pool.

Increased innovation and diversity

Employers can benefit from diverse teams that bring a variety of work experiences, perspectives, and ideas, fostering innovation and creativity.

Improved productivity

Remote work provides employees with the freedom and control over their schedules, allowing them to work at times that suit them best and from any comfortable environment, whether it’s their home or other preferred location. This flexibility often leads to increased efficiency and productivity compared to being confined in an office.

For employees

Improved job satisfaction

Job satisfaction is important in the workplace, as employees who are satisfied with their work tend to be more engaged, motivated, and loyal. Seeing how important job satisfaction is for companies, employers should work with distributed teams to provide flexibility, autonomy, and a better work-life balance. This approach can lead to higher levels of job satisfaction, ultimately benefiting both the employees and the organization.

Read next: How to Motivate Employees: 8 Data-Backed Tips for Managers

Global exposure

In a distributed team, employees work with colleagues from different parts of the world. This gives them greater exposure and sensitivity into different cultural practices, communication styles and work ethics. Companies who want to compete in a global market can benefit with culturally aware employees. Global teams can also provide insights into regional markets, helping the company meet customers preferences and needs.

Work-life balance

The ability to work from anywhere allows employees better balance their professional and personal lives, reducing burnout and turnover.

Cost of Distributed Teams

While there are significant benefits, there are also challenges and costs associated with distributed teams. These include:

Communication challenges

The advantages of having distributed teams are clear, but it’s also important to note that team diversity can pose challenges for companies. A study revealed that cultural diversity within global teams may result in communication barriers and reduced trust, ultimately affecting team performance negatively.

Cybersecurity risks

Accessing company information and resources from various locations increases the risk of data breaches and cyber attacks. This decentralized access can expose the company to vulnerabilities such as unsecured networks, phishing scams, and malware.

Social isolation

Isolation is a common problem among remote and distributed teams. In 2023, one in four employees worldwide who worked from home often felt lonely during the day. While employees are free to choose their work location, it can also lead to feelings of loneliness, especially for distributed teams with rare in-person interactions.

Tips for Managing Distributed Teams

You may be deterred after learning the challenges of managing distributed teams. However, don’t let that hold you back from unlocking the benefits it offers. Here are five strategies on how you can alleviate these issues:

1. Establish clear communication guidelines

Establish communication channels and tools

Remote work thrives on effective communication. Open and consistent communication builds trust and transparency within the team, which is vital for a productive remote work environment. You can make use of virtual tools such as Slack, Zoom and Microsoft Teams to facilitate collaboration and communication among teams. Employers should also provide distributed teams with training on how to utilize these tools.

Host regular virtual meetings

Another way to facilitate effective communication among distributed teams is to have regular virtual meetings. These can be used for updates, brainstorming, and solving problems together. Video calls help team members feel connected and keep everyone on the same page.

2. Set clear performance goals and expectations

Implement flexible feedback mechanisms

According to a Microsoft team analytics report, employees are four times more likely to be disengaged if there is no regular feedback and guidance provided.

Feedback is important in a remote work setting because it helps employees understand their performance, identify areas for improvement, stay aligned with team goals, and feel connected to the organization. Managers should schedule 1-on-1 meetings as a way to provide feedback, support and handle any obstacles faced by employees.

Additional reading: The Manager’s Guide to Asking for Feedback

Provide remote learning and development opportunities

Training and development are additional ways to improve performance among teams. Investing in online learning tools and courses such as Coursera, LinkedIn Learning, and Udemy can help remote teams develop new skills, stay updated with industry trends, and enhance professional growth. Also, encourage your employees to participate in webinars, workshops and conferences.

3. Maintaining employee engagement

Prioritize work-life balance

Promote mental and physical well-being through wellness initiatives. To boost employee engagement among distributed teams, prioritize regular virtual team activities, encourage open communication, and support flexible work schedules.

Promote culture of trust and autonomy

Another way to manage distributed teams is fostering a workplace environment where team members feel trusted and empowered to make decisions. This can be done by clearly defining roles and responsibilities, delegating decision-making authority, and providing necessary resources and support.

