If you’re looking to expand your company or hire employees in Thailand, it’s crucial to obey its local regulations, especially when it comes to Thailand payroll.

However, effectively running Thailand payroll can be demanding. One reason is that Thai labor laws can be complex, and it isn’t always easy to keep up with frequent amendments. But if you flout these laws, you risk getting a penalty or other negative legal consequences.

Your best bet is to familiarize yourself with Thailand payroll processes. Hence, we’ve created this guide to help you avoid compliance issues in Thailand. Whether you’re a business owner or an HR manager, this article will help you handle Thailand payroll with information on everything from taxes to payroll software.

Preparing for Thailand Payroll

Running payroll in Thailand typically begins with these factors:

Legal entity

Before you can handle payroll activities, your business has to be a legal entity in Thailand. This process can take several months as it involves registering the company, sorting out paperwork, getting employment permits, and understanding Thailand’s employment regulations.

To do so:

- Register your company name in Thai (not English or another language) with the Department of Business Development.

- File a memorandum of association. This document provides details about your company, including its founders and activities.

- Choose a company type. It could be a public limited company, private limited company, partnership, or a branch office (for foreign companies).

- Register your entity with the Ministry of Commerce.

- Register with the Thai Revenue Department for a company registration certificate and income tax number.

- If you’re not a Thai citizen but your company has a physical location in Thailand, apply for an alien business license.

- Create a Thai bank account. It’s required to operate in the country..

However, you can skip the rigorous process by using an Employer of Record (EOR).

To put it simply, EOR is an organization that legally hires employees on behalf of an employer. They simplify the process and handle administrative and legal responsibilities, such as payroll, compliance, taxation, and employee benefits.

However, setting up an EOR for your business can take up to six months and may be costly. It is important to assess your needs and budget to determine which way to go when registering your entity.

Tax identification number

A Tax Identification Number (TIN) is a unique identifier the government assigns to individuals and business entities for easy taxation. You need a TIN to open a business bank account. To get one, register with the Thai Revenue Department. And if your turnover exceeds the threshold of 1.8 million baht within 12 months, register for a VAT number.

Employment obligations

Thailand requires employers to provide specific mandatory benefits. Depending on the length of employment, job position, and industry, they include:

- Annual leave and public holidays

Full-time Thailand employees who have worked for a year are entitled to six days of paid annual leave. However, some employers offer workers 10 to 15 days of paid vacation every year to compete in the market. Workers who don’t use their vacation time can accumulate and carry it forward.

Besides annual leave, workers are entitled to at least 13 compulory public holidays yearly.

- Maternity leave

Expectant mothers in Thailand are entitled to 98 days of fully paid maternity leave. While the employer pays for the first 45 days, the government pays the remaining period through the Social Security fund at 50% of the regular salary rate.

- Sick leave

In Thailand, an employee is entitled to 30 days of paid sick leave every year after working for a year. If the sickness persists for over a month, they can use their paid vacation or take unpaid leave. And if an employee falls ill for more than three consecutive days, they are required to submit a medical certificate.

Read next: HR’s Guide to Employee Leave Management

Thailand Payroll Processing Steps

Employees in Thailand generally earn monthly in the local Thai Baht currency. However, some companies may pay employees bi-monthly or weekly, depending on their internal policies and agreements with employees. Once you’ve settled payment dates, here’s how to process Thailand payroll:

1. Calculate gross salary

Calculate the total amount an employee earns prior to any deductions. This includes their basic salary, overtime, allowances, bonuses, commissions, and any other payments they get. Gross salary does not include taxes, social contributions, or other deductions.

Thailand operates a monthly payroll cycle with a maximum of eight working hours daily and 48 hours per week. Employees who work more than 48 hours a week should be paid overtime, which is 150% of the employee’s hourly rate.

