Tax season can be stressful for employers anywhere, and this is no different in Hong Kong. With a plethora of specific forms, changing submission deadlines and frequently updated tax laws, staying on top of your Hong Kong tax return can be tricky—and the penalties for non-compliance steep.

But not to fear— we will be taking a look at everything you need to know about filing taxes in Hong Kong, including the relevant authorities, deadlines for tax submissions, forms you’ll need to fill out, penalties you want to avoid and tips for making the process as smooth as possible.

The Hong Kong Tax Governing Authority

In Hong Kong, the Inland Revenue Department (IRD) is the governing authority responsible for administering and enforcing tax laws. The IRD operates under the Financial Services and the Treasury Bureau and is tasked with overseeing all things tax related, including income tax, property tax, profits tax, and salaries tax.

The primary role of the IRD is to ensure compliance with tax regulations, collect taxes owed to the government, and provide guidance and assistance to taxpayers looking to better understand their tax obligations. This includes for employers who are responsible for withholding and remitting taxes on behalf of their employees. So, if you’re an employer in Hong Kong, keep an eye out for releases from the IRD as they may contain pertinent info to make your tax time easier.

The IRD also plays an important role in the development and implementation of new tax policies, including updates to tax laws and regulations. Employers in Hong Kong must closely follow the guidelines and regulations created by the IRD when preparing and filing tax returns for their employees, and stay up to date with any changes that occur, in case of accidental non-compliance based on new, or changed tax law.

When to File Hong Kong Tax Return?

The deadlines for Hong Kong tax return are determined based on the taxpayer’s role and status, as well as the type of income they’re reporting. For employees paying their salary tax, the filing deadline is typically on or before April 30th of the year following the relevant tax year. For example, the tax return for the year 2023 should be filed on or before April 30th, 2024.

Employers on the other hand are required to report how much they paid to their employees through employer’s returns, which are usually due on or before the 10th day of April following the end of the tax year. Employers must also issue tax returns, commonly known as Forms IR56 series, to their employees by the end of February each year.

If you’re an employer in Hong Kong, it’s essential you meet these deadlines to avoid penalties and stay compliant with Hong Kong’s tax regulations. Because the specific tax deadlines are prone to change, this is an area you should pay extra attention to each year to avoid incurring any late penalties.