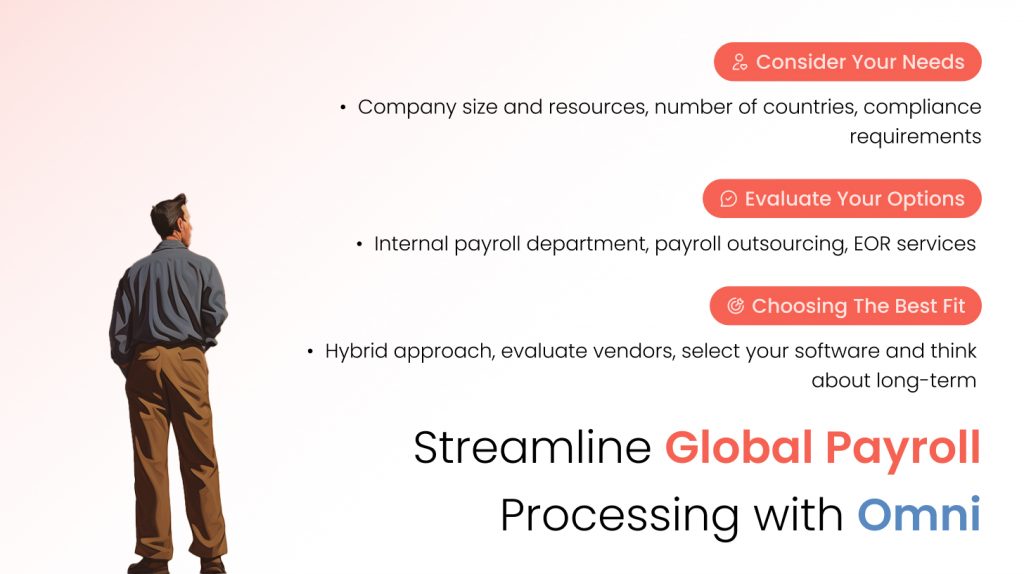

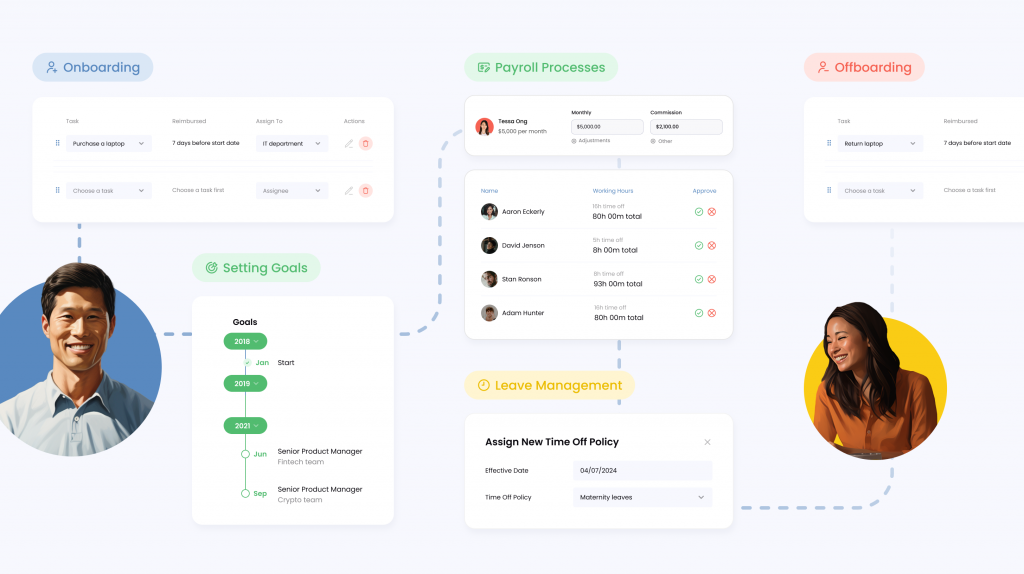

4. Payroll processing

Take into account for multiple currencies

When it comes to managing distributed teams, another important thing you must take note of is handling payroll processing in multiple currencies. Use payroll services that support multiple currencies to pay employees in their local currency.

Adhere to local tax regulations

To avoid legal disputes, ensure compliance with tax regulations for each country.

Offer variety of payment methods

Payments must be convenient and reliable for remote workers, offering options such as direct bank transfers, PayPal, TransferWise, or other secure electronic payment platforms. This flexibility helps accommodate different preferences and ensures timely and hassle-free payments across borders.