For example, an employee’s earns:

- 30,000 baht as a basic salary

- 5,000 baht as housing allowance

- 2,000 baht as transportation allowance

In that instance, their hourly rate is 125 baht (30,000/30/8). If they work 10 hours of overtime in a month, their overtime pay will be 187.5 per hour (150% of 125 baht). Multiplied by 10, that’s 1875 baht.

Therefore, the employee’s gross salary is 38,875 baht.

Additional reading: Thailand Minimum Wage Guide for Employers

2. Withhold income tax

Once you’ve registered your company, you can withhold tax from your employees’ salaries. Thailand operates a progressive income tax system, and tax rates range from 0% to 35% depending on income levels.

Employers and HR managers must calculate and deduct income taxes from employee earnings while considering the applicable tax rates. They should also remit the withheld income taxes to the Revenue Department by the 7th of the following month, alongside proper documentation and reporting.

Learn more: Understanding Income Tax in Thailand

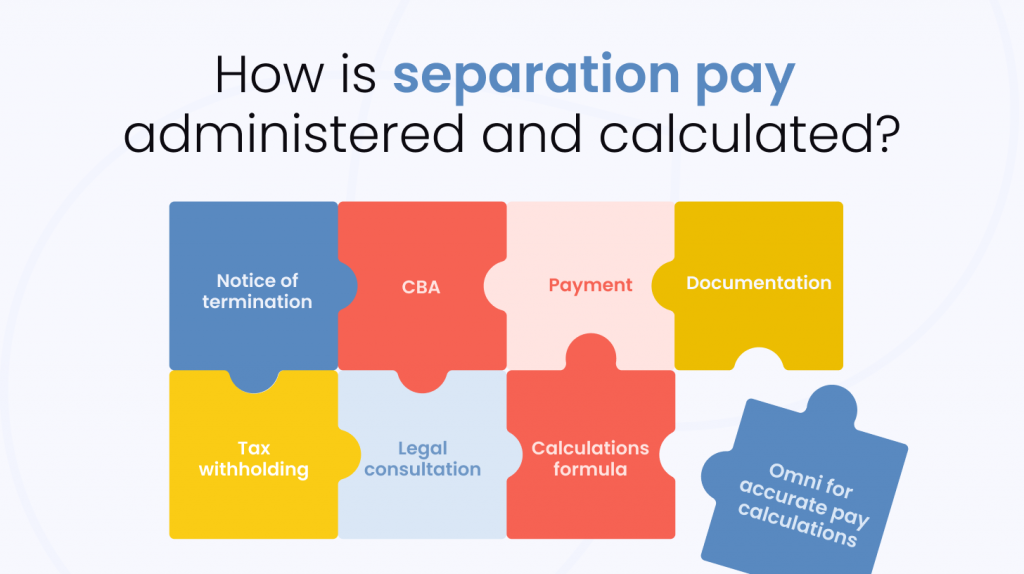

3. Payroll contributions

When running Thailand payroll, you should also withhold and remit these other payroll taxes with income tax.

- Workmen’s Compensation Fund

This compensation fund offers financial assistance to employees who suffer from work-related injuries, disease, disability, illnesses, or death. Employees contribute 0.2% to 1% of their earnings to this fund once a year.

- Employees Provident Fund

The Provident Fund is a voluntary retirement savings plan that gives financial support to employees when they retire. Contributions typically range from 2% to 15% of an employee’s salary.

- Social Security Fund

As part of Thailand payroll, employers and employees should contribute to the Social Security Fund by paying 5% of their income (capped at 875 baht per month) on the 15th of every month. This fund covers employees during unemployment, disability, maternity and paternity leave, injury, illness, death, and retirement.

4. Process authorized deductions

After withholding all authorized deductions such as income tax, social security contributions, employee provident fund, etc., process them for remittance.

First, ensure all deductions align with Thai statutory demands. And if you are withholding more than stipulated, let it be a written agreement between the employee and employer through the employment contract or a separate authorization form.

5. Calculate net salary

Net salary is the money an employee takes home after deducting tax, contributions, and other withholdings from their paychecks.

