In the Philippines, a common topic of discussion within organizations is the subject of Service Incentive Leave (SIL). Employers often wonder how many days they should give for SIL and how it differs from conventional sick leave and vacation days.

This article will guide you to understand what SIL is according to the Philippine Labor Code, the criteria for granting this benefit to your employees, and how it differs from other types of leave. Let’s dive into the SIL meaning and why it is compulsory in the Philippines.

What is Service Incentive Leave (SIL) and is it mandatory?

Service Incentive Leave (SIL) is a benefit your employees are entitled to after working for at least a year. The SIL entitles eligible employees who have worked for over a year to have five days of incentive leave with pay. Eligible employees can also convert their leaves to cash if they don’t use it by the end of the year.

The SIL is mandated in the Philippines under Article 95 of the Labor Code which states that offering service incentive leave to eligible employees is not optional and is a legal requirement. Additionally, service incentive leave in the Philippines is a government-mandated benefit as it gives employees a chance to maintain a better work-life balance.

With knowledge of the SIL meaning and why it is mandatory, let us examine who is entitled to service incentive leave.

Who is entitled to SIL?

As the Labor Code mandates, your employees who have worked continuously for at least 1 year are entitled to service incentive leave. A year of service is calculated from the first day of employment, regardless of continuous or broken work schedule. It includes authorized leave and holidays.

Eligible employees are entitled to 5 days of paid incentive leave per year. According to the Philippine Labor Law, the rule is that employees are entitled to five service leave credits after the end of each work anniversary year. Also, unused leave credits should be converted to cash.

The SIL is a general leave credit which may be used by employees for medical treatments, vacations, or any other personal reasons.

Who is not entitled to SIL?

Although SIL is mandatory to eligible employees, there are groups of people excluded from this benefit:

1. Government employees

SIL benefits apply only to employees in the private sector. Personnel employed in government-owned or controlled corporations are exempted from service incentive leave.

2. Managerial employees

Employees who perform managerial functions like managing an establishment and having the authority to hire or fire other employees of lower ranks do not qualify for SIL provisions.

3. Field personnel

Personnel who perform their duties away from the office environment and whose hours and days of work are not supervised by the employer are not entitled to service incentive leaves.

4. Domestic helpers and persons in the personal service of another

Employees in this category are not covered by the benefits of service incentive leave.

5. Employees already enjoying a similar benefit

Companies that offer their employees benefits similar to SIL, for example, providing more than five days of paid leave, are exempted from providing additional SIL to their employees.

6. Employees in establishments regularly employing less than ten workers

Small businesses with less than ten employees are exempted from providing their employees with service incentive leave.

With an understanding of who is entitled to service incentive leave, it is easier for you as an employer to design an employee benefits package that adheres to the Labor Code whilst rewarding employees for their service.

How to calculate SIL?

Scenario 1: Employee completes 1 year of service

After an employee completes one year of service, they are entitled to five days of paid Service Incentive Leave. For instance, if an employee starts working on 1 January 2023, they will be eligible for SIL from 1 January 2024.

The calculation is simple. Your employee must receive 5 days of SIL to be used within the next year after their first work anniversary. Also, depending on your company policy, the unused leave can be carried over to the next year or converted to cash.

Scenario 2: Employee leaves before completing 1 year

If an employee resigns or you terminate their contract before they complete their one year of service, they will not be entitled to any service incentive leave.

For example, an employee who leaves your company after 11 months of service will not be entitled to any leave benefits.

Scenario 3: Employee works for more than 1 year

Your employees who have completed one year of service must have their SIL entitlement renewed every year. For instance, if your employee has worked continuously for three years and has used up their SIL benefits from the previous years, they will be entitled to five days of SIL at the beginning of their fourth service year.

Additionally, your employees who have completed more than one year of service are entitled to prorated leave credits for any additional months worked beyond their anniversary date. This means an employee who has completed 14 months of service will be entitled to 6 days of SIL.

Here’s the calculation:

- Calculate the monthly accrual rate:

- 5 days of SIL per year divided by 12 months = 0.4167 SIL per month.

- Calculate total SIL for 14 months of service:

- 12 months (first year) = 5 days of SIL.

- Additional 2 months (second year) = 0.4167 SIL/month * 2 months = 0.8334 SIL, rounded to 1 day.

So, the employee would be entitled to:

- 5 days of SIL for the first year (anniversary).

- 1 additional day of SIL for the extra 2 months.

Therefore, an employee with 14 months of service will be entitled to a total of 6 days of SIL.

Omni tip for SIL: When calculating SIL, the rule of thumb is your employees must have completed one year of service. Only after they fulfill this requirement can they be entitled to service incentive leave benefits.

Now that we understand the SIL meaning and how to calculate it, let’s address a common question.

Is SIL convertible to cash?

The answer is “yes.” Unused service incentive leave can be converted to cash. The Labor Code clearly states that any unused SIL at the end of the year can be converted to its cash equivalent.

Here’s how the calculation works:

1. Determine the daily wage of your employee:

For example, your employee earns ₱500 per day.

2. Calculate the value of their unused SIL:

If your employee has 5 unused SIL days, the calculation would be:

5 days * ₱500/day = ₱2,500.

Thus, your employee will receive ₱2,500 for their unused SIL days.

It’s important to note that the encashment can occur at the end of a complete service year or when eligible employees terminate their employment contract.

How does SIL differ from sick leave and vacation days?

To clearly understand the difference between service incentive leave, sick leave, and vacation days, let us briefly define what each means.

