It’s beyond question that diverse teams simply perform better than less diverse ones. Which makes sense—imagine you were only allowed to recruit from one specific pool of people. That would severely hinder your access to top talent and the varied experiences that spark creative brilliance.

That is why a Diversity, Equity and Inclusion (DEI) policy is so important. Such a policy not only states your organization’s commitment to diversity and inclusion (which helps the wellness of your employees and your business’ bottom line), but also outlines a strategy to enforce it.

In this article, we’ll be diving into the key elements of a great DEI policy, how you can incorporate them in your workplace, and strategies for communicating them to your team.

What is a Diversity, Equity and Inclusion (DEI) Policy?

A DEI policy is the official document outlining your organization’s commitment to encouraging diversity, equity, and inclusion in the workplace. It’s the guiding framework for creating a workplace environment where all your employees can feel valued, regardless of their background, identity, or experiences. DEI policies outline your organization’s stance on fostering diversity and combating discrimination, as well as how it plans to go about developing an inclusive culture.

At its core, an effective DEI policy communicates your organization’s commitment to creating a workplace culture that embraces and celebrates differences while striving for fairness and equality. By establishing clear expectations and standards, your DEI policy sets the tone for workplace culture and aligns the efforts of leaders, managers, and employees toward building a more inclusive workplace, where everyone has equal opportunities to contribute and thrive.

Why are DEI Policies Important?

While the value of diversity might seem obvious, there could be unconscious biases or outdated practices still in use that make true equity difficult to achieve. But with a DEI policy, you can tackle them head on. Here’s why that’s important:

Promoting fairness and equality: DEI policies help ensure that all your employees, regardless of their background, identity, or experiences, are treated fairly and have equal opportunities for advancement within your organization. By clearly laying out your organization’s commitment to equity and inclusion, these policies set clear expectations for behavior and decision-making that impacts individuals on the team.

Fostering a positive work environment: DEI policies are important for creating a workplace culture where all team members feel valued, respected, and included. By embracing diversity and encouraging inclusion, your organization can cultivate a sense of belonging among its employees, leading to higher morale, increased engagement, and improved overall well-being.

Enhancing organizational performance: Research has shown that diverse teams are more innovative, creative, and effective at problem-solving. By promoting diversity and inclusion through DEI policies, your organization can tap into the unique perspectives, skills, and experiences of its employees, leading to better decision-making and better business outcomes. In this case, employee well-being directly contributes to your organization’s bottom line.

Attracting and retaining talent: In today’s competitive job market, candidates (especially those in Gen Z and Gen Alpha) increasingly seek out employers that prioritize diversity, equity, and inclusion. Organizations with robust DEI policies are more likely to attract top talent from diverse backgrounds and retain employees over the long term by creating an environment where all individuals can thrive and grow.

Meeting legal and regulatory requirements: Implementing DEI policies will help your organization comply with legal and regulatory requirements related to discrimination, harassment, and equal employment opportunity. By establishing clear guidelines and procedures for addressing issues of discrimination and bias, your DEI policies help minimize legal risks and protect your organization from potential liabilities.

DEI policies are essential tools for creating a workplace culture that celebrates diversity, promotes equity, and encourages inclusion. By embedding these principles into official policies and practices, your organization can create an environment where all employees feel empowered and able to contribute their unique talents and perspectives to achieve common goals.