Say an employee’s gross salary is 38,875 baht. You’ll have to deduct the percentages of the social security funds, employee provident fund, and income tax to get their net salary.

Payroll Payment and Records

Managing Thailand payroll involves using certain payment methods and records while adhering to labor laws and tax regulations. They include:

Payment methods

Employers must pay employees at least once a month, typically at the end of the month, via cash, bank transfer, or cheque. Furthermore, you should state your company’s specific payment dates in the employment contract so workers know when to expect their salary.

Payslips

Payslips should include employees’ gross salary, authorized deductions, and net salary. They should also include employee data, payment dates, and overtime or bonuses. Employees should receive their pay slips as hard or soft copies on or before payday.

Overtime pay

As mentioned earlier, employees who work beyond the standard 48 hours should receive an overtime fee of 150% of their hourly wages.

If an employee’s hourly rate is 125 baht and works overtime for 10 hours a month, their overtime pay will be 1875 baht (150% of 125 =187.5 baht per hour multiplied by 10).

Year-end tax adjustments

Year-end tax adjustments are crucial to Thailand payroll and tax compliance. They ensure employers withhold the accurate amount of personal income tax from employees’ salaries throughout the year while complying with the Revenue Department’s regulations.

Carry out year-end tax adjustments before the last payroll of the year. Furthermore, inform employees of updates while maintaining accurate records of all Thailand payroll transactions and adjustments for easy annual review.

Recordkeeping

Regular recordkeeping is essential when handling Thailand payroll. It ensures correct payroll processing and compliance with labor laws. Furthermore, it also encourages transparency between employers and employees.

Your payroll records should contain employee information, gross salary, allowances, benefits, payment dates, authorized deductions, and net pay.

Payroll software

Adhering to employment regulations and keeping records can be challenging. But with software, it becomes easier. Thankfully, many HR software exist to solve payroll problems. They automate calculations, track employee work hours, and streamline your payroll workflow.

This helps eliminate errors, ensure accuracy, and simplify the process of processing Thailand payroll. But before choosing payroll software, ensure the pricing plan suits your company’s budget and its features align with your organizational goals.

Read next: The HR Tools Growing Teams Need in 2024

Benefits of Payroll Software for Thailand Payroll

Enhanced accuracy and efficiency

Payroll software helps you keep and maintain accurate records of all transactions, including earnings, deductions, and payment histories. It automates the Thailand payroll process and reduces errors in computing salaries, overtime, taxes, and other calculations. The best part is that anyone on your team can easily access and retrieve relevant data, boosting efficiency and productivity.

Improved compliance

Using these tools makes it easier to follow through with labor laws. For example, it automatically calculates compulsory deductions from salaries. And when there are changes in Thai laws or tax regulations, you can easily update the tool to reflect them.

Cost savings and time management

Automating routine tasks like calculating earnings, withholding tax, and generating reports frees up space for more HR and finance duties. Also, since these tools help you process payment for multiple employees simultaneously, they save time and money that would have been spent executing the tasks manually.

Integration with HR Systems

Integrate your payroll software with other HR, accounting, and enterprise resource planning (ERP) systems to efficiently execute other administrative tasks. This improves your workflow and ensures a smooth process. It also reduces the need to duplicate efforts and creates a synchronized transition between systems.

Enhanced security

Many software have encryption features that secure and protect employee information and sensitive financial data from unauthorized access. This is necessary for the security of any company.

Automate Your Thailand Payroll Processes and Ensure Compliance

Navigating the ever-evolving regulations of Thailand payroll can be challenging, and staying up to date with the latest mandates is crucial for HR teams to remain compliant.

Omni helps HR teams stay up to date with the latest laws and regulations while streamlining the end-to-end employee management lifecycle. Our comprehensive payroll solution is tailored to Thailand’s specific requirements. With features like support for Thai baht, automated tax calculations, and instant payroll reports, Omni can help HR teams simplify their payroll processing while ensuring compliance.