Read next: Your Guide to Managing Payroll Hong Kong

Employers’ Checklist for Filing Hong Kong Tax Return

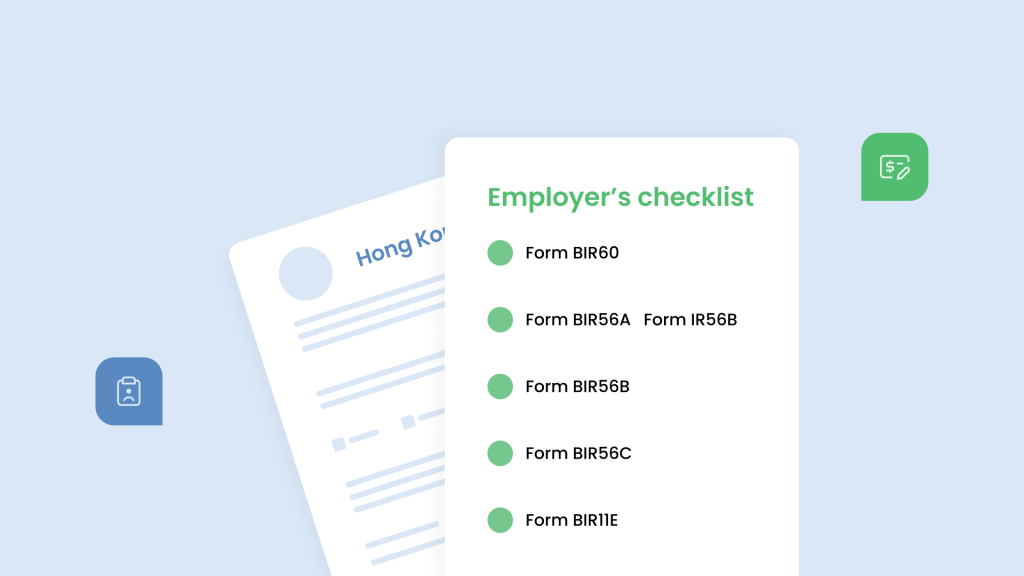

As with tax submissions in many other places in the world, Hong Kong tax returns involve quite a lot of form-filling (which, as of 2023, must be filled and submitted electronically). Here, we’ve created a handy checklist of forms you’re going to need to be aware of for Hong Kong tax return season:

Tax withholding and remittance

- Form BIR60: Employers are responsible for withholding taxes from their employees’ salaries and remitting them to the IRD on their behalf. This process involves completing Form BIR60, which provides details of the tax withheld and remitted for each employee.

Employer’s returns of remuneration and pensions

Employers are required to submit employer’s returns of remuneration and pensions to the IRD annually. These returns include the following forms:

- BIR56A Form: This form provides details of the remuneration paid to each employee during the tax year.

- IR56B Form: This form is used to report the end of employment or departure of an employee from Hong Kong.

For more information: How to File a Hong Kong Employer’s Return: Understanding Forms BIR56A and IR56B

Record Keeping

Employers must maintain accurate records of their employees’ remuneration, including salaries, bonuses, allowances, and other benefits. The IRD requires that these employee records should be retained and accessible for at least seven years for auditing purposes.

Additional Forms and Requirements

In addition to the above forms, there’s a few additional forms to consider, based on the specific nature of an employer’s circumstances:

- BIR56B: This form is used to report the remuneration paid to non-resident employees.

- BIR56C: Employers who provide benefits-in-kind to their employees must complete this form to report the cash value of these benefits.

- BIR11E: Employers who make payments to self-employed individuals or subcontractors must complete this form to report such payments.

When it comes to tax time, make sure to run through this checklist and take note of all the forms relevant to you and your employees, so that you can submit a thorough and accurate Hong Kong tax return.

Penalties for Late Hong Kong Tax Return

Late tax filing is universally frowned upon, and in Hong Kong is no exception. There are a series of penalties and fines for employers who are tardy on their tax submissions. The penalties for late submission or non-compliance may include:

- Late filing penalty: Employers who fail to file their employer’s returns of remuneration and pensions (the BIR56A and IR56B forms we mentioned above) by the deadlines outlined by the IRD will incur late filing penalties. The amount of the penalty varies depending on the duration of the delay. The maximum penalty for late filing is HK$50,000 (depending on the circumstances), but if payment isn’t promptly made an additional fine of HK$1,000 will be imposed every day until the issue has been resolved.

- Late payment penalty: Filing is one thing, but payment is even more important. Employers who fail to remit the taxes withheld from their employees’ salaries by the IRD due date will also incur steep late payment penalties. The penalty is calculated based on the amount of tax outstanding and the duration of the delay. The longer the delay, the steeper the fine. Alternatively, the IRD may reassess the employer and give them a tax assessment much higher than the original amount submitted.

- Surcharge: In addition to late filing and late payment penalties, employers may be liable for a surcharge on the outstanding tax amount. The surcharge is imposed to deter non-compliance and is calculated as a percentage of the tax outstanding.

The IRD also has a framework under Section 82A of their Penalty Policy to help them analyze how much to penalize employers who submit their Hong Kong tax return late, largely based on attitude, cooperation, and how well informed you are. For instance, people who express genuine surprise or regret for filing late will usually face less steep penalties than employers who are combative or disagreeable. In the event you file late, make sure you are as cooperative and polite as possible with the IRD.

Tips to Stay Ahead of Hong Kong Tax Return

Now that you’ve got an understanding of the penalties for non-compliance, here’s what you can do to avoid that and to streamline your Hong Kong tax return:

- Stay updated on regulations: Keep up to date with changes in tax laws and regulations issued by the IRD in Hong Kong. Regularly review updates and announcements to make sure you’re staying compliant with the latest requirements.