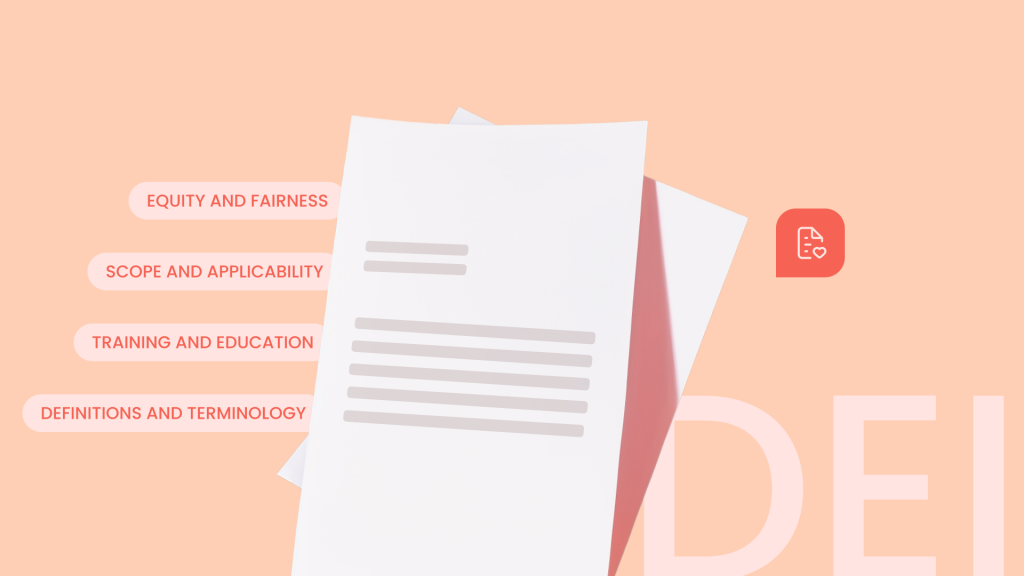

What Should a DEI Policy Include?

Comprehensive DEI policies should reflect your organization’s commitment to promoting diversity and creating an inclusive workplace culture. The key elements that your DEI policies needs to include are:

Mission statement and commitment: Begin the policy with a clear and concise mission statement that plainly states your organization’s commitment to diversity, equity, and inclusion. This statement should encompass your company values and emphasize the importance of creating a workplace where all team members are respected, valued, and empowered to succeed, regardless of background.

Definitions and terminology: Define key terms related to diversity, equity, and inclusion and how they relate to your workplace. This ensures clarity and understanding among your employees, and can be pointed to in case any policies are contested. Provide explanations of terms such as equity, inclusion, unconscious bias, microaggressions, and privilege to foster a shared understanding of these concepts within your organization.

Scope and applicability: Specify the scope and applicability of your DEI policies, including who is covered by the policy. Clarify whether it applies to all aspects of employment, including recruitment, hiring, promotion, compensation, training, and development.

Non-discrimination and anti-harassment policies: Outline policies prohibiting discrimination, harassment, and retaliation based on protected characteristics (like race, religion, or gender identity). Clearly identify prohibited conduct, reporting procedures for complaints or concerns, and your organization’s commitment to investigating and addressing any allegations of discrimination or harassment as soon as they’re made aware of them.

Accommodation for disabilities: Include provisions outlining your organization’s commitment to offering accommodations for employees with disabilities to ensure equal access to employment opportunities at your workplace. Describe the process for requesting accommodations and how your organization will help to provide access and opportunities for those who’ve made requests for accommodation.

Diversity and inclusion initiatives: Describe the specific initiatives, programs, and strategies your organization will use to promote diversity and foster inclusion within its workplace. This could include recruitment and employee retention programs aimed at increasing diversity, training and education opportunities to raise awareness of unconscious bias, or employee resource groups to support underrepresented communities.

Equity and fairness principles: State your organization’s commitment to promoting equity and fairness in all aspects of employment, including compensation, performance evaluation, and career advancement. Outline the policies and practices aimed at identifying and overcoming traditional barriers to equity.

Training and education: Highlight your organization’s commitment to providing training and education on diversity, equity, and inclusion topics for employees at all levels. Describe the content, format, and frequency of DEI training initiatives and expectations for employee participation.

Accountability and measurement: Establish mechanisms for holding leaders, managers, and employees accountable for upholding the principles outlined in your DEI policy. Make sure to include regular monitoring and assessment of DEI initiatives in your policy, as well as for collecting feedback and measuring progress toward your goals.

Examples of DEI Policy

The best way to understand how DEIs work is to consider them in practice. Here are 10 examples of DEI policies for you to consider including in your own:

1. Zero-Tolerance Policy for Discrimination and Harassment

Implement a clear and enforceable policy that prohibits discrimination, harassment, and retaliation based on protected characteristics such as race, gender, sexual orientation, religion, disability, and age. Make sure to outline procedures for reporting and investigating complaints and specify consequences for violations.

2. Inclusive Recruitment and Hiring Practices

Consider adopting blind recruitment practices, where identifying information is removed from the resumes of potential candidates. This helps mitigate unconscious bias and promote fair evaluation of candidates based on qualifications and experience.

You should also actively seek out and recruit candidates from underrepresented groups to increase diversity within the organization. Regardless of background, provide a comprehensive onboarding process that introduces new hires to the organization’s culture, values, and diversity initiatives.

Get inspired: Onboarding 10 Companies That Have the Best Employee Onboarding Experience

(and You Can Too)

3. Flexible Working Arrangements

Put in place policies that support flexible or hybrid work models such as remote work, flexible hours, or compressed workweeks to accommodate diverse needs and lifestyles. For instance, if you have employees with mobility limitations, allowing them to work more frequently from home could greatly improve their workplace comfort and effectiveness.