5. Time off management

Standardize leave policies across all locations

Develop written policies outlining how leave requests are submitted, approved, and recorded. For clarity purposes, communicate the policies to all team members so everyone understands their entitlements and responsibilities.

Read next: HR’s Guide to Employee Leave Management

Track time across different time zones

Invest in a time tracking software that supports multiple time zones to effectively track and record working hours across different regions. Regularly monitor your time tracking recordings to identify any performance gaps or issues early on. This helps maintain accurate records of working hours and ensures compliance with labor laws across various time zones.

Consider public holidays within the region

Recognizing regional holidays helps in planning workloads and deadlines effectively, respecting local customs and business practices. Research and maintain a database of public holidays in each team member’s location. This way, you can plan project timelines, meetings, and deliverables around these holidays to ensure smooth operations and avoid any potential disruptions.

Ensure fairness and transparency

Document all time off policies and procedures in a centralized location to make them accessible to all team members. To ensure fair treatment for all team members, apply each policy consistently to everyone, regardless of seniority, role, or location. Transparent policies build trust among team members, demonstrating that everyone is treated equally regarding time off and work expectations.

Build a Thriving Distributed Workforce

Omni makes it easy to support employees across multiple countries, time zones, and currencies.

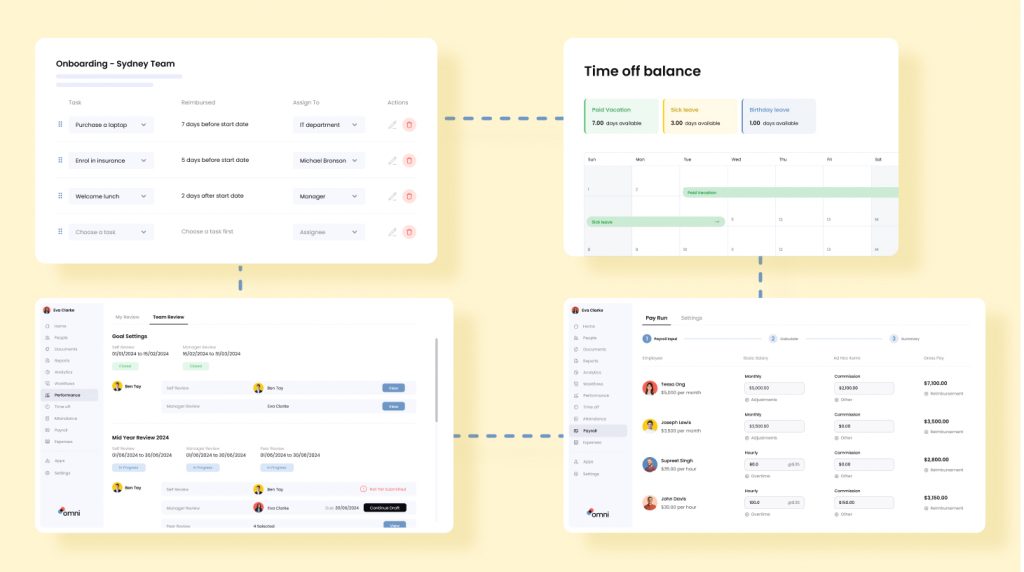

Affordable, functional, and suitable for modern growing businesses — Omni is the payroll provider that your business can rely on. With a comprehensive payroll solution tailored to various countries specific requirements with features like support for HKD, SGD, and MYR, automated tax calculations, and managed contributions, HR teams can simplify their payroll processes while ensuring adherence to regulatory standards.

Our centralized document management solution makes gathering the necessary data required to apply for employment passes, rental schemes, and other country-specific initiatives seamless and timely. With customized workflows and automated reminders, HR can help empower employees to manage the deadlines and documentation requirements for applications. And centralized documents and real-time data makes it easy for employees to access salary information and produce reports and documents necessary for verification.

Additionally, Omni’s customizable dashboard allows your teams to set and manage calendars pre-loaded with country or region specific holidays and timezones, seamlessly onboarding individuals in various locations.

Start your free trial today or book a demo to learn more about how Omni can support your international workforce.