- Maintain organized records: Maintain accurate and organized records of employee remuneration, tax withholdings, and other relevant financial data (and keep it that way for at least seven years.) Proper record-keeping helps with the preparation and submission of tax returns and minimizes the risk of errors or omissions.

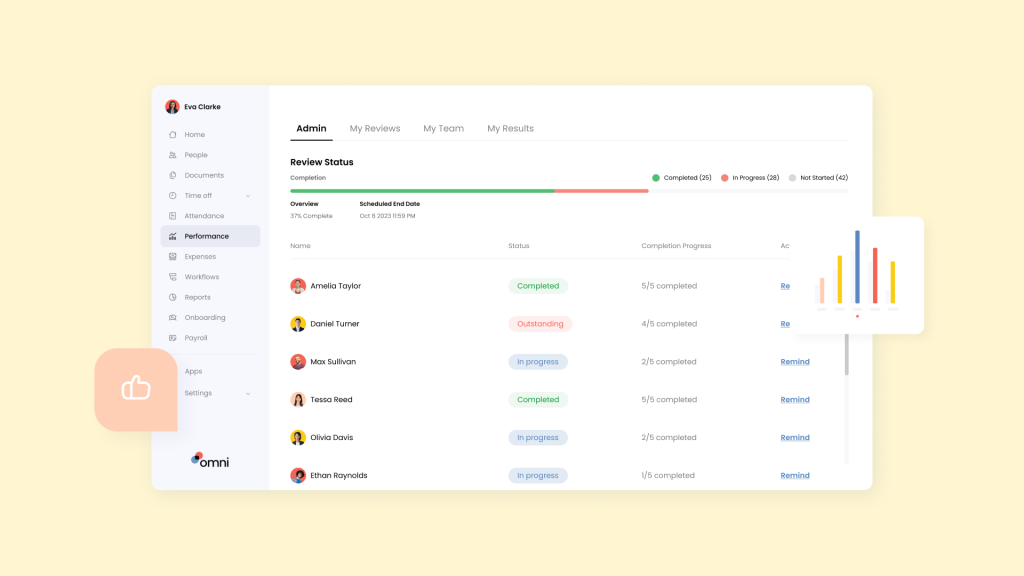

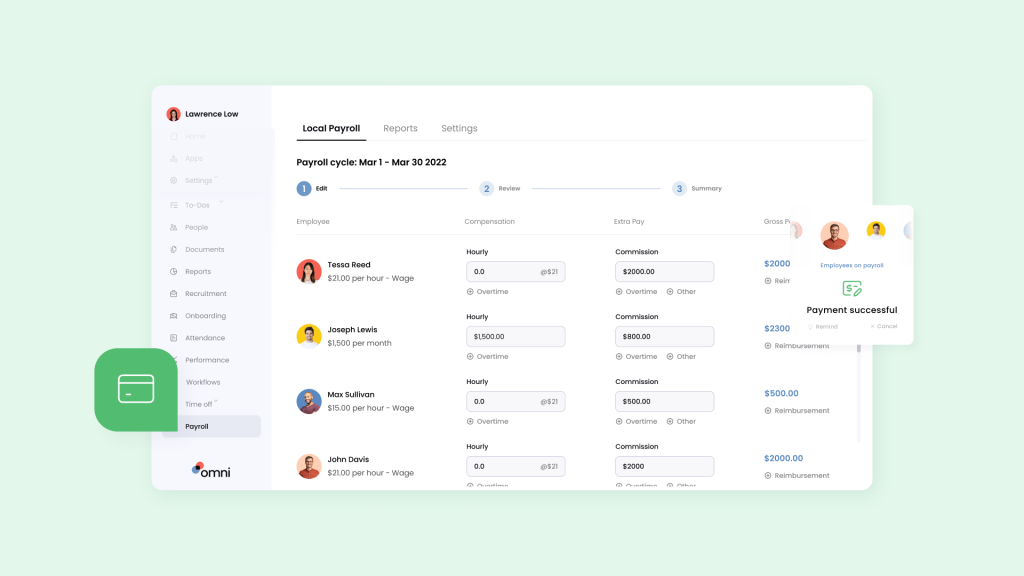

- Utilize HR technology: Leverage HR automation and software solutions to streamline payroll processes, automate tax calculations, and generate required tax forms. Human Resources Information Systems (HRIS) can help simplify payroll management and ensure accuracy in tax reporting.