4. Inclusive Language and Communication

Promote the use of inclusive language in all communications, including job postings, internal communications, and external messaging. Provide training and guidelines to educate your employees on the importance of inclusive language and respectful communication.

5. Accessibility and Accommodations

Ensure that your workplace facilities, technologies, and communication channels are accessible to employees with disabilities. Provide reasonable accommodations, such as modifying facilities (e.g. reorganizing the workplace layout to facilitate wheelchair access) or providing assistive technologies to create equal access to employment opportunities and the workplace.

6. Inclusive Benefits and Wellness Programs

Offer benefits and wellness programs that address the diverse needs of your employees, including parental policies, mental health resources, and accommodations for religious observances and holidays. A comprehensive and flexible wellness program allows for greater diversity and appeals to a greater talent pool.

7. Performance Evaluations and Feedback

Implement fair and objective performance evaluation processes that are free from bias and discrimination. Provide regular feedback and coaching to support your employees’ professional growth and development. Training to overcome unconscious performance appraisal biases will offer value as leaders approach key performance review seasons.

Read more: A Guide to Mastering Performance Management

8. Professional Development and Advancement

Pair employees from underrepresented groups with mentors or sponsors who can provide guidance, support, and advocacy in their career development. You should also provide training programs for leaders and managers to increase awareness of diversity and inclusion issues and develop inclusive leadership skills.

Offer training and development opportunities that address the specific needs and career aspirations of diverse employee groups. Talk to your employees directly and get a sense of their ambitions and goals, and shape your training opportunities accordingly.

9. Company Culture and Engagement

Create a policy that firmly codifies an inclusive company culture where all employees feel valued, respected, and included. Promote diversity and inclusion initiatives, celebrate diverse perspectives and contributions, and create opportunities for employee engagement and collaboration.

10. Unconscious Bias Training

Provide training to educate employees on unconscious bias and its impact on decision-making processes. Offer practical tools (like the Implicit Association Test) and strategies to help your employees recognize and mitigate bias in their interactions and decision-making. Remember—unconscious bias is subtle and affects everyone, even if they don’t recognize it. Combating unconscious bias through education should be a cornerstone of successful DEI policies.

How to Communicate Your DEI Policies?

Creating a DEI policy is insufficient; it needs to be effectively communicated and consistently reinforced to ensure its impact. Here are some tactics you can employ to ensure your whole team is aware of your DEI policy:

Clear and transparent communication: Make sure that your DEI policy is clearly articulated in writing and easily accessible to all members of your workforce. Consider creating a dedicated section on your company intranet or website where your employees can easily access and reference the policy.

Employee training and workshops: Conduct training sessions and workshops to educate employees about your DEI policy, its importance, and their role in supporting diversity and inclusion efforts. Provide examples and case studies to illustrate key concepts and encourage interactive discussions.

Leadership endorsement: Demonstrate visible support for the DEI policy by having senior leaders and executives endorse it publicly. Encourage leaders to communicate your organization’s commitment to diversity and inclusion in company-wide meetings, emails, and other internal communications.

Regular communication: Incorporate messages about diversity and inclusion into regular communication channels such as newsletters, internal memos, and team meetings. Use these opportunities to reinforce your organization’s values and highlight initiatives that promote diversity and inclusion.

Feedback opportunities: Create regular feedback opportunities to allow employees to provide input and share their experiences related to diversity and inclusion in the workplace. Encourage open and honest communication and assure employees that their feedback will be valued and acted upon.

Employee Resource Groups (ERGs): Encourage the formation of ERGs or affinity groups focused on promoting diversity and inclusion. These groups can act like forums for your employees to discuss DEI-related topics, share best practices, and organize events and initiatives, or even as solidarity groups for underrepresented communities within your workforce.

External communication: Communicate your organization’s commitment to diversity and inclusion to external stakeholders, including clients, customers, partners, and the broader community. Highlight initiatives and partnerships that support diversity and inclusion efforts and demonstrate your organization’s values.

Fostering Inclusivity with Omni

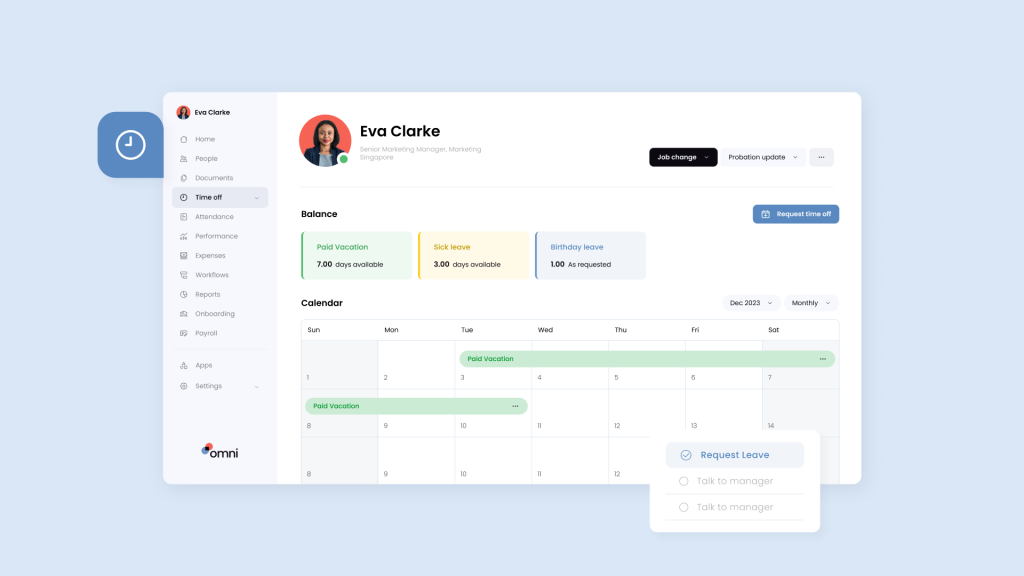

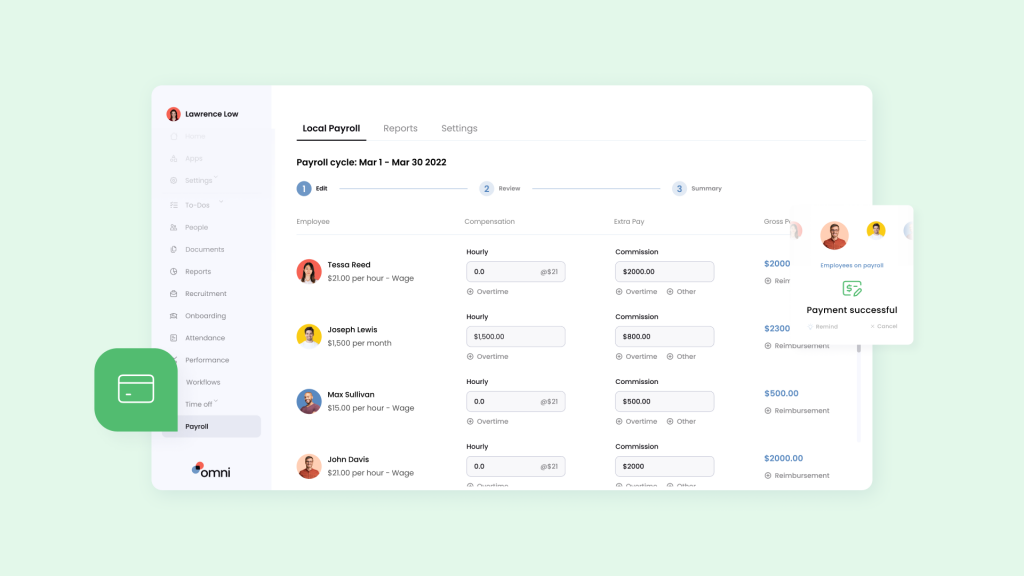

Undoubtedly, DEI policies are crucial for fostering a positive workplace culture and drive organizational success. HR Information Systems (HRIS) play an important role in supporting these policies by automating processes, encouraging transparency, and providing insights to help organizations effectively implement and reinforce their DEI policies.

With modern HR automation tools like Omni, you gain access to data-driven insights that facilitate informed decision-making, as well as seamless integrations that effortlessly connect with your existing employee favored systems, making your entire engagement process more efficient and modern.

Our performance management module provides you with instant reports to track diversity and inclusion goals, ensuring these initiatives are prioritized and progress is measurable. Furthermore, our employee self-service portals empower employees to access and understand DEI policies, fostering awareness and inclusivity.

With a full suite of modules supporting every aspect of your business, Omni’s intuitive and customizable platform integrates with your team’s favorite systems for a seamless and timely adoption, ensuring diversity, equity and inclusion are adopted into your company’s culture.

If you’d like to learn more about how Omni’s all-in-one HR software can bring your DEI initiatives to the next level, book a demo with us today and start building a more diverse and equitable organization!