- Service Incentive Leave (SIL): This is a mandated benefit under the Philippine Labor Code that entitles employees to five days of paid leave after completing one year of service. Service incentive leave can be used for any purpose the employee deems fit.

- Sick leave: This type of leave entitles an employee to a certain number of days in a year to take care of any health-related issues and is separate from SIL. The Philippine Labor Code does not mandate sick leave days. However, many companies offer them as part of their employee benefits package.

- Vacation days: Vacation days are leave days you grant your employees, allowing them to rest or have their leisure. This type of leave is mostly planned and requires approval. Additionally, similar to sick leave days, vacation days are not mandated by the law in the Philippines.

Read next: HR’s Guide to Employee Leave Management

Now, with the understanding of the SIL meaning, sick leave, and vacation days, let us explore their key differences:

- Purpose: Service incentive leave can be used for any purpose. However, sick leave is for health-related issues, and vacation days are for leisure or personal reasons.

- Legal Requirement: SIL is mandated by the Philippine Labor Code, whereas sick leave and vacation days are not.

- Conversion to Cash: Unused SIL credits can be converted to cash. However, sick leave and vacation leave can’t be converted unless permitted by the organization’s policy.

In conclusion, service incentive leave differs from sick leave and vacation days because SIL is a mandatory requirement for Philippine employers according to the Labor Code. On the other hand, sick leave and vacation days are mostly part of companies’ employee benefits packages.

What are the benefits of offering SIL?

When you offer service incentive leave to your employees, you meet legal requirements and also show them you recognize and reward their contributions. Here are some other key benefits of offering SIL:

Incentive for service

Offering service incentive leave serves as a way for you to reward your employees for their one-year work commitment. Incentive for service motivates your employees to maintain a consistent performance and stay longer with you, reducing attrition rates.

Foster work-life balance

Allowing your employees to take paid time off for rest or leisure is essential in helping them maintain their mental health and reduce burnout, which impacts their job satisfaction. Further, employees who take time to recharge will be more focused when they return to work.

Boost employee engagement and morale

Service incentive leave significantly boosts your employee’s engagement and morale, which can lead to an increase in efficiency. When you make your employees feel valued through benefits like SIL, they will be more motivated to do their work.

Putting Employee Well-being First

Offering SIL to your employees demonstrates how you prioritize their well-being. By providing paid leave, you show your employees you care about their health and overall quality of life. This commitment promotes a positive work environment.

Remember, offering SIL to your employees helps create a supportive and motivating workplace, which impacts their overall productivity and benefits the organization.

Additional resources: The Modern CEO’s Guide to Growth Through Company Culture

Promoting a Culture of Recognition and Reward

Employee recognition can boost employee engagement, which affects every aspect of your organization, from culture to morale, productivity to innovation, investing in your employees is a sure fire way to improve your business functions and drive growth.

By implementing service incentive leave in the Philippines, you ensure that you’re complying to regulations and drive employee motivation.

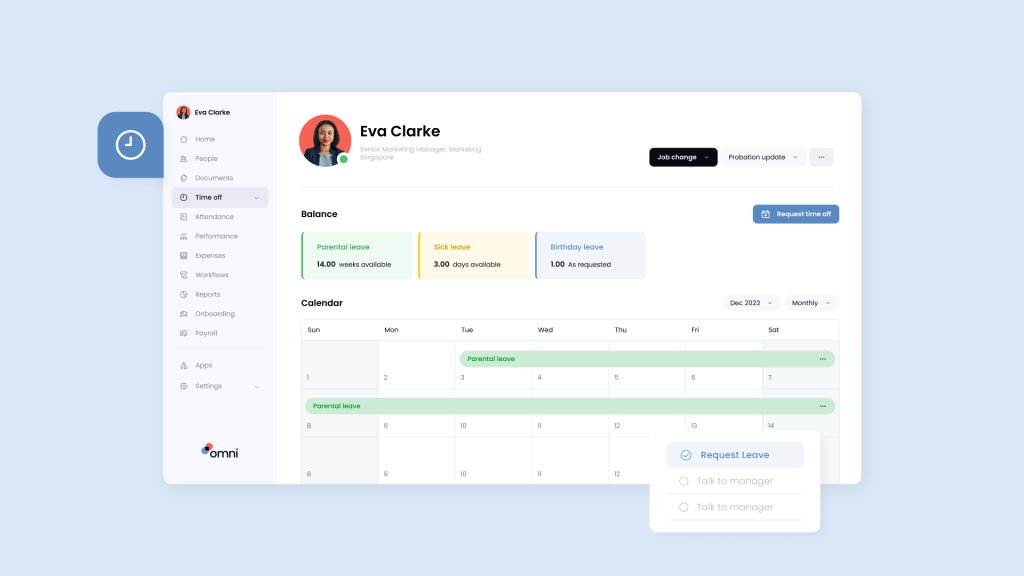

Omni’s time off management capabilities help managers and HR teams swiftly navigate employee leave management. Omni’s platform allows you to approve service incentive leave on the go and keep track of who’s in and out of the office with at-a-glance scheduling.

Our employee self-service portal empowers employees to submit their time off requests, which automatically routes to the appropriate manager thanks to customizable approval workflows. Omni seamlessly integrates with your team’s favorite work tools such as Slack, enabling managers to manage time off approvals with a simple push of a button. With automated calculations, employees and managers can easily view SIL leave balances in real-time, and track how many vacation days they have left without having to go through HR.

If you’re not quite ready to take the leap, try leveraging some free tools to simplify your leave management efforts for free. Download Omni’s Employee Time-off Request Form Template to easily gather the information you need to manage employee time and attendance.