- Plan and prepare early: Start preparing for tax return filing well in advance of the deadlines. Establish a timeline for completing key tasks, such as gathering financial data, compiling records, and submitting tax returns. Early planning allows for enough time to address any issues or challenges that might come up.

- Communicate with employees: Maintain open communication with your employees regarding tax matters, including deductions from their salaries, tax filing deadlines, and any changes in tax policies or procedures. Clear and transparent communication will help your employees understand their tax obligations and reduce misunderstandings or confusion.

Make Hong Kong Tax Return Easy with Omni

Managing Hong Kong tax returns requires meticulous attention to legal requirements and thorough documentation—especially when the consequences for misfiling can cause significant penalties and troubles for your organization. You should strive to minimize human error by leveraging automation to ensure accuracy and compliance.

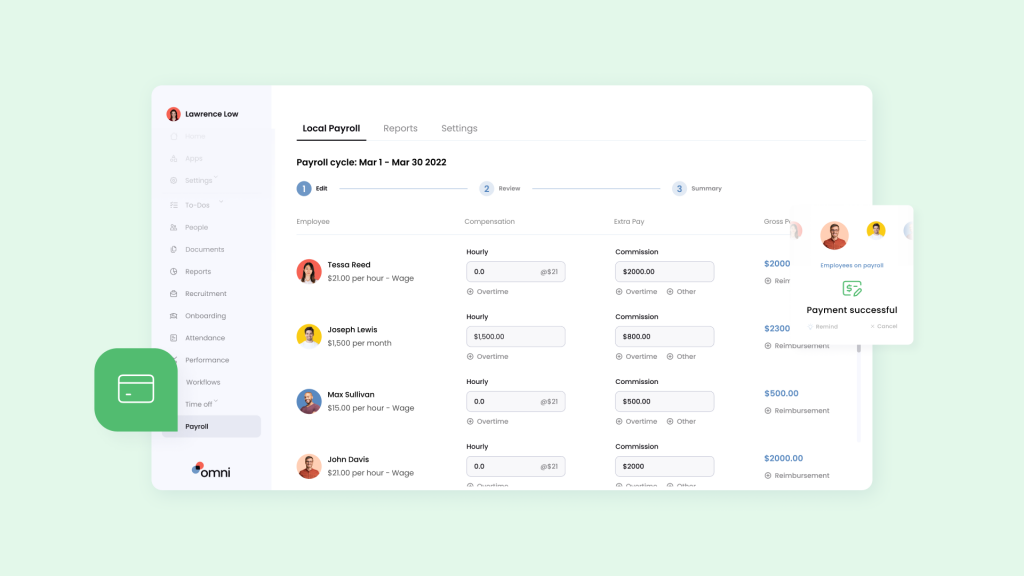

Omni’s suite of features makes the requirements for running a compliant and efficient payroll system in Hong Kong easy. With secure and centralized employee records, HR teams can swiftly access employment contracts and essential documents that support payroll practices.

Our time and attendance features empower teams to automate data and produce accurate reports in minutes, making payroll calculations seamless and accurate. And with payroll solutions that support HKD and pay schedules, Omni offers an entire suite of solutions to make your Hong Kong tax return seamless.

With Omni, you not only get the convenience of automation but also the peace of mind that comes with a solution designed to meet the specific needs of your business in Hong Kong. Ready to take advantage of the convenience, efficiency and reliability of automated